Question: Check my work mode: This she completed so far. It does not indicate completion. Return to question 10 Shimmer Inc. is a calendar-year-end, accrual-method corporation.

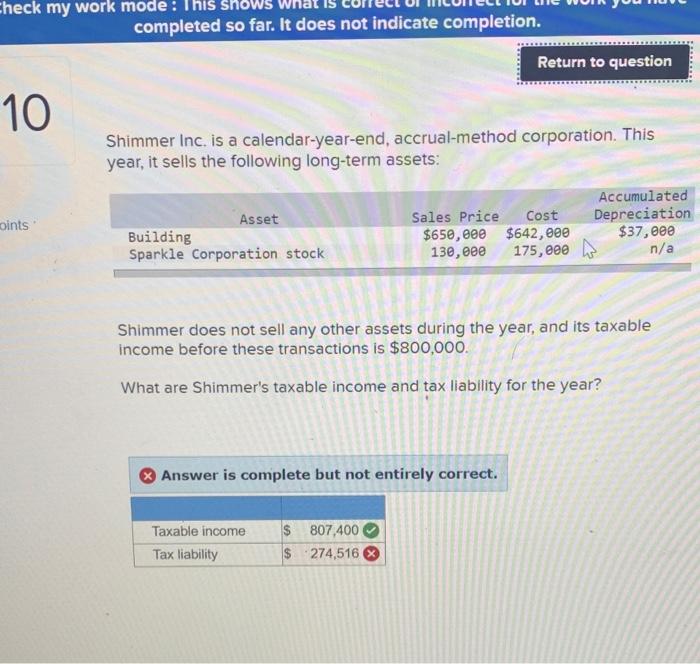

Check my work mode: This she completed so far. It does not indicate completion. Return to question 10 Shimmer Inc. is a calendar-year-end, accrual-method corporation. This year, it sells the following long-term assets: pints Asset Building Sparkle Corporation stock Accumulated Sales Price Cost Depreciation $650,000 $642,000 $37,000 130,000 175, eee . n/a Shimmer does not sell any other assets during the year, and its taxable income before these transactions is $800,000. What are Shimmer's taxable income and tax liability for the year? Answer is complete but not entirely correct. Taxable income Tax liability $ 807,400 $ 274,516

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts