Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not in Wardell

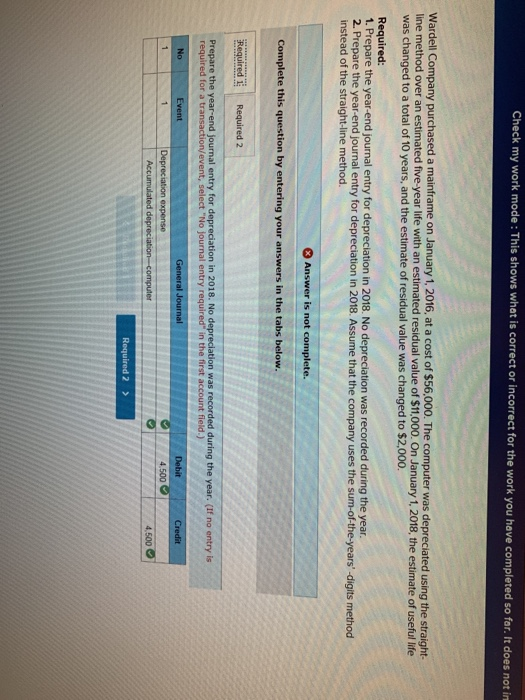

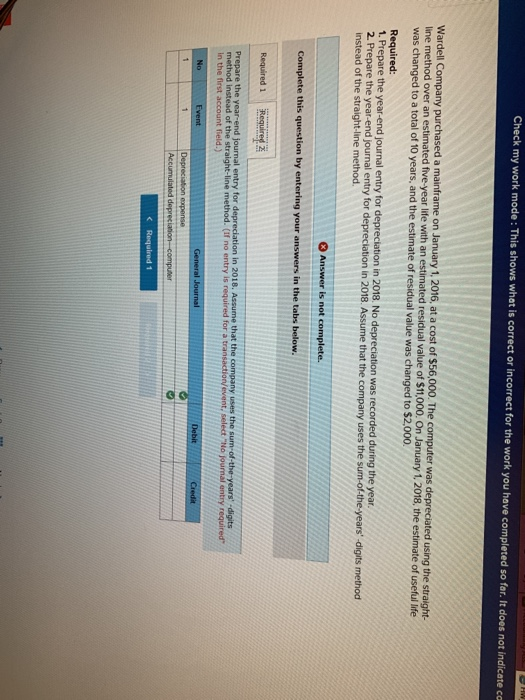

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not in Wardell Company purchased a mainframe on January 1, 2016, at a cost of $56,000. The computer was depreciated using the straight line method over an estimated five-year life with an estimated residual value of $11,000. On January 1, 2018, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $2,000 e the year-end journal entry for depreclation in 2018. No depreciation was recorded during the year 2. Prepare the year-end journal entry for depreciation in 2018. Assume that the company uses the sum-of-the-years' -digits method instead of the straight-line method. entry required" in the first a Check my work mode : This shows what is correct or incorrect for the work you have completed so far. lt does not indicate co chased a mainframe on January 1, 2016, at a cost of $56,000. The computer was depreciated using the straight- line method over an estimated five-year life with an estimated residual value of $11,000. On January 1, 2018, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $2,000 Required 2. Prepare the year end journal entry for depreciation in 2018 Assume that the company u for depreciation in 2018. No depreciation was recorded during the year. uses the sum-of-the-years' -digits method instead of the straight-line method Complete this question by entering your answers in the tabs below Prepare the y in 2018. uses the s in the first account field.) No C Required 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts