Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does GL 0 4

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does

GLAlgo Based on Problem A LO A P P

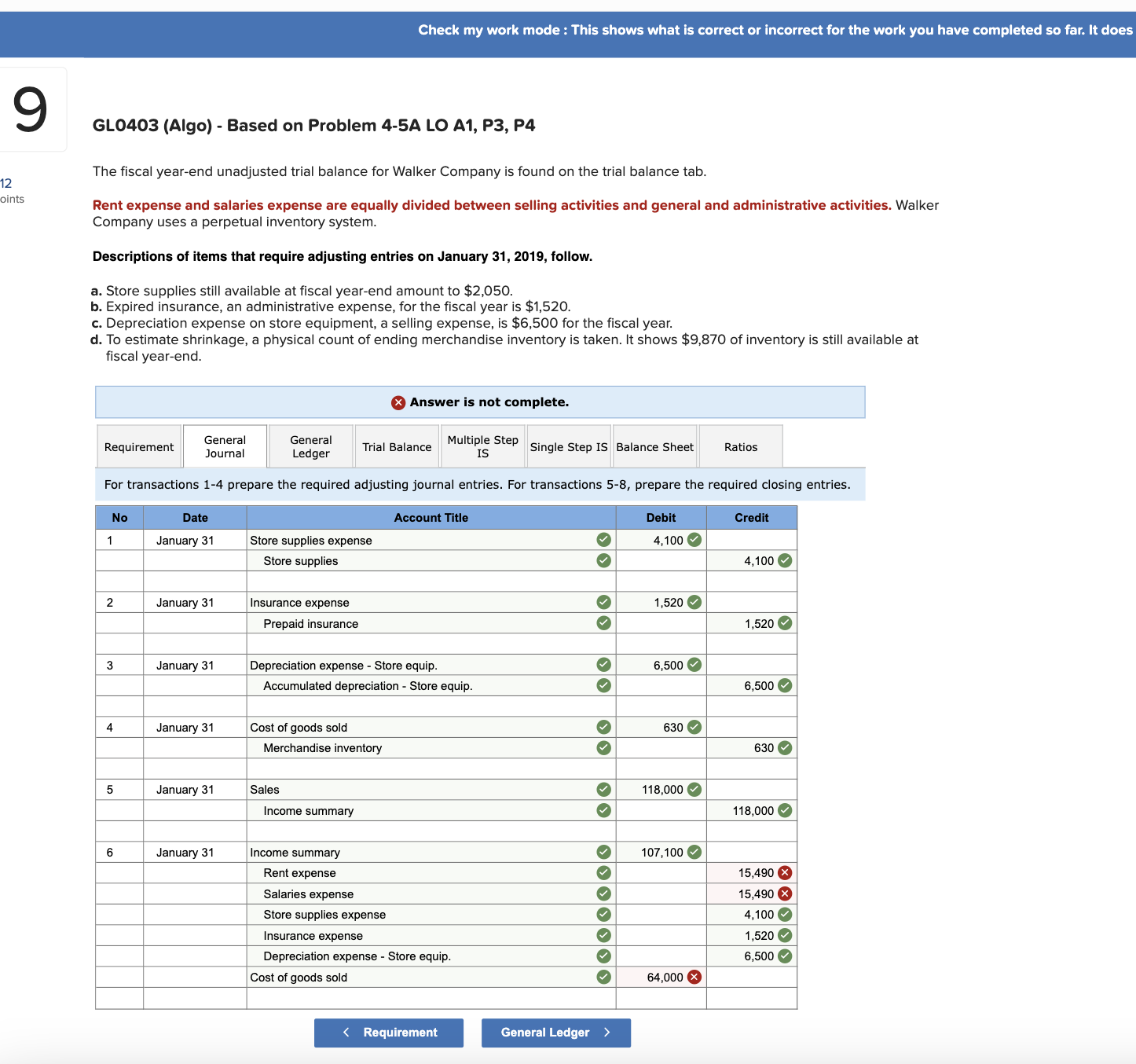

The fiscal yearend unadjusted trial balance for Walker Company is found on the trial balance tab.

Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Walker Company uses a perpetual inventory system.

Descriptions of items that require adjusting entries on January follow.

a Store supplies still available at fiscal yearend amount to $

b Expired insurance, an administrative expense, for the fiscal year is $

c Depreciation expense on store equipment, a selling expense, is $ for the fiscal year.

d To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $ of inventory is still available at fiscal yearend.

Answer is not complete.

begintabularlllllll

hline Requirement & begintabularc

General

Journal

endtabular & begintabularc

General

Ledger

endtabular & Trial Balance & begintabularc

Multiple Step

IS

endtabular & Single Step IS Balance Sheet & Ratios

hline

endtabular

For transactions prepare the required adjusting journal entries. For transactions prepare the required closing entries.

begintabularcccccc

hline No & Date & multicolumnlAccount Title & Debit & Credit

hline & January & Store supplies expense & checkmark & &

hline & & Store supplies & & &

hline & & & & &

hline & January & Insurance expense & & &

hline & & Prepaid insurance & & &

hline & & & & &

hline & January & Depreciation expense Store equip. & checkmark & &

hline & & Accumulated depreciation Store equip. & & &

hline & & & & &

hline & January & Cost of goods sold & & &

hline & & Merchandise inventory & & &

hline & & & & &

hline & January & Sales & & &

hline & & Income summary & & &

hline & & & & &

hline & January & Income summary & & &

hline & & Rent expense & & & times

hline & & Salaries expense & & & times

hline & & Store supplies expense & & &

hline & & Insurance expense & & &

hline & & Depreciation expense Store equip. & & &

hline & & Cost of goods sold & & times &

hline & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock