Question: Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

On January Patterson Corporation acquired percent of the outstanding voting shares of Soriano, Incorporated, in exchange for $ per share cash. The remaining percent of Soriano's shares continued to trade for $ both before and after Patterson's acquisition.

At January Soriano's book and fair values were as follows:

points

tableBook ValuesCurrent assets Items,$

Return

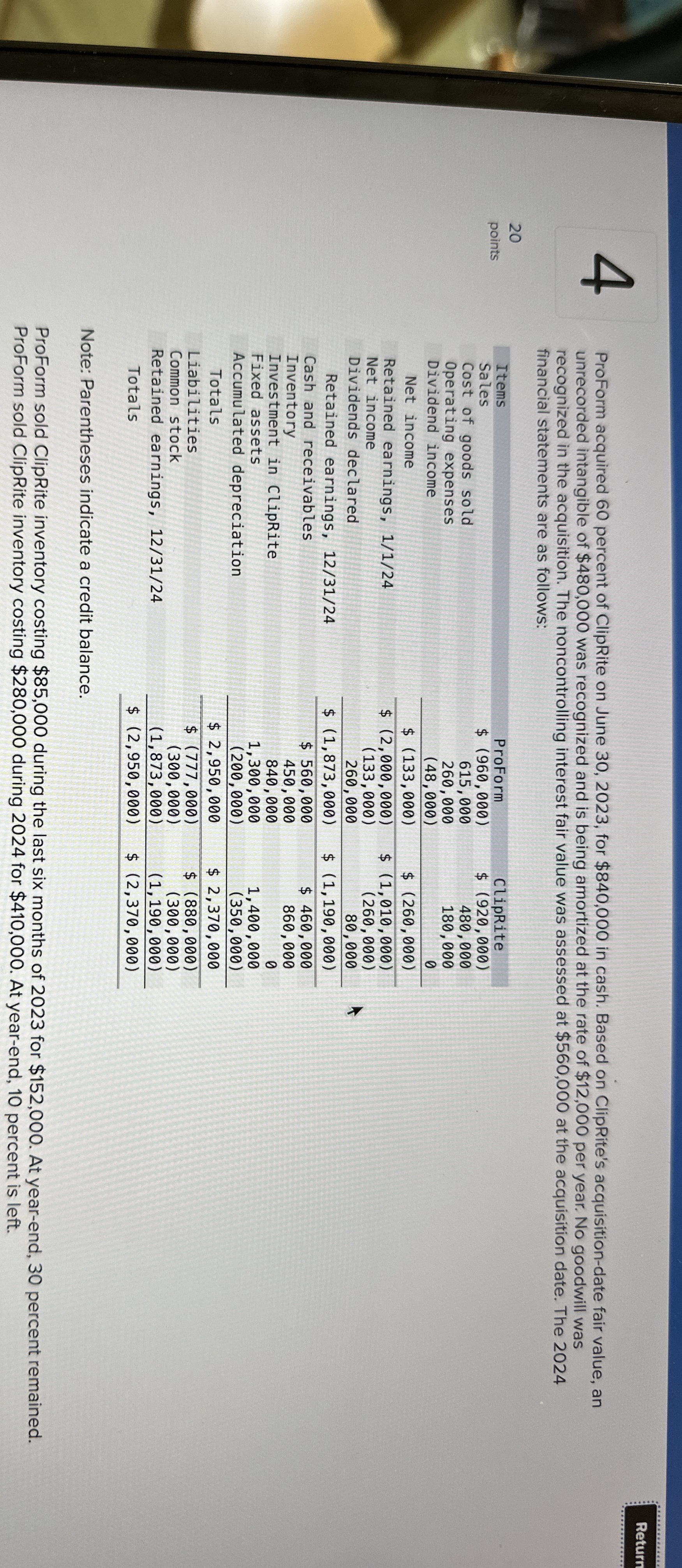

ProForm acquired percent of ClipRite on June for $ in cash. Based on ClipRite's acquisitiondate fair value, an unrecorded intangible of $ was recognized and is being amortized at the rate of $ per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $ at the acquisition date. The financial statements are as follows:

points

Note: Parentheses indicate a credit balance.

Proform sold ClipRite inventory costing $ during the last six months of for $ At yearend, percent remained. ProForm sold ClipRite inventory costing $ during for $ At yearend, percent is left with these facts, determine the consolidated balances for sales, COGS, operating expenses, dividend income, net income attributable to noncontrolling interest, inventory and noncontrolling jnterest in subsidiary,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock