Question: Check my work Required information Problem 9-47 (LO 9-2) [The following information applies to the questions displayed below.] Part 2 of 4 Melissa recently paid

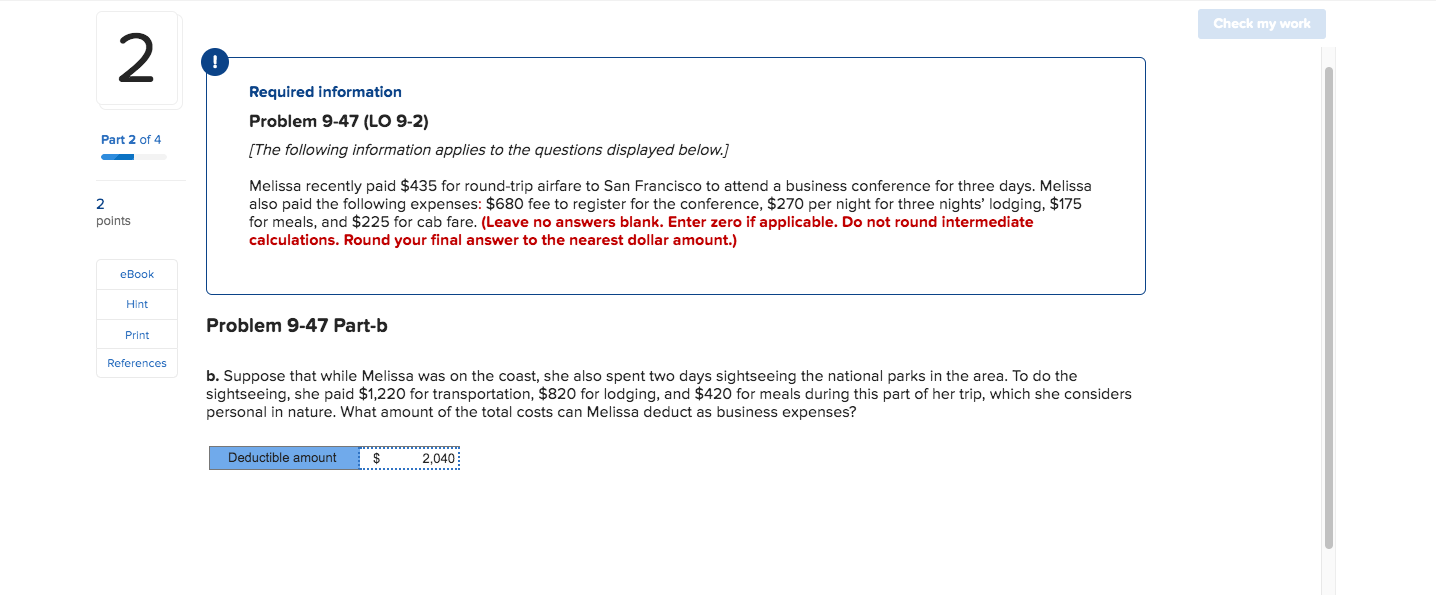

Check my work Required information Problem 9-47 (LO 9-2) [The following information applies to the questions displayed below.] Part 2 of 4 Melissa recently paid $435 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $680 fee to register for the conference, $270 per night for three nights' lodging, $175 for meals, and $225 for cab fare. (Leave no answers blank. Enter zero if applicable. Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) points eBook Hint Problem 9-47 Part-b Print References b. Suppose that while Melissa was on the coast, she also spent two days sightseeing the national parks in the area. To do the sightseeing, she paid $1,220 for transportation, $820 for lodging, and $420 for meals during this part of her trip, which she considers personal in nature. What amount of the total costs can Melissa deduct as business expenses? Deductible amount $ 2,040

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts