Question: Check my work Required information Problem 9-49 (LO 9-2) (The following information applies to the questions displayed below.) Ryan is self-employed. This year Ryan used

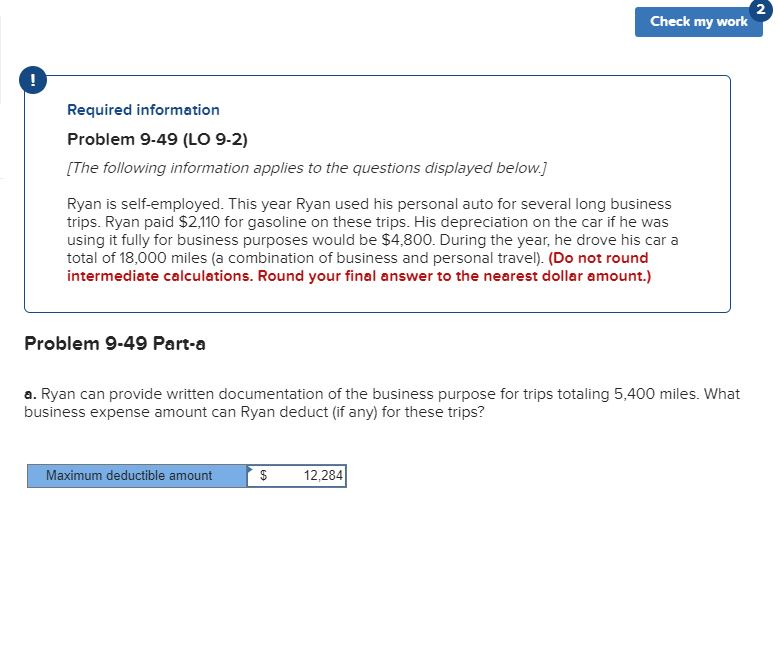

Check my work Required information Problem 9-49 (LO 9-2) (The following information applies to the questions displayed below.) Ryan is self-employed. This year Ryan used his personal auto for several long business trips. Ryan paid $2,110 for gasoline on these trips. His depreciation on the car if he was using it fully for business purposes would be $4,800. During the year, he drove his car a total of 18,000 miles (a combination of business and personal travel). (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) Problem 9-49 Part-a a. Ryan can provide written documentation of the business purpose for trips totaling 5,400 miles. What business expense amount can Ryan deduct (if any) for these trips? Maximum deductible amount $ 12,284

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts