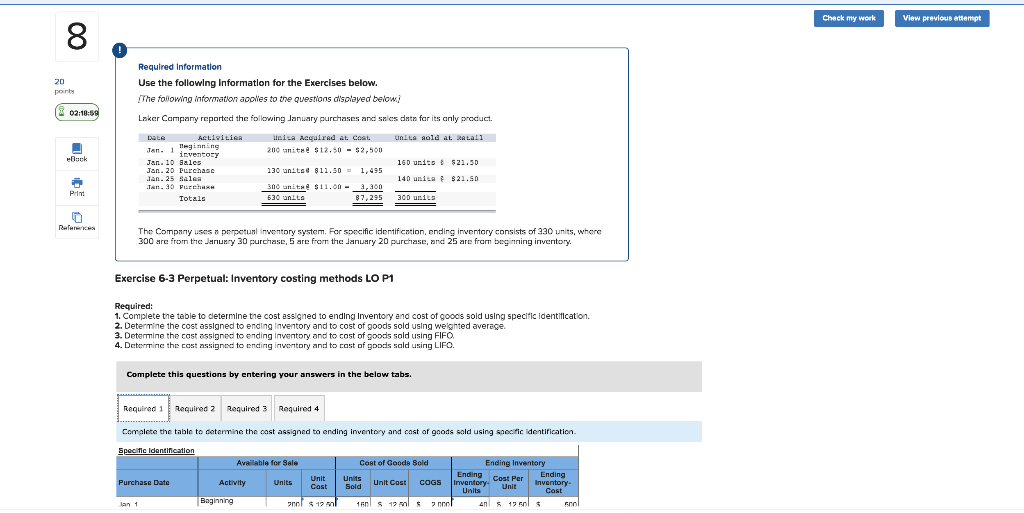

Question: Check my work View previous attempt Required information Use the followlng Informatlon for the Exercises below. pointy The folowing information apples to the questions displayed

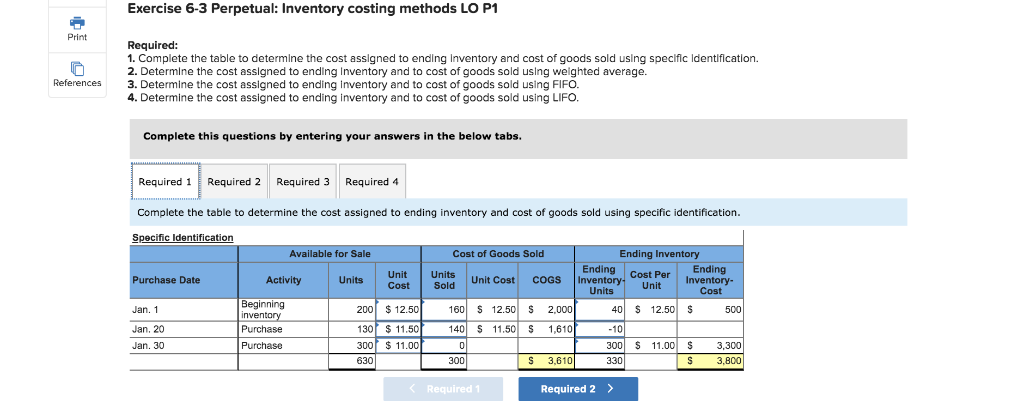

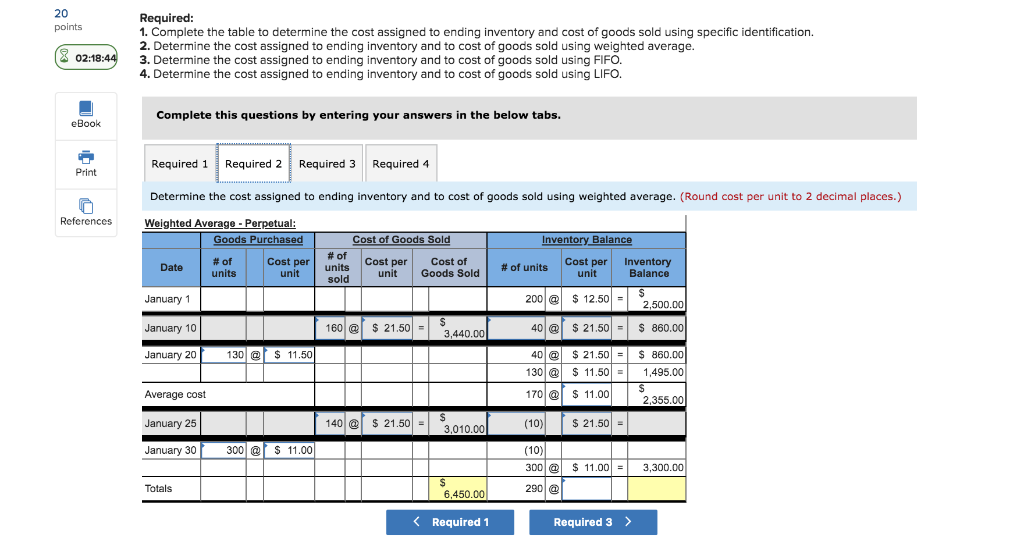

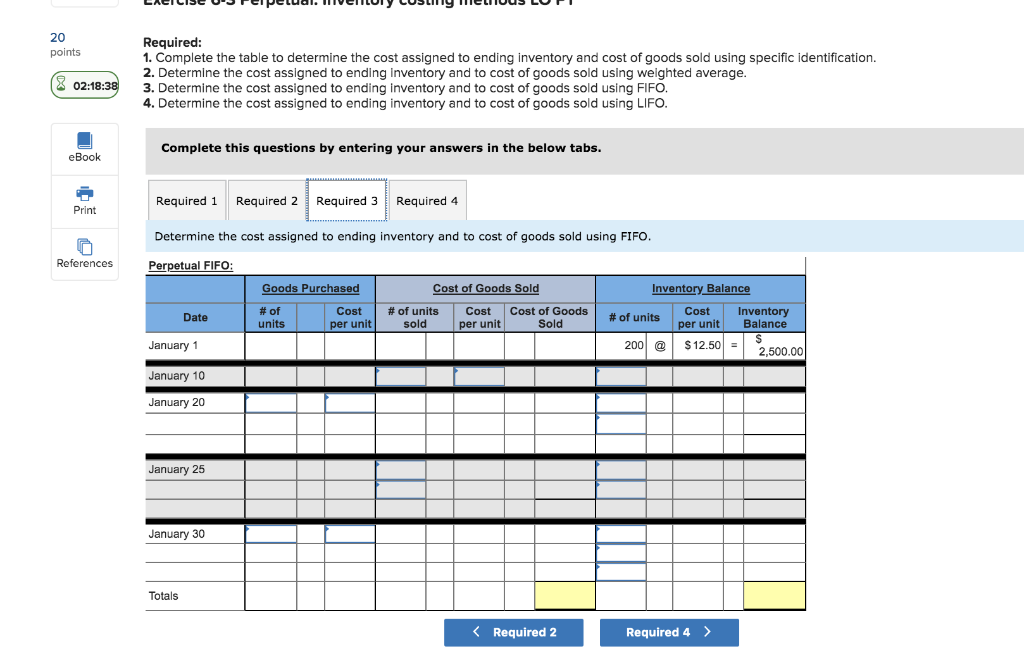

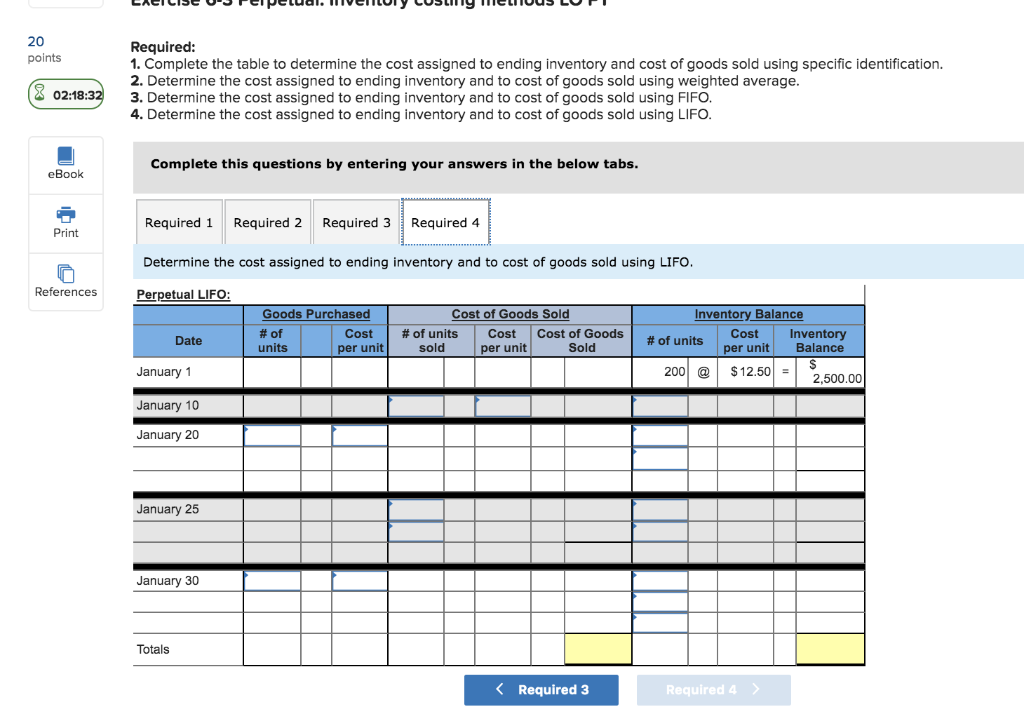

Check my work View previous attempt Required information Use the followlng Informatlon for the Exercises below. pointy The folowing information apples to the questions displayed belowi 02:1059 Laker Campany reported the following January purchases and salcs data for s anly product. Activitiea ia Acqairad at Cost units aold at tall bate 200 anite s12.50 $2,50 Jan : rk 160 urits s21.50 Ten. 20 Purchage 130 untteg 811.50 1495 140 unisa 821.50 rchase 300 unita s11.o0 3,3on Print 630 10! t: 87,295 300 units Totala References The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 330 units, whore 300 are fromn the Janunry 0 purchase, 5 are from the January 20 purchase, and 25 are fromn beginning inventory Exercise 6-3 Perpetual: Inventory costing methods LO P1 Compiete the table to determine the cost essigned to ending Inventory and cost of goocs sold using specific ldentfication lermne ihe cost assighed to endlng inwentory and to Cost of poods sold using weghted average. Determine the cost assigned to ending inventory and to cost of qpods sald using LIFO. the below tabs. Complete this questions by entering your answers Required 1 Roquired 2 Roouirod 3 Required 4 Complete the table to detemine the cost assigned to ending inventory and cast of goods sold using saecfic identification. Specific Identification Available for Sale Cost of Goods Sold Ending Inventory Enrting Ending Unit Soid Unit Cost Purchase Date Activity Units cOGS Inventory Inventory Baginning 2rc s120. 2cco 1 120 col lan 1 Exercise 6-3 Perpetual: Inventory costing methods LO P1 Print Required: Complete the table Determine the cost asslgned to ending inventory and to cost of goods sold using weighted average. . Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. . Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. ending Inventory and cost of goods sold using specific Identification. determine the cost asslgned References Complete this questions by entering your answers in the below tabs. Required 1 Required 2 Required 3 Required 4 Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. Specific Identification Available for Sale Ending Inventory Cost of Gogds Sold Ending C Inventory Units Ending Inventory- Cost Purchase Date Activity Units Unit Cost COGS Cost Sold Unit Beginning inventory S 12.50 S 12.50 S 12.50 500 Jan. 1 200 160 2,000 40 $ 11.50 S 11.50 Jan. 20 Purchase 130 140 S 1.610 -10 $ 11.00 11.00 S Jan. 30 Purchase 300 aon 3,300 S30 300 3.610 330 3,800 Required 2 Required 1 20 Required: points lete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO ( 02:18:44 Complete this questions by entering your answers in the below tabs. eBook Required 3 Required 1 Required 2 Required 4 Print Determine the cost assigned to ending inventory and too cost goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average - Perpetual: References Cost of Goods Sold Goods Purchased Inventory Balance #of Cost per #of Cost per unit Cost of Cost per unit Inventory Balan Date #of units units Goods Sold units unit sold 200@ 12.50 January 1 2.500,00 160@ $ 21,50 40@ 21.50 860.00 January 10 3,440.00 40 21.50 $ 860.00 130 January 20 130 S 11.50 $ 11.50 1,495.00 170a S 11.00 Average cost 2,355.00 140 21.50 January 25 (10) 21.50 3.010.00 January 30 300 S11.00 (10) 300@ 3,300.00 11.00 290 Totals 6.450.00 Required 1 Required 3> 20 Required: .Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory and to cost of goods sold using welghted average. 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO points X02:18:38 Complete this questions by entering your answers in the below tabs eBook Required 1 Required 3 Required 4 Required 2 Print Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. References Perpetual FIFO: Inventory Balance Goods Purchased Cost of Goods Sold # of units Cost # of units sold Cost Cost Goods Cost Inventory Balance Date of units per unit per unit Sold per unit $12.50 January 1 200 2.500.00 January 10 January 20 January 25 January 30 Totals Required 2 Required 4 > 20 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. points 02:18:32 Complete this questions by entering your answers in the below tabs. eBook Required 1 Required 2 Required 3 Required 4 Print Determine the cost assigned to ending inventory and to cost of goods sold using LIFO References Perpetual LIFO: Cost of Goods Sold Goods Purchased Inventory Balance Cost of Goods Sold #of units Cost # of units Cost Cost Inventory Balance Date #of units per unit sold per unit per unit $12.50 January 1 200 2,500.00 January 10 January 20 January 25 January 30 Totals Required 4 Required 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts