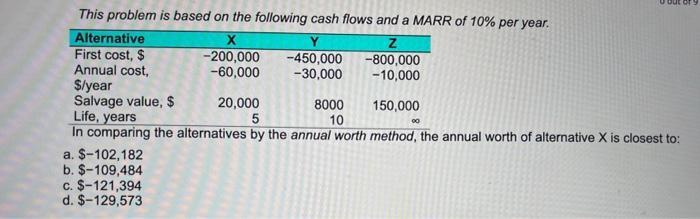

This problem is based on the following cash flows and a MARR of 10% per year....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

This problem is based on the following cash flows and a MARR of 10% per year. Z -800,000 -10,000 Alternative First cost, $ Annual cost, $/year Salvage value, $ X -200,000 -60,000 a. $-102,182 b. $-109,484 c. $-121,394 d. $-129,573 -450,000 -30,000 20,000 8000 150,000 Life, years 5 10 In comparing the alternatives by the annual worth method, the annual worth of alternative X is closest to: out of 00 This problem is based on the following cash flows and a MARR of 10% per year. Z -800,000 -10,000 Alternative First cost, $ Annual cost, $/year Salvage value, $ X -200,000 -60,000 a. $-102,182 b. $-109,484 c. $-121,394 d. $-129,573 -450,000 -30,000 20,000 8000 150,000 Life, years 5 10 In comparing the alternatives by the annual worth method, the annual worth of alternative X is closest to: out of 00

Expert Answer:

Answer rating: 100% (QA)

Answer Geren MARR 10 01 Cashflow diagram of alternative X 120000 5 20000... View the full answer

Related Book For

Project Management A Systems Approach to Planning Scheduling and Controlling

ISBN: 978-0470278703

10th Edition

Authors: Harold Kerzner

Posted Date:

Students also viewed these economics questions

-

Answer the following questions with reference to Figure . a. The base case for a program is priced out at $22 million. The companys chief executive officer is required to obtain written permission...

-

Answer the following questions based on Tables 5P-1 and 5P-2. a. What is the quantity demanded at $10? What is the quantity supplied at $10? b. What is the quantity demanded at $25? What is the...

-

Answer the following questions related to these goods: apples, Stephen King novels, street lighting on campus, and NPR radio broadcasts. a. Which of these goods are non-rival? b. Which of these goods...

-

Given the following table of assets held at death, how much is the probate estate worth? Asset Value (millions) Notes Investments $7 Retirement Account $6 Named Beneficiary Residence $4 Joint Tenancy...

-

You randomly call friends who could be potential partners for a dance. You think that they all respond to your requests independently of each other, and you estimate that each one is 7% likely to...

-

Three different plans for financing a $200,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount,...

-

Using the variance data for Menounos Manufacturing Co., prepare an income statement through gross profit for the year ended December 31, 20Y6. Assume the company sold 3,000 units at $100 per unit.

-

Lawsons Department Store faces a buying decision for a seasonal product for which demand can be high, medium, or low. The purchaser for Lawsons can order 1, 2, or 3 lots of the product before the...

-

A 120-room building has 14 1-bedroom units renting monthly at $150.00. 12 2-bedroom units at $200.00, and 8 3-bedroom units at $250.00. The gross annual rental would be?

-

[The following information applies to the questions displayed below.) Assume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporated-a company that sells de- motivational...

-

The observed element times and performance ratings collected in a direct time study are indicated in the table below. The snapback timing method was used. The personal time, fatigue, and delay...

-

Today we are going to play the "Questionizer" game. I will start by asking a question related to Lesson 1. The first student to respond to my question will do his or her best to answer it and then...

-

Read the given case study and answer the following questions (Question 1-Question 5) You are appointed by a local consulting company for a project to design and implement an employee's records...

-

Scenario one Each regional site will produce for their own region Demand is met! No site has exceeded their capacity! Minimized fixed costs by running each site at 200k Total cost (fixed and...

-

To find the utility-maximizing combination of goods x and y for this consumer, we can use the concept of consumer optimization subject to a budget constraint. The consumer's goal is to maximize...

-

Unemployment insurance benefits help individuals who have lost their job to sustain a desirable consumption level. An MIT economist, Jonathan Gruber, argues that private insurance or savings are not...

-

discuss different roles and levels of responsibility of employees

-

Discuss the concept of the looking-glass self. how do you think others perceive you? do you think most people perceive you correctly?

-

Referring to Problem 543, during contract negotiations between company Q and company Z, you, as project manager for the subcontractor, are sitting in your office when the phone rings. It is company Q...

-

Does a functional employee have the right to challenge any items in the project managers non-confidential evaluation form?

-

For the network shown in Figure with all times indicating weeks, answer the following questions: a. What is the impact on the end date of the project if activity I slips by three weeks? b. By how...

-

Describe an example of resistance to change that you have observed. Why did it occur?

-

Discuss: The best organizational structure to generate innovative ideas might not be the best structure to implement those ideas.

-

You have been charged with staffing and organizing an R&D group in a new high-tech firm. What will you do to ensure that the group is innovative?

Study smarter with the SolutionInn App