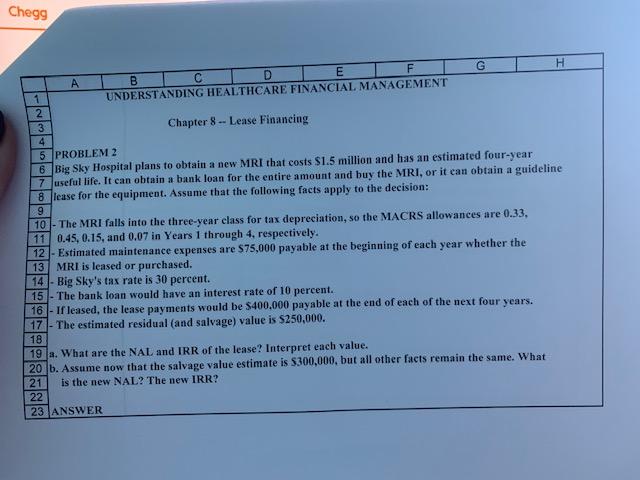

Question: Chegg B C D E I F G H 1 UNDERSTANDING HEALTHCARE FINANCIAL MANAGEMENT 2 3 Chapter 8 -- Lease Financing 4 5 PROBLEM 2

Chegg B C D E I F G H 1 UNDERSTANDING HEALTHCARE FINANCIAL MANAGEMENT 2 3 Chapter 8 -- Lease Financing 4 5 PROBLEM 2 6 Big Sky Hospital plans to obtain a new MRI that costs $1.5 million and has an estimated four-year 7 useful life. It can obtain a bank loan for the entire amount and buy the MRI, or it can obtain a guideline 8 case for the equipment. Assume that the following facts apply to the decision: 9 10 - The MRI falls into the three-year class for tax depreciation, so the MACRS allowances are 0.33, 11 0.45, 0.15, and 0.07 in Years 1 through 4, respectively. 12 - Estimated maintenance expenses are $75,000 payable at the beginning of each year whether the 13 MRI is leased or purchased. 14 - Big Sky's tax rate is 30 percent. 15 - The bank loan would have an interest rate of 10 percent. 16 - If leased, the lease payments would be $400,000 payable at the end of each of the next four years. 17- The estimated residual (and salvage) value is $250,000. 18 19 a. What are the NAL and IRR of the lease? Interpret each value. 20 b. Assume now that the salvage value estimate is $300,000, but all other facts remain the same. What 21 is the new NAL? The new IRR? 22 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts