Question: Chen- FINA 3110-091 - Spring 2019 Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt P 6-12 (book/static) Sa 9 of 1014 complete) |

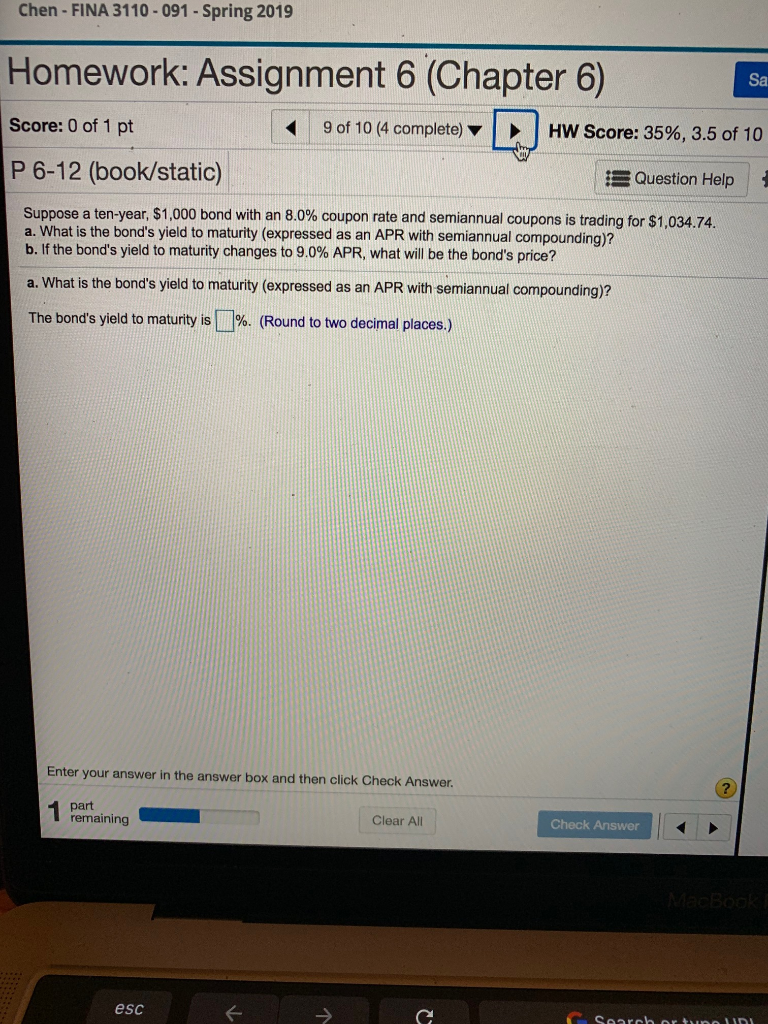

Chen- FINA 3110-091 - Spring 2019 Homework: Assignment 6 (Chapter 6) Score: 0 of 1 pt P 6-12 (book/static) Sa 9 of 1014 complete) | > | Hw score: 35%, 3.5 of 10 Question Help Suppose a ten-year, $1,000 bond with an 8.0% coupon rate and semiannual coupons is trading for $1,034.74 a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.0% APR, what will be the bond's price? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? The bond's yield to maturity is []%. (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer 2 part remaining Clear All Check Answer esc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts