Question: Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job. Materials were purchased on account. $ 1

Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job.

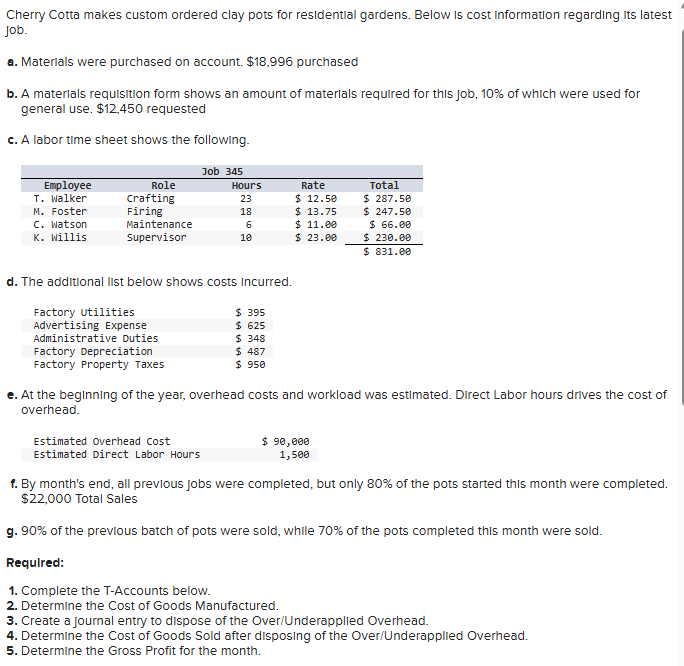

Materials were purchased on account. $ purchased

A materials requisition form shows an amount of materials required for this job, of which were used for general use. $ requested

A labor time sheet shows the following.

Job EmployeeRoleHoursRateTotalT. WalkerCrafting$ $ M FosterFiring$ $ C WatsonMaintenance$ $ K WillisSupervisor$ $ $

The additional list below shows costs incurred.

Factory Utilities$ Advertising Expense$ Administrative Duties$ Factory Depreciation$ Factory Property Taxes$

At the beginning of the year, overhead costs and workload was estimated. Direct Labor hours drives the cost of overhead.

Estimated Overhead Cost$ Estimated Direct Labor Hours

By month's end, all previous jobs were completed, but only of the pots started this month were completed. $Total Sales

of the previous batch of pots were sold, while of the pots completed this month were sold.

Required:

Complete the TAccounts below.

Determine the Cost of Goods Manufactured.

Create a journal entry to dispose of the OverUnderapplied Overhead.

Determine the Cost of Goods Sold after disposing of the OverUnderapplied Overhead.

Determine the Gross Profit for the month.

Note: When calculating amounts below, use the total in the TAccounts.

Please use the t accounts name and show excel formulas

Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest

Job.

a Materlals were purchased on account. $ purchased

b A materials requisition form shows an amount of materlals required for this Job, of which were used for

general use. $ requested

c A labor time sheet shows the following.

d The additional list below shows costs incurred.

e At the beginning of the year, overhead costs and workload was estimated. Direct Labor hours drives the cost of

overhead.

Estimated Overhead cost $ $

Estimated Direct Labor Hours

f By month's end, all prevlous Jobs were completed, but only of the pots started this month were completed.

$ Total Sales

g of the previous batch of pots were sold, while of the pots completed this month were sold.

Required:

Complete the TAccounts below.

Determine the Cost of Goods Manufactured.

Create a journal entry to dispose of the OverUnderapplied Overhead.

Determine the Cost of Goods Sold after disposing of the OverUnderapplied Overhead.

Determine the Gross Profit for the month.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock