Question: Cheryl's AGI is 2 5 1 , 0 0 0 her current tax liability is 5 2 , 8 6 8 Quantitatively, what is the

Cheryl's AGI is her current tax liability is

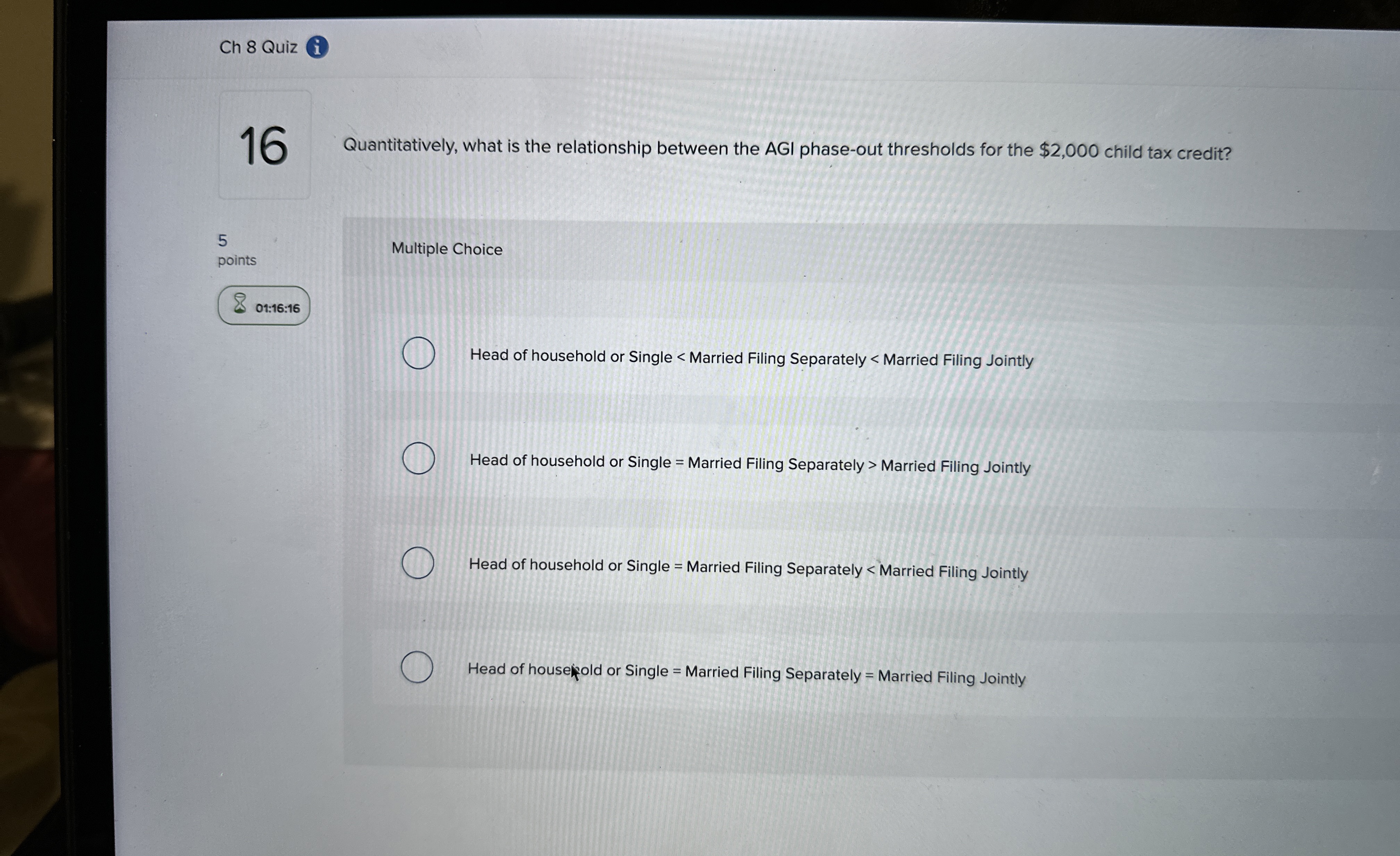

Quantitatively, what is the relationship between the AGI phaseout thresholds for the $ child tax credit?

Multiple Choice

Head of household or Single Married Filing Separately Married Filing Jointly

Head of household or Single Married Filing Separately Married Filing Jointly

Head of household or Single Married Filing Separately Married Filing Jointly

Head of housejold or Single Married Filing Separately Married Filing Jointly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock