Question: chicken grows and processes chickens. each chicken is disassembled into five main parts. the ending inventory amount for July 2017 are: 15lbs breasts, 6lbs wings,

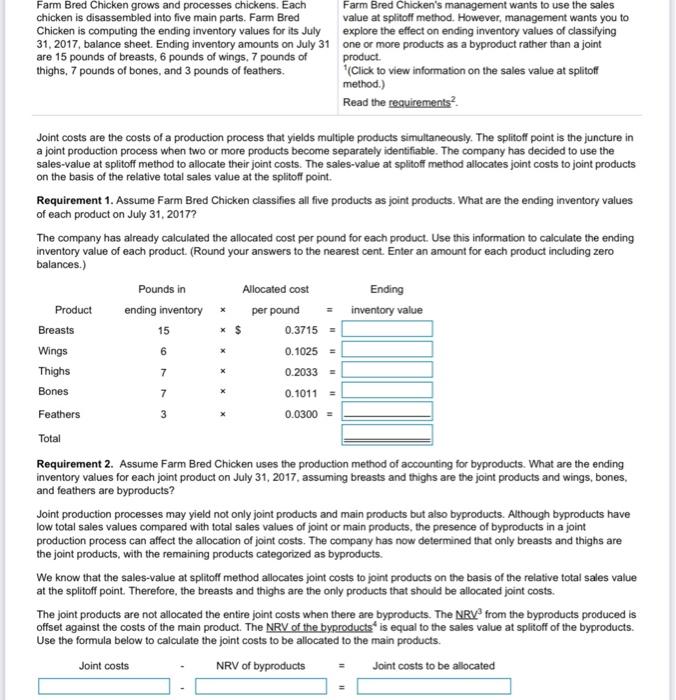

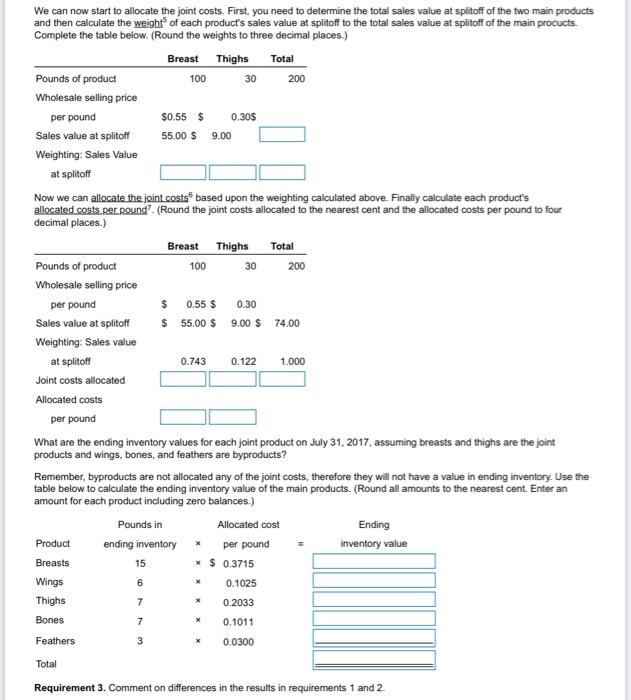

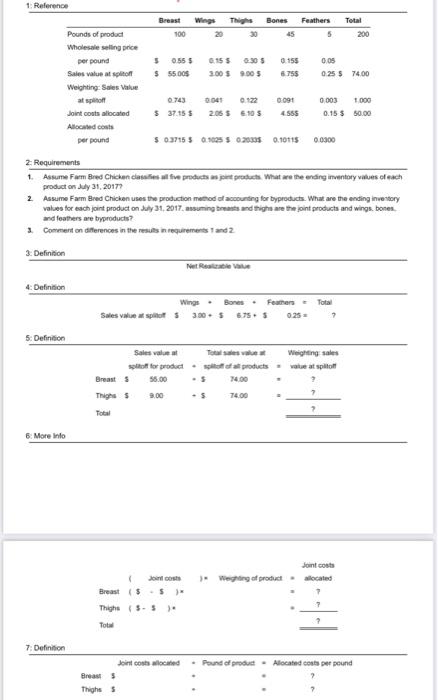

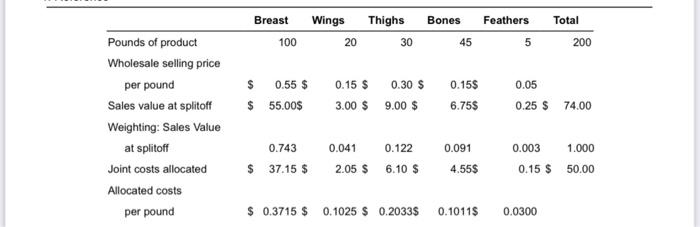

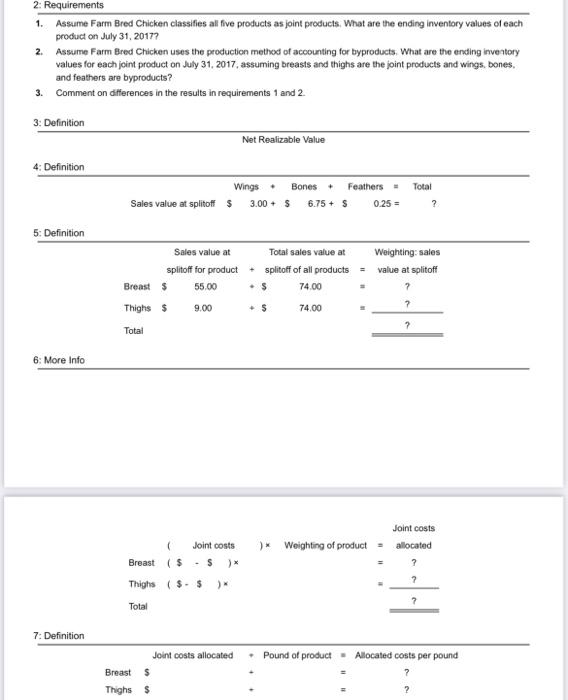

Farm Bred Chicken grows and processes chickens. Each Farm Bred Chicken's management wants to use the sales chicken is disassembled into five main parts. Farm Bred value at splitoff method. However, management wants you to Chicken is computing the ending inventory values for its July explore the effect on ending inventory values of classifying 31, 2017, balance sheet. Ending inventory amounts on July 31 one or more products as a byproduct rather than a joint are 15 pounds of breasts, 6 pounds of wings. 7 pounds of product thighs, 7 pounds of bones, and 3 pounds of feathers. Click to view information on the sales value at splitoff method.) Read the requirements * $ 7 7 Joint costs are the costs of a production process that yields multiple products simultaneously. The splitoff point is the juncture in a joint production process when two or more products become separately identifiable. The company has decided to use the sales-value at splitoff method to allocate their joint costs. The sales-value at splitoff method allocates joint costs to joint products on the basis of the relative total sales value at the splitoff point. Requirement 1. Assume Farm Bred Chicken classifies all five products as joint products. What are the ending inventory values of each product on July 31, 2017? The company has already calculated the allocated cost per pound for each product. Use this information to calculate the ending inventory value of each product. (Round your answers to the nearest cent. Enter an amount for each product including zero balances.) Pounds in Allocated cost Ending Product ending inventory per pound inventory value Breasts 15 0.3715 = Wings 6 0.1025 = Thighs 0.2033 - Bones 0.1011 = Feathers 0.0300 = Total Requirement 2. Assume Farm Bred Chicken uses the production method of accounting for byproducts. What are the ending inventory values for each joint product on July 31, 2017, assuming breasts and thighs are the joint products and wings, bones, and feathers are byproducts? Joint production processes may yield not only joint products and main products but also byproducts. Although byproducts have low total sales values compared with total sales values of joint or main products, the presence of byproducts in a joint production process can affect the allocation of joint costs. The company has now determined that only breasts and thighs are the joint products, with the remaining products categorized as byproducts. We know that the sales-value at splitoff method allocates joint costs to joint products on the basis of the relative total sales value at the splitoff point. Therefore, the breasts and thighs are the only products that should be allocated joint costs. The joint products are not allocated the entire joint costs when there are byproducts. The NRV from the byproducts produced is offset against the costs of the main product. The NRV of the byproducts is equal to the sales value at splitoff of the byproducts. Use the formula below to calculate the joint costs to be allocated to the main products. NRV of byproducts Joint costs to be allocated 3 Joint costs 100 30 9.00 0.30 We can now start to allocate the joint costs. First, you need to determine the total sales value at splitoff of the two main products and then calculate the weight of each product's sales value at splitoff to the total sales value at splitoff of the main procucts. Complete the table below. (Round the weights to three decimal places.) Breast Thighs Total Pounds of product 200 Wholesale selling price per pound $0.55 $ 0.30$ Sales value at splitoff 55.00 $ Weighting: Sales Value at splitoff Now we can allocate the joint costs based upon the weighting calculated above. Finally calculate each product's allocated costs perround? (Round the joint costs allocated to the nearest cent and the allocated costs per pound to four decimal places.) Breast Thighs Total Pounds of product 100 30 200 Wholesale selling price per pound $ 0.55 $ Sales value at splitoff $ 55.00 $ 9.00 $ 74.00 Weighting: Sales value at splitoff 1.000 Joint costs allocated Allocated costs per pound What are the ending inventory values for each joint product on July 31, 2017, assuming breasts and thighs are the joint products and wings, bones, and feathers are byproducts ? Remember, byproducts are not allocated any of the joint costs, therefore they will not have a value in ending inventory. Use the table below to calculate the ending inventory value of the main products. (Round all amounts to the nearest cent. Enter an amount for each product including zero balances.) Pounds in Allocated cost Ending Product ending inventory per pound inventory value Breasts 15 * $ 0.3715 Wings 0.1025 0.2033 Bones 0.743 0.122 6 x Thighs 7 7 x 0.1011 Feathers 3 x 0.0300 Total Requirement 3. Comment on differences in the results in requirements 1 and 2 1. Reference Breast The Bones Feathers Total Pounds of product 100 30 45 5 200 Wholesale selling price per pound 5 0.555 0:30 5 0.155 0.05 Sales value at sport $ 55005 3.00 $9.00 5 6.755 0.255 74.00 Weighting Sales Value 0743 0.00+ 0.122 0.091 0.003 1.000 Joint costs allocated $ 37.15$ 2.05 $ 105 4555 0.15$ 80.00 Allocated costs per pound $ 0.37155 0.90255 020005 0.10115 0.0000 2. Requirements 1. Assume Form Bred Chicken classes of five products per products What we the ending inventory values of each product on July 31, 2017 2 Assume Farm Bred Chicken uses the production method of accounting for byproducts. What are the ending investory values for each joint product on July 31, 2017, assuming and highs are the point products and wings. bones and feathers are byproducts 3 Comment on differences in the results requirements and 2 3. Definition Net alle 4: Definition Wings - Bones. Feathers Sales Value splits 3:30.5 6753 0.25 Total 2 5: Definition Sales valeat Weighings plot for product to al products we at spilton Breasts 55.00 14.00 Thighes 9.00 74.00 Total 6: More Info Joint costs Wepting of product located Joints Breast (55) Thighs Total 7: Definition Pound of product - Allocated cost per pound Joint costs owed Brass Thighs Breast Thighs Bones Wings 20 Feathers 5 Total 200 100 30 45 0.15$ $ 0.55 $ $ 55.00$ 0.15 0.30 $ 3.00 $ 9.00 $ 0.05 0.25 $ 74.00 6.75$ Pounds of product Wholesale selling price per pound Sales value at splitoff Weighting: Sales Value at splitoff Joint costs allocated Allocated costs per pound 0.091 0.743 $ 37.15 $ 0.041 0.122 2.05 $ 6.10 $ 0.003 1.000 0.15 $ 50.00 4.55$ $ 0.3715 $ 0.1025 $ 0.20335 0.10115 0.0300 2: Requirements 1. Assume Farm Bred Chicken classifies all five products as joint products. What are the ending inventory values of each product on July 31, 2017? 2. Assume Farm Bred Chicken uses the production method of accounting for byproducts. What are the ending inventory values for each joint product on July 31, 2017, assuming breasts and thighs are the joint products and wings bones, and feathers are byproducts? 3. Comment on differences in the results in requirements 1 and 2. 3: Definition Net Realizable Value 4: Definition Wings. Bones + Feathers Sales value at splitoff $ 3.00 + $ 6.75 + S Total ? 0.25 5: Definition Sales value at splitoff for product Breast $ 55,00 Thighs $ 9.00 Total Total sales value at Weighting: sales splitoff of all products - value at splitoff S 74.00 7 $ 74.00 7 2 6: More Info )* Weighting of product - Joint costs Breast ($.$)* Thighs ($.$ Joint costs allocated ? Total 7. Definition Joint costs allocated Pound of product Allocated costs per pound ? Breast $ Thighs $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts