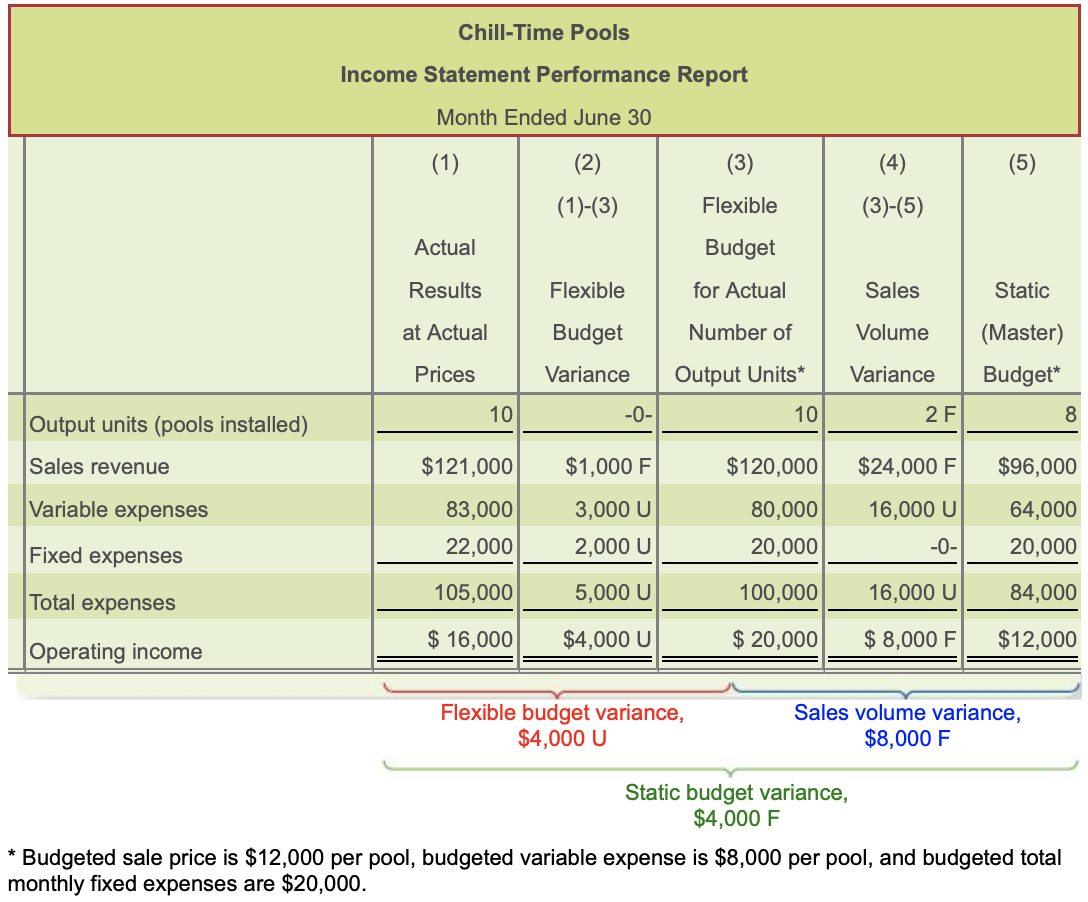

Question: Chill-Time Pools Income Statement Performance Report Month Ended June 30 (1) (2) (3) (4) (5) (1)-(3) Flexible (3)-(5) Actual Budget Results Flexible for Actual Sales

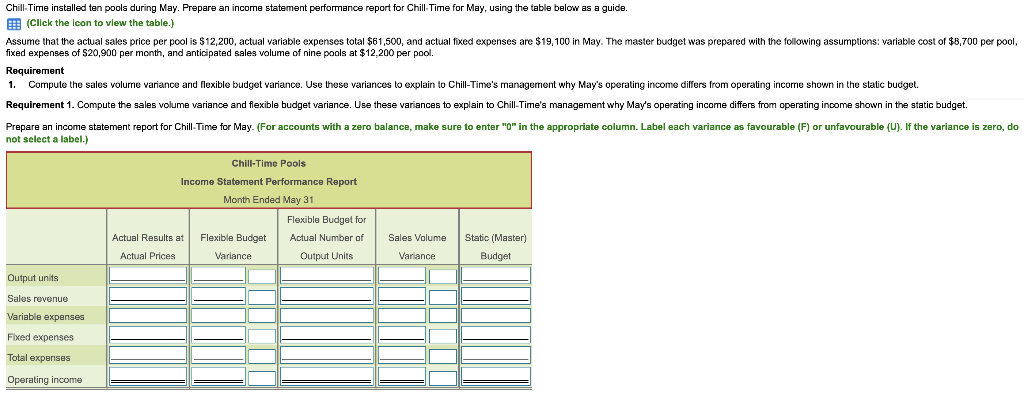

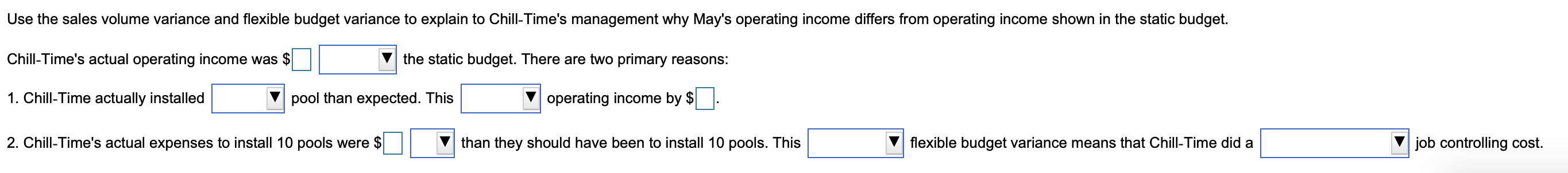

Chill-Time Pools Income Statement Performance Report Month Ended June 30 (1) (2) (3) (4) (5) (1)-(3) Flexible (3)-(5) Actual Budget Results Flexible for Actual Sales Static at Actual Budget Number of Volume (Master) Budget* Prices Variance Output Units* Variance 10 -0- 10 2 F 8 Output units (pools installed) Sales revenue $121,000 $1,000 F $120,000 $24,000 F $96,000 Variable expenses 16,000 U 83,000 22,000 3,000 U 2,000 U 80,000 20,000 64,000 20,000 Fixed expenses -0- Total expenses 105,000 5,000 U 100,000 16,000 U 84,000 $ 16,000 $4,000 U $ 20,000 $ 8,000 F $12,000 Operating income Flexible budget variance, $4,000 U Sales volume variance, $8,000 F Static budget variance, $4,000 F * Budgeted sale price is $12,000 per pool, budgeted variable expense is $8,000 per pool, and budgeted total monthly fixed expenses are $20,000. Chill-Time installed ten pools during May. Prepare an income statement performance report for Chill-Time for May, using the table below as a guide. (Click the Icon to view the table.) Assume that the actual sales price per pool is $12,200, actual variable expenses total $61,500, and actual fixed expenses are $19,100 in May. The master budget was prepared with the following assumptions: variable cost of $8,700 per pool, fixed expenses of $20,900 per month, and anticipated sales volume of nine pools at $12,200 per pool. Requirement 1. Compute the sales volume variance and flexible budget variance. Use these variances to explain to Chill-Time's management why May's operating income differs from operating income shown in the static budget. Requirement 1. Compute the sales volume variance and flexible budget variance. Use these variances to explain to Chill-Time's management why May's operating income differs from operating income shown in the static budget. Prepare an income statement report for Chill-Time May- (For accounts with a zero balance, make sure enter "o" in the appropriate column. Label each variance as favourable (F) or unfavourable (U). If the variance is zero, do not select a label.) Chill-Time Pools Income Statement Performance Report Month Ended May 31 Flexible Budget for Actual Results at Flexible Budget Actual Number of Actual Prices Variance Output Units Sales Volume Variance Static (Master) Budget Output units Sales revenue Variable expenses Fixed expenses Total expenses Operating income Use the sales volume variance and flexible budget variance to explain to Chill-Time's management why May's operating income differs from operating income shown in the static budget. Chill-Time's actual operating income was $ the static budget. There are two primary reasons: 1. Chill-Time actually installed pool than expected. This operating income by $ 2. Chill-Time's actual expenses to install 10 pools were $ than they should have been to install 10 pools. This flexible budget variance means that Chill-Time did a job controlling cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts