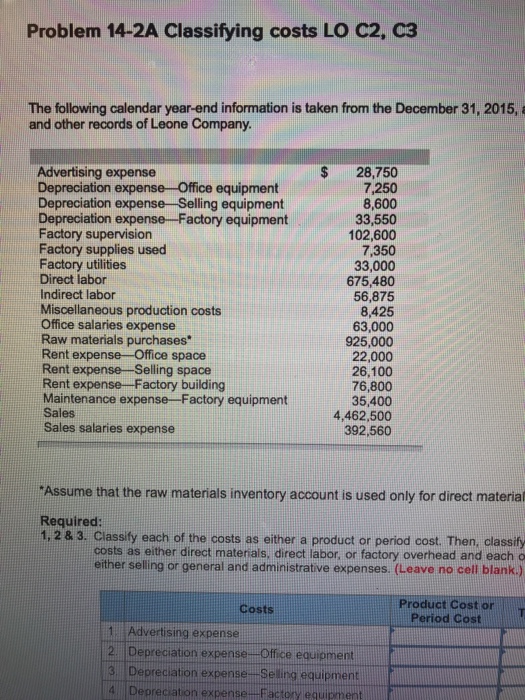

Question: Problem 14-2A Classifying costs LO C2, C3 The following calendar year-end information is taken from the December 31, 2015, a and other records of Leone

Problem 14-2A Classifying costs LO C2, C3 The following calendar year-end information is taken from the December 31, 2015, a and other records of Leone Company Advertising expense Depreciation expense Office Depreciation expense Selling equipment Depreciation expense -Factory equipment Factory supervision Factory supplies used Factory utilities Direct labor Indirect labor Miscellaneous production costs Office salaries expense Raw materials purchases Rent expense Office space Rent expense Selling space Rent expense Factory building Maintenance expense -Factory equipment Sales Sales salaries expense $ 28,750 7,250 8,600 33,550 102,600 7,350 33,000 675,480 56,875 8,425 63,000 925,000 22,000 26,100 76,800 35,400 4,462,500 392,560 equipment Assume that the raw materials inventory account is used only for direct material Required: 1,2 & 3. Classify each of the costs as either a product or period cost. Then, classify costs as either direct materials, direct labor, or factory overhead and each o either selling or general and administrative expenses (Leave no cell blank-) Costs Period Cost 1. Advertising expense 2. Depreciation expense Office equipment Depreciation expense Seling equipment iation expense Factory equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts