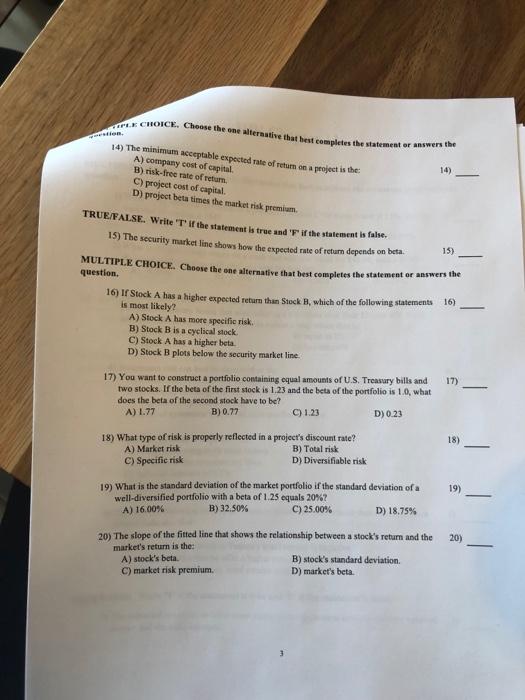

Question: CHOICE. Choose the one alteraative that best completes the statement or answers 14) The minimam acceptable expected rate of return on a project is the:

CHOICE. Choose the one alteraative that best completes the statement or answers 14) The minimam acceptable expected rate of return on a project is the: A) company cost of capital. B) risk-free rate of return. C) project cost of capital. D) project beta times the market risk premium. 14) TRUE/FALSE. Write T if the statement is true and 'F if the statement is false. 15) The security market line shows how the expected r rate of return depends on beta. 15) question e one alternative that best completes the statement or answers the 16) If Stock A has a higher expected returm tham Stock B, which of the following statements is most likely? A) Stock A has more specific risk. B) Stock B is a cyclical stock C) Stock A has a higher beta. D) Stock B plots below the security market line. 17) You want to construct a portfolio containing oqual amounts of U.S. Treasury bills and 17) two stocks. If the beta of the first stock is 1.23 and the beta of the portfolio is 1.0, what does the beta of the second stock have to be? B) 0.77 C) 1.23 D) 0.23 A) 1.77 18) 18) What type of risk is properly reflected in a project's discount rate? A) Market risk C) Specific risk B) Total risk D) Diversifiable risk 19) What is the standard deviation of the market portfolio if the standard deviation of a D) 18.75% 19) well-diversified portfolio with a beta of 1.25 equals 20%? B) 32.50% C) 25.00% A) 16.00% 20) 20) The slope of the fitted line that shows the relationship between a stock's return and the market's return is the: A) stock's beta. C) market risk premium B) stock's standard deviation. D) market's beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts