Question: CHOICE. Choose the one alternative that best completes the statement or answers the question. Generally, for CAPM calculations, the value to use for the risk-free

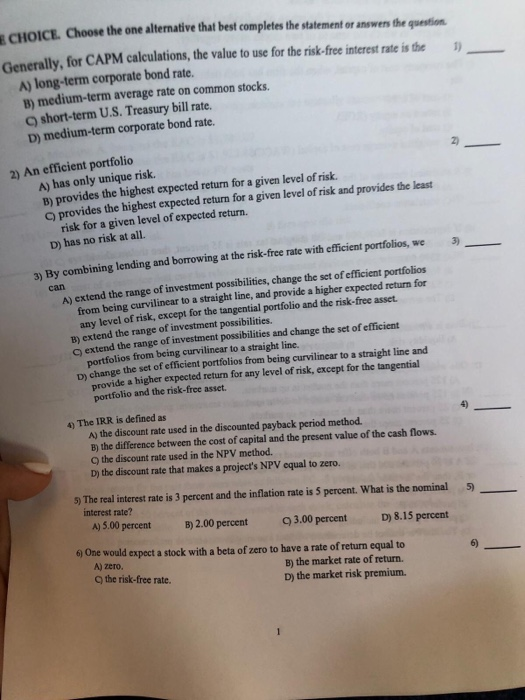

CHOICE. Choose the one alternative that best completes the statement or answers the question. Generally, for CAPM calculations, the value to use for the risk-free interest rate is the 1) A) long-term corporate bond rate. B) medium-term average rate on common stocks. short-term U.S. Treasury bill rate. D) medium-term corporate bond rate. 2) An efficient portfolio A) has only unique risk. B) provides the highest expected return for a given level of risk. provides the highest expected return for a given level of risk and provides the least risk for a given level of expected return. D) has no risk at all. By combining lending and borrowing at the risk-free rate with efficient portfolios, we can extend the range of investment possibilities, change the set of efficient portfolios from being curvilinear to a straight line, and provide a higher expected return for any level of risk, except for the tangential portfolio and the risk-free asset. B) extend the range of investment possibilities. extend the range of investment possibilities and change the set of efficient portfolios from being curvilinear to a straight line. change the set of efficient portfolios from being curvilinear to a straight line and provide a higher expected return for any level of risk, except for the tangential portfolio and the risk-free asset. portfolio e set of efficiend return for any les The IRR is defined as A) the discount rate used in the discounted payback period method. to the difference between the cost of capital and the present value of the cash flows. the discount rate used in the NPV method. D) the discount rate that makes a project's NPV equal to zero. 5) 5) The real interest rate is 3 percent and the inflation rate is 5 percent. What is the nominal interest rate? A) 5.00 percent B) 2.00 percent 93.00 percent D) 8.15 percent One would expect a stock with a beta of zero to have a rate of return equal to A) zero B) the market rate of return. the risk-free rate. Dy the market risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts