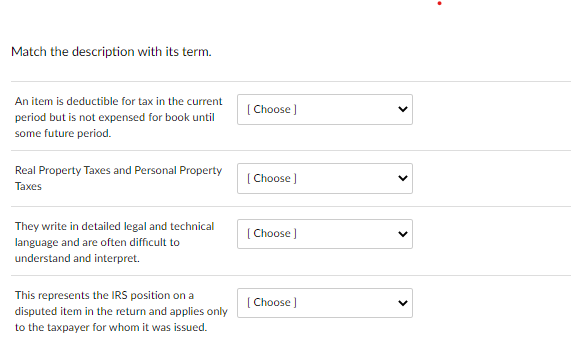

Question: Choices are: Substance over from Doctrine, Code Section Numbers, primary Authorities, Tax Advise Memo (TAM), Doctrine of Constructive Receipt, Treasury Regulations, US District Court Decision,

Choices are: Substance over from Doctrine, Code Section Numbers, primary Authorities, Tax Advise Memo (TAM), Doctrine of Constructive Receipt, Treasury Regulations, US District Court Decision, Assignment of Income Doctrine, Ad Valorem Taxes, PSCs, Abatement, Deferred Tax Liability, Deferred Tax Asset, US Court Appeals Citation.

Match the description with its term. An item is deductible for tax in the current period but is not expensed for book until some future period. [ Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts