Question: Choices: Substance over from Doctrine, Code Section Numbers, primary Authorities, Tax Advise Memo (TAM), Doctrine of Constructive Receipt, Treasury Regulations, US District Court Decision, Assignment

Choices: Substance over from Doctrine, Code Section Numbers, primary Authorities, Tax Advise Memo (TAM), Doctrine of Constructive Receipt, Treasury Regulations, US District Court Decision, Assignment of Income Doctrine, Ad Valorem Taxes, PSCs, Abatement, Deferred Tax Liability, Deferred Tax Asset, US Court Appeals Citation.

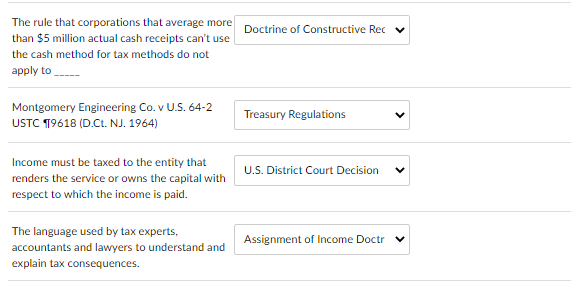

Doctrine of Constructive Rec The rule that corporations that average more than $5 million actual cash receipts can't use the cash method for tax methods do not apply to Montgomery Engineering Co.v U.S. 64-2 USTC 19618 (D.Ct. NJ. 1964) Treasury Regulations U.S. District Court Decision V Income must be taxed to the entity that renders the service or owns the capital with respect to which the income is paid. Assignment of Income Doctr V The language used by tax experts, accountants and lawyers to understand and explain tax consequences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts