Question: Choose 10 stocks screened using a valid criterion: Return on invested capital, P/E ratio, ROE, Sales growth, PEG ratio, etc. You need to back test

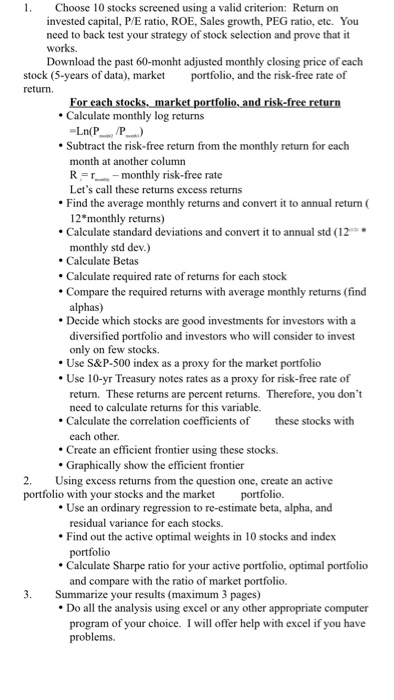

Choose 10 stocks screened using a valid criterion: Return on invested capital, P/E ratio, ROE, Sales growth, PEG ratio, etc. You need to back test your strategy of stock selection and prove that it works Download the past 60-monht adjusted monthly closing price of each stock (5-years of data), market return. portfolio, and the risk-free rate of Calculate monthly log returns Subtract the risk-free return from the monthly return for each month at another column R-rmonthly risk-free rate Let's call these returns excess returns Find the average monthly returns and convert it to annual return( 12 monthly returns) Calculate standard deviations and convert it to annual std (12 monthly std dev.) .Calculate Betas Calculate required rate of returns for each stock Compare the required returns with average monthly returns (find alphas) Decide which stocks are good investments for investors with a diversified portfolio and investors who will consider to invest only on few stocks. Use S&P-500 index x as a proxy for the market portfolio Use 10-yr Treasury notes rates as a proxy for risk-free rate of return. These returns are percent returns. Therefore, you don't need to calculate returns for this variable. .Calculate the correlation coefficients of stocks with each other. Create an efficient frontier using these stocks. Graphically show the efficient frontier 2. Using excess returns from the question one, create an active portfolio wit h your stocks and the market Use an ordinary regression to re-estimate beta, alpha, and residual variance for each stocks. portfolio. Find out the active optimal weights in 10 stocks and index portfolio Calculate Sharpe ratio for your active portfolio, optimal portfolio and compare with the ratio of market portfolio. 3. Summarize your results (maximum 3 pages) Do all the analysis using excel or any other appropriate computer program of your choice. I will offer help with excel if you have problems. Choose 10 stocks screened using a valid criterion: Return on invested capital, P/E ratio, ROE, Sales growth, PEG ratio, etc. You need to back test your strategy of stock selection and prove that it works Download the past 60-monht adjusted monthly closing price of each stock (5-years of data), market return. portfolio, and the risk-free rate of Calculate monthly log returns Subtract the risk-free return from the monthly return for each month at another column R-rmonthly risk-free rate Let's call these returns excess returns Find the average monthly returns and convert it to annual return( 12 monthly returns) Calculate standard deviations and convert it to annual std (12 monthly std dev.) .Calculate Betas Calculate required rate of returns for each stock Compare the required returns with average monthly returns (find alphas) Decide which stocks are good investments for investors with a diversified portfolio and investors who will consider to invest only on few stocks. Use S&P-500 index x as a proxy for the market portfolio Use 10-yr Treasury notes rates as a proxy for risk-free rate of return. These returns are percent returns. Therefore, you don't need to calculate returns for this variable. .Calculate the correlation coefficients of stocks with each other. Create an efficient frontier using these stocks. Graphically show the efficient frontier 2. Using excess returns from the question one, create an active portfolio wit h your stocks and the market Use an ordinary regression to re-estimate beta, alpha, and residual variance for each stocks. portfolio. Find out the active optimal weights in 10 stocks and index portfolio Calculate Sharpe ratio for your active portfolio, optimal portfolio and compare with the ratio of market portfolio. 3. Summarize your results (maximum 3 pages) Do all the analysis using excel or any other appropriate computer program of your choice. I will offer help with excel if you have problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts