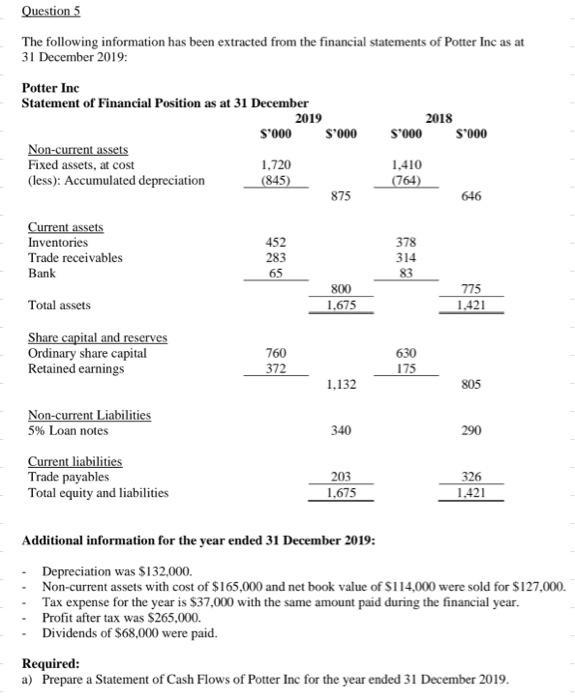

Question: Question 5 The following information has been extracted from the financial statements of Potter Inc as at 31 December 2019: Potter Inc Statement of

Question 5 The following information has been extracted from the financial statements of Potter Inc as at 31 December 2019: Potter Inc Statement of Financial Position as at 31 December $'000 Non-current assets Fixed assets, at cost (less): Accumulated depreciation Current assets Inventories Trade receivables Bank Total assets Share capital and reserves Ordinary share capital Retained earnings Non-current Liabilities 5% Loan notes Current liabilities Trade payables Total equity and liabilities 1,720 (845) 452 283 65 760 372 2019 $'000 875 800 1,675 1,132 340 203 1,675 S'000 1,410 (764) 378 314 83 630 175 2018 $'000 646 775 1,421 805 290 326 1,421 Additional information for the year ended 31 December 2019: Depreciation was $132,000. Non-current assets with cost of $165,000 and net book value of $114,000 were sold for $127,000. Tax expense for the year is $37,000 with the same amount paid during the financial year. Profit after tax was $265,000. Dividends of $68,000 were paid. Required: a) Prepare a Statement of Cash Flows of Potter Inc for the year ended 31 December 2019. Question 5 The following information has been extracted from the financial statements of Potter Inc as at 31 December 2019: Potter Inc Statement of Financial Position as at 31 December $'000 Non-current assets Fixed assets, at cost (less): Accumulated depreciation Current assets Inventories Trade receivables Bank Total assets Share capital and reserves Ordinary share capital Retained earnings Non-current Liabilities 5% Loan notes Current liabilities Trade payables Total equity and liabilities 1,720 (845) 452 283 65 760 372 2019 $'000 875 800 1,675 1,132 340 203 1,675 S'000 1,410 (764) 378 314 83 630 175 2018 $'000 646 775 1,421 805 290 326 1,421 Additional information for the year ended 31 December 2019: Depreciation was $132,000. Non-current assets with cost of $165,000 and net book value of $114,000 were sold for $127,000. Tax expense for the year is $37,000 with the same amount paid during the financial year. Profit after tax was $265,000. Dividends of $68,000 were paid. Required: a) Prepare a Statement of Cash Flows of Potter Inc for the year ended 31 December 2019.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Youve presented a financial statement and additional information from Potter Inc as of 31 December 2019 and youre asking to prepare a Statement of Cash Flows for the year ended 31 December 2019 The St... View full answer

Get step-by-step solutions from verified subject matter experts