Question: Choose from the dropdown list the probable justification for each of the following aspects of the tax law. Be sure to use concepts and terminology

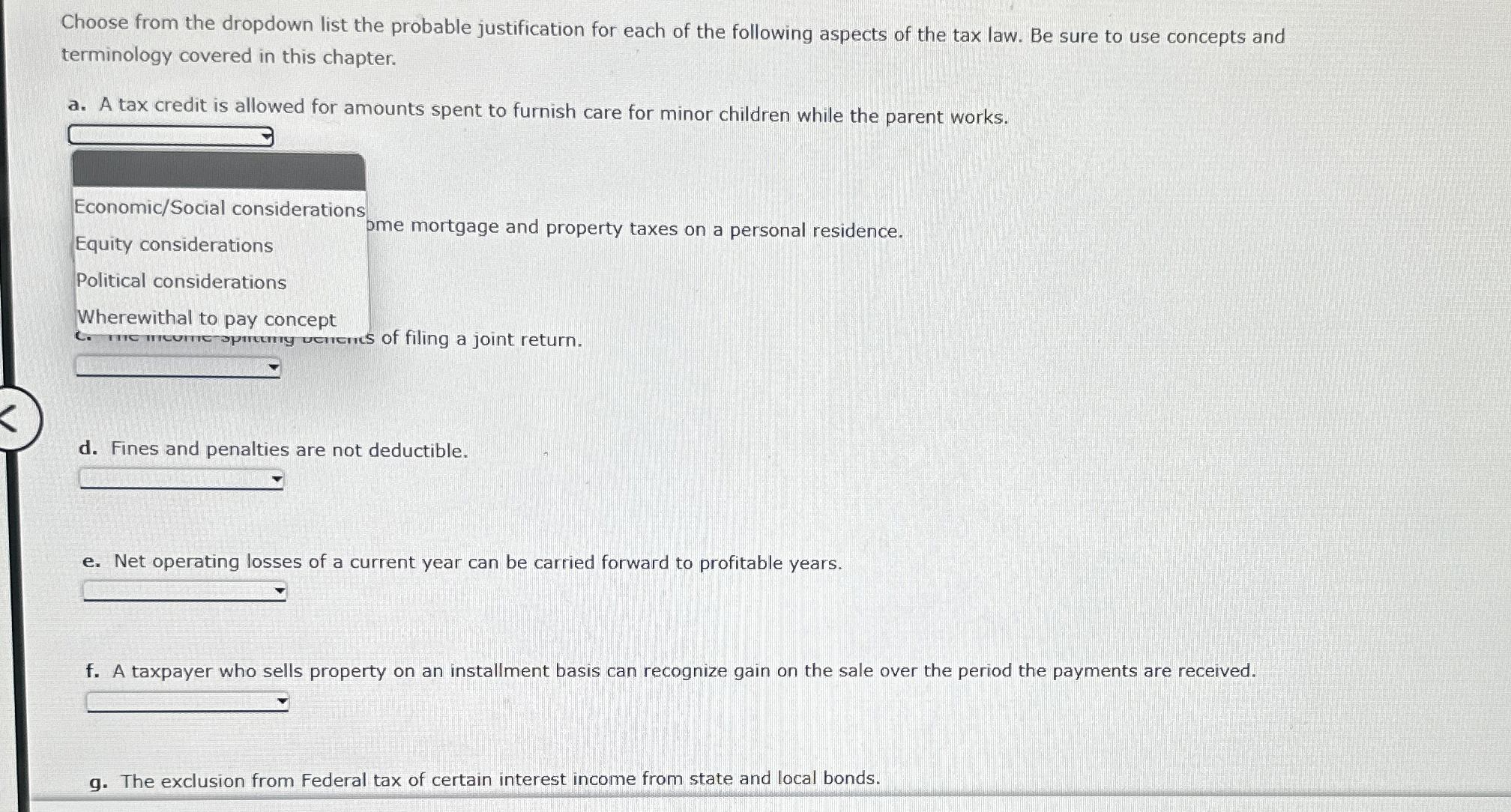

Choose from the dropdown list the probable justification for each of the following aspects of the tax law. Be sure to use concepts and terminology covered in this chapter.

a A tax credit is allowed for amounts spent to furnish care for minor children while the parent works.

EconomicSocial considerations

Equity considerations

ome mortgage and property taxes on a personal residence.

Political considerations

Wherewithal to pay concept

d Fines and penalties are not deductible.

e Net operating losses of a current year can be carried forward to profitable years.

f A taxpayer who sells property on an installment basis can recognize gain on the sale over the period the payments are received.

g The exclusion from Federal tax of certain interest income from state and local bonds.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock