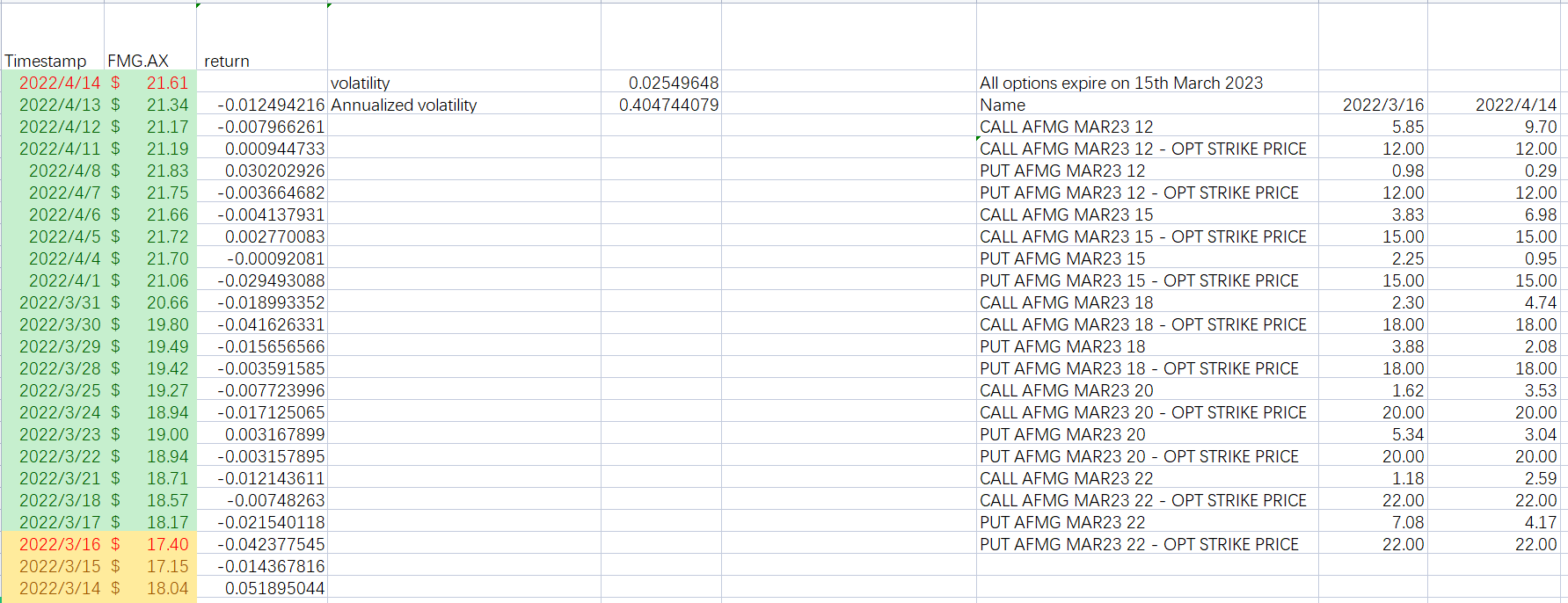

Question: choose ONE mispriced option to execute an arbitrage strategy for the period of 16/3/2022 14/4/2022. In other words, students should open all relevant position on

choose ONE mispriced option to execute an arbitrage strategy for the period of 16/3/2022 14/4/2022. In other words, students should open all relevant position on the 16th of March, and close out all positions on the 14th April 2022

Timestamp FMG.AX return 2022/4/14 $ 21.61 volatility 2022/4/13 $ 21.34 -0.012494216 Annualized volatility 2022/4/12 $ 21.17 -0.007966261 2022/4/11 $ 21.19 0.000944733 2022/4/8 $ 21.83 2022/4/7 $ 21.75 2022/4/6 $ 21.66 2022/4/5 $ 21.72 2022/4/4 $ 21.70 2022/4/1 $ 21.06 2022/3/31 $ 20.66 2022/3/30 $ 19.80 2022/3/29 $ 19.49 0.030202926 -0.003664682 -0.004137931 0.002770083 -0.00092081 -0.029493088 -0.018993352 -0.041626331 -0.015656566 2022/3/28 $ 19.42 -0.003591585 2022/3/25 $ 19.27 -0.007723996 2022/3/24 $ 18.94 -0.017125065 0.003167899 2022/3/23 $ 19.00 2022/3/22 $ 18.94 2022/3/21 $ 18.71 2022/3/18 $ 18.57 -0.003157895 -0.012143611 -0.00748263 2022/3/17 $ 18.17 -0.021540118 2022/3/16 $ 17.40 -0.042377545 2022/3/15 $ 17.15 -0.014367816 2022/3/14 $ 18.04 0.051895044 0.02549648 0.404744079 All options expire on 15th March 2023 Name CALL AFMG MAR23 12 CALL AFMG MAR23 12 - OPT STRIKE PRICE PUT AFMG MAR23 12 PUT AFMG MAR23 12 - OPT STRIKE PRICE CALL AFMG MAR23 15 CALL AFMG MAR23 15 - OPT STRIKE PRICE PUT AFMG MAR23 15 PUT AFMG MAR23 15 - OPT STRIKE PRICE CALL AFMG MAR23 18 CALL AFMG MAR23 18 OPT STRIKE PRICE PUT AFMG MAR23 18 PUT AFMG MAR23 18 - OPT STRIKE PRICE CALL AFMG MAR23 20 CALL AFMG MAR23 20 - OPT STRIKE PRICE PUT AFMG MAR23 20 PUT AFMG MAR23 20 - OPT STRIKE PRICE CALL AFMG MAR23 22 CALL AFMG MAR23 22 - OPT STRIKE PRICE PUT AFMG MAR23 22 PUT AFMG MAR23 22 - OPT STRIKE PRICE 2022/3/16 5.85 12.00 0.98 12.00 3.83 15.00 2.25 15.00 2.30 18.00 3.88 18.00 1.62 20.00 5.34 20.00 1.18 22.00 7.08 22.00 2022/4/14 9.70 12.00 0.29 12.00 6.98 15.00 0.95 15.00 4.74 18.00 2.08 18.00 3.53 20.00 3.04 20.00 2.59 22.00 4.17 22.00 Timestamp FMG.AX return 2022/4/14 $ 21.61 volatility 2022/4/13 $ 21.34 -0.012494216 Annualized volatility 2022/4/12 $ 21.17 -0.007966261 2022/4/11 $ 21.19 0.000944733 2022/4/8 $ 21.83 2022/4/7 $ 21.75 2022/4/6 $ 21.66 2022/4/5 $ 21.72 2022/4/4 $ 21.70 2022/4/1 $ 21.06 2022/3/31 $ 20.66 2022/3/30 $ 19.80 2022/3/29 $ 19.49 0.030202926 -0.003664682 -0.004137931 0.002770083 -0.00092081 -0.029493088 -0.018993352 -0.041626331 -0.015656566 2022/3/28 $ 19.42 -0.003591585 2022/3/25 $ 19.27 -0.007723996 2022/3/24 $ 18.94 -0.017125065 0.003167899 2022/3/23 $ 19.00 2022/3/22 $ 18.94 2022/3/21 $ 18.71 2022/3/18 $ 18.57 -0.003157895 -0.012143611 -0.00748263 2022/3/17 $ 18.17 -0.021540118 2022/3/16 $ 17.40 -0.042377545 2022/3/15 $ 17.15 -0.014367816 2022/3/14 $ 18.04 0.051895044 0.02549648 0.404744079 All options expire on 15th March 2023 Name CALL AFMG MAR23 12 CALL AFMG MAR23 12 - OPT STRIKE PRICE PUT AFMG MAR23 12 PUT AFMG MAR23 12 - OPT STRIKE PRICE CALL AFMG MAR23 15 CALL AFMG MAR23 15 - OPT STRIKE PRICE PUT AFMG MAR23 15 PUT AFMG MAR23 15 - OPT STRIKE PRICE CALL AFMG MAR23 18 CALL AFMG MAR23 18 OPT STRIKE PRICE PUT AFMG MAR23 18 PUT AFMG MAR23 18 - OPT STRIKE PRICE CALL AFMG MAR23 20 CALL AFMG MAR23 20 - OPT STRIKE PRICE PUT AFMG MAR23 20 PUT AFMG MAR23 20 - OPT STRIKE PRICE CALL AFMG MAR23 22 CALL AFMG MAR23 22 - OPT STRIKE PRICE PUT AFMG MAR23 22 PUT AFMG MAR23 22 - OPT STRIKE PRICE 2022/3/16 5.85 12.00 0.98 12.00 3.83 15.00 2.25 15.00 2.30 18.00 3.88 18.00 1.62 20.00 5.34 20.00 1.18 22.00 7.08 22.00 2022/4/14 9.70 12.00 0.29 12.00 6.98 15.00 0.95 15.00 4.74 18.00 2.08 18.00 3.53 20.00 3.04 20.00 2.59 22.00 4.17 22.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts