Question: choose the correct answer for first 3 and fill in the blank for last one. > Question 1 1 pts A planned investment requires me

choose the correct answer for first 3 and fill in the blank for last one.

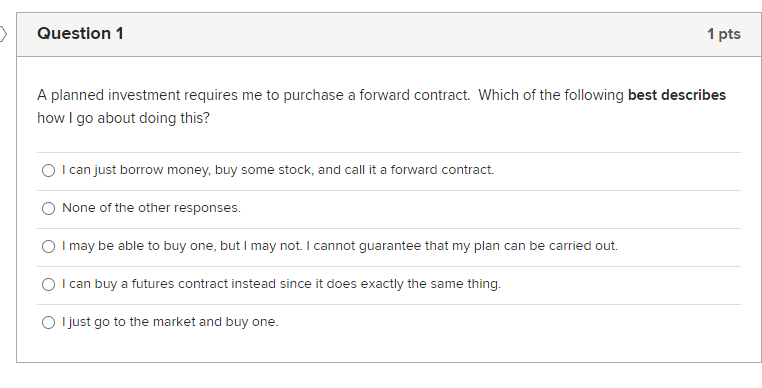

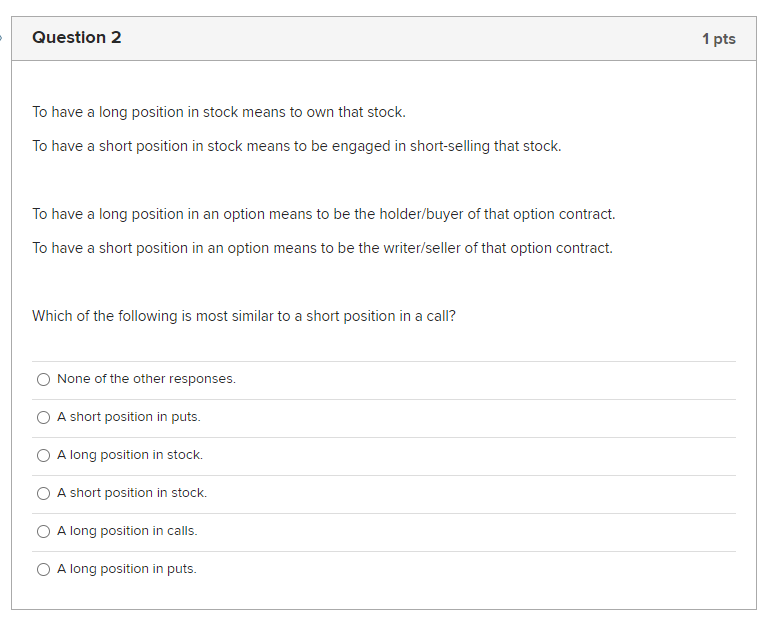

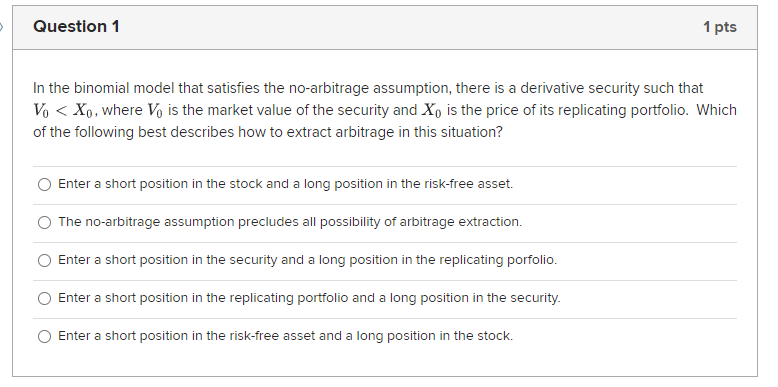

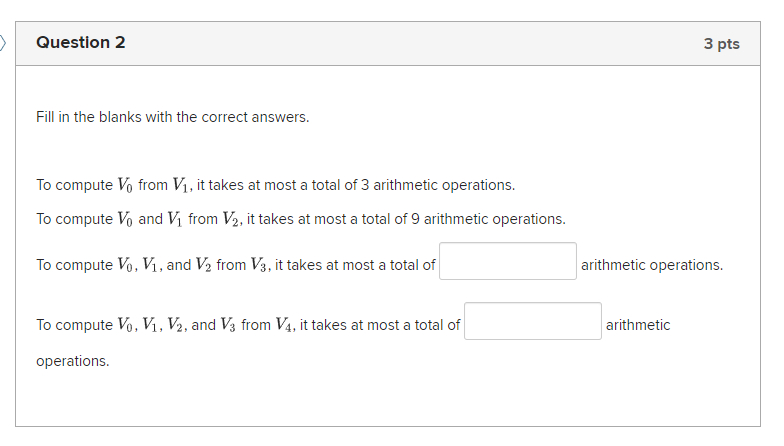

> Question 1 1 pts A planned investment requires me to purchase a forward contract. Which of the following best describes how I go about doing this? I can just borrow money, buy some stock, and call it a forward contract. None of the other responses. I may be able to buy one, but I may not. I cannot guarantee that my plan can be carried out. I can buy a futures contract instead since it does exactly the same thing. O I just go to the market and buy one. Question 2 1 pts To have a long position in stock means to own that stock. To have a short position in stock means to be engaged in short-selling that stock. To have a long position in an option means to be the holder/buyer of that option contract. To have a short position in an option means to be the writer/seller of that option contract. Which of the following is most similar to a short position in a call? None of the other responses. A short position in puts. A long position in stock. A short position in stock. A long position in calls. O A long position in puts. Question 1 1 pts In the binomial model that satisfies the no-arbitrage assumption, there is a derivative security such that Vo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts