Question: Chpt 5 reading and questiond.pdf X + X C O D file:///C:/Users/houcem/AppData/Local/Temp/Temp1_Chapter 5-20220605.zip/Chpt 5 reading and questiond.pdf E Sign In @ Google Scholar @ Gmail

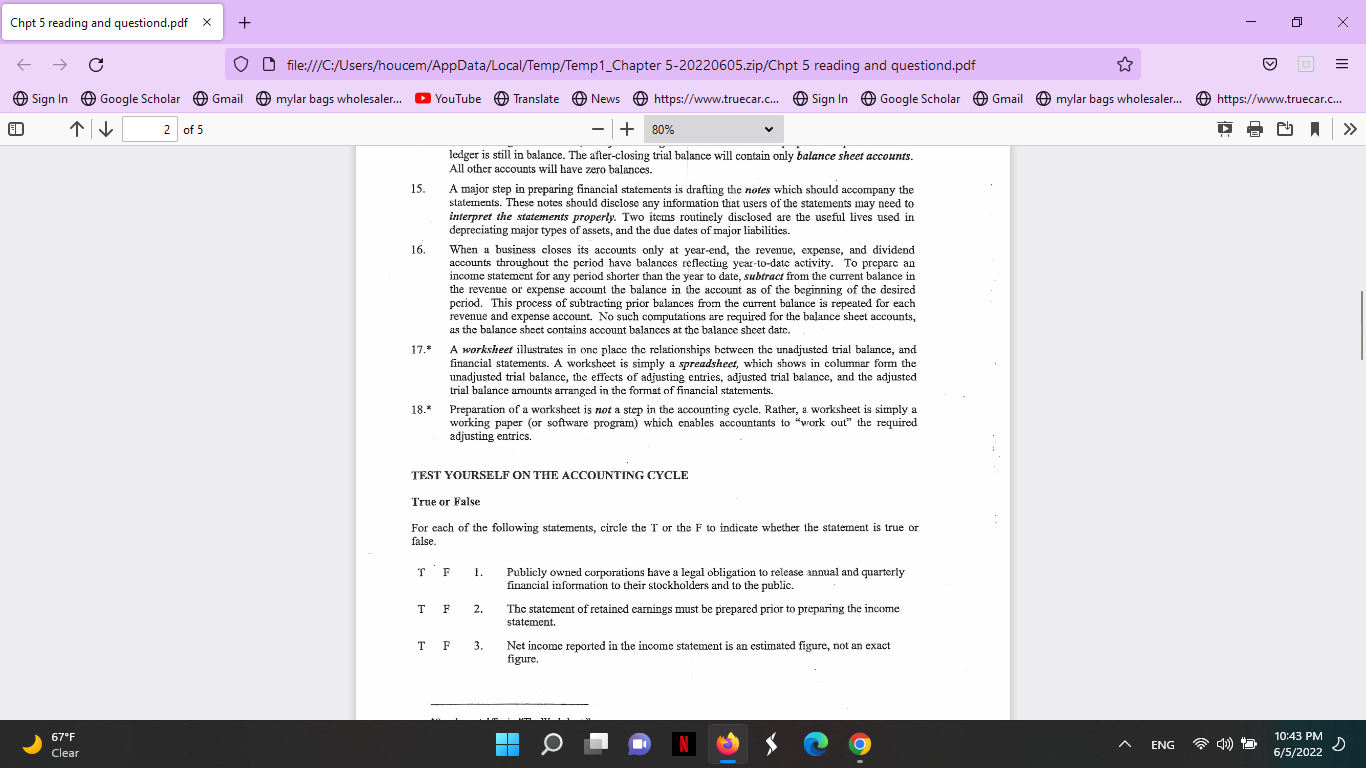

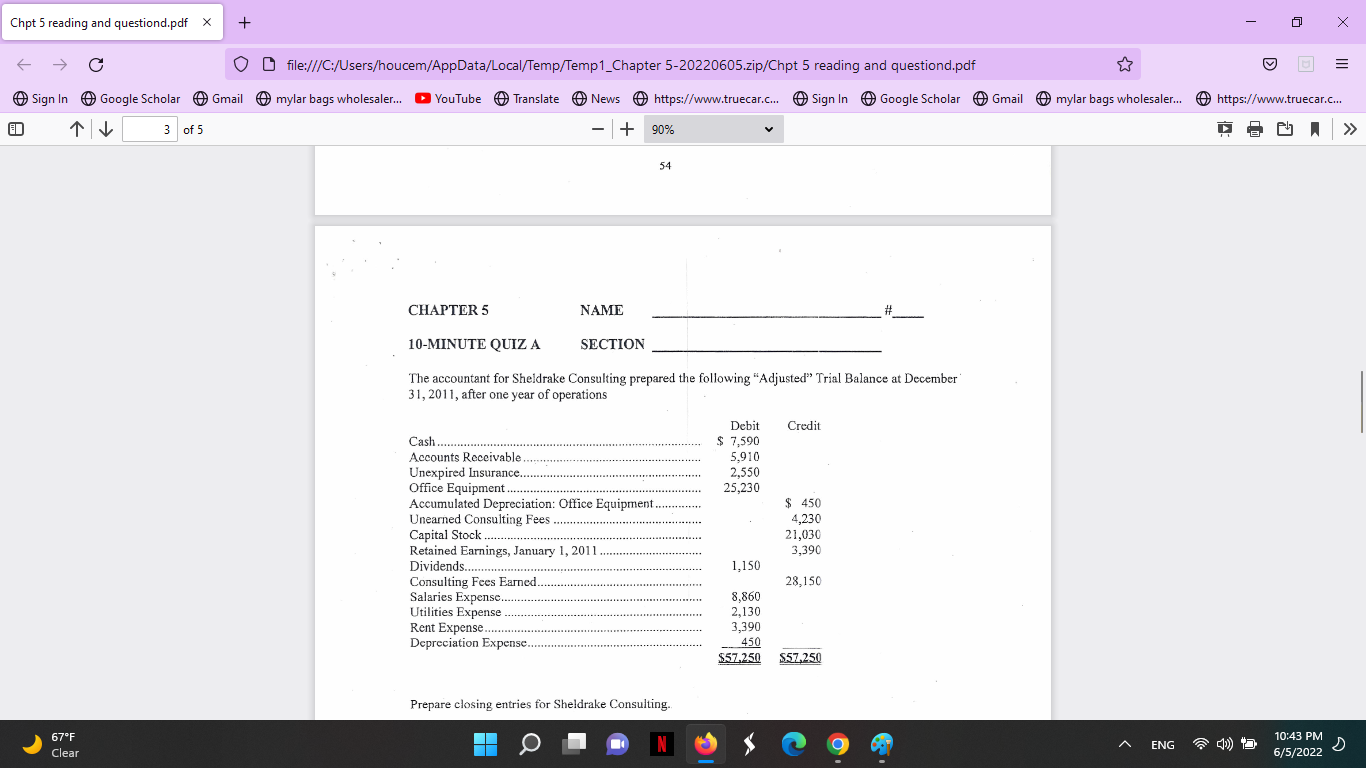

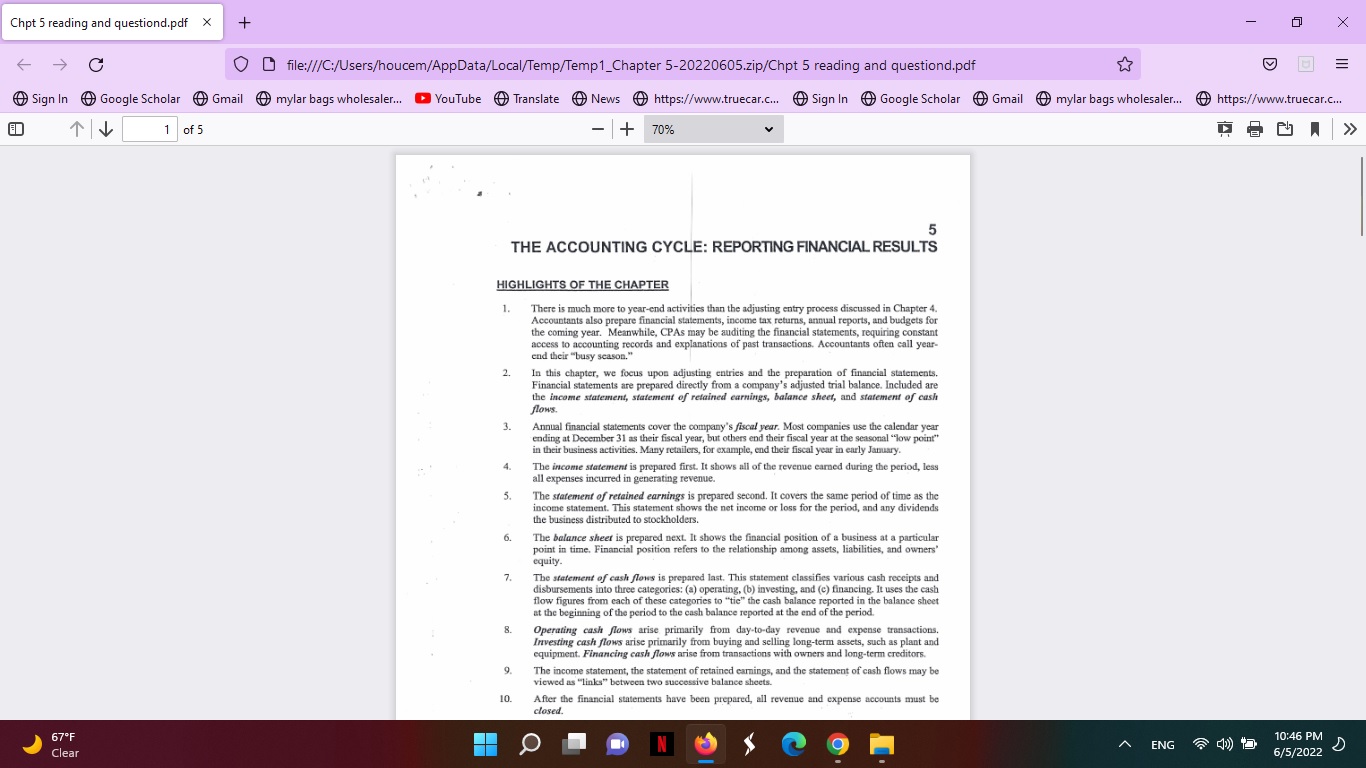

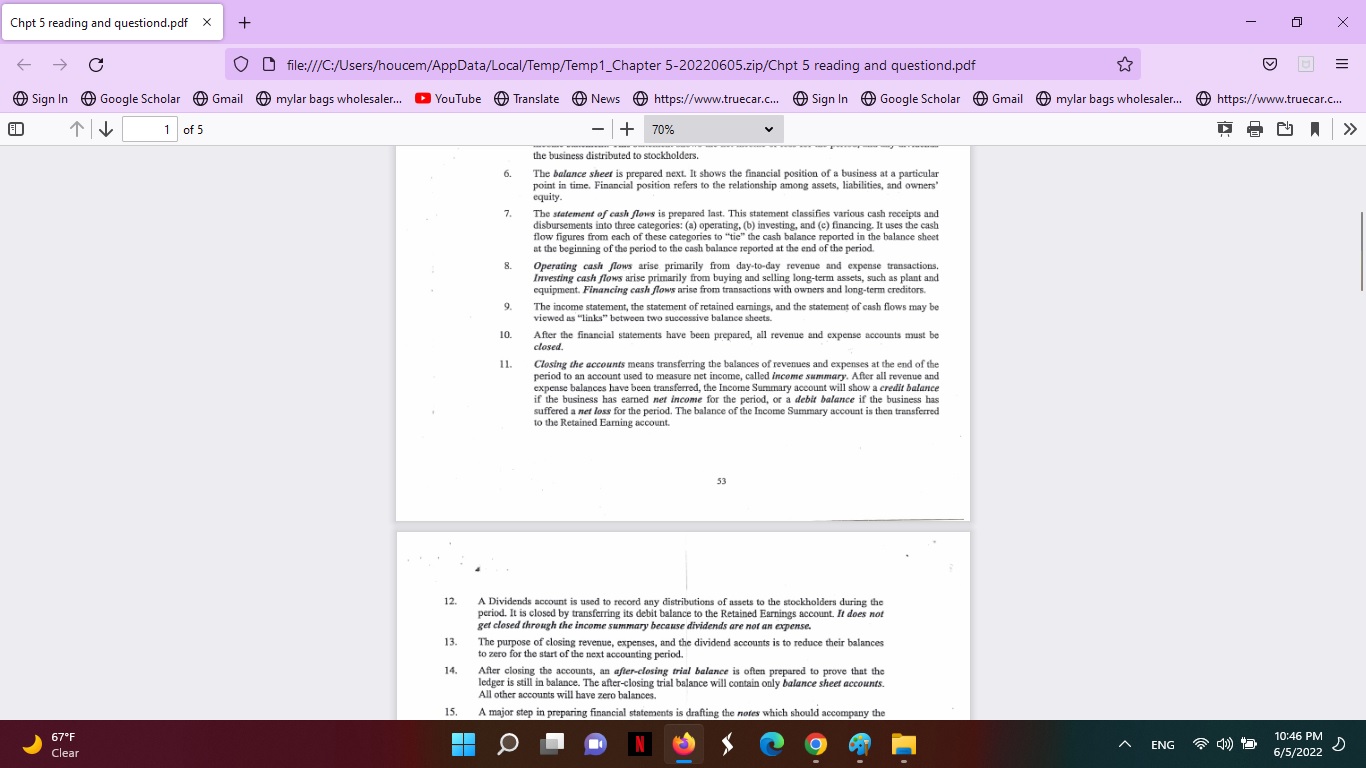

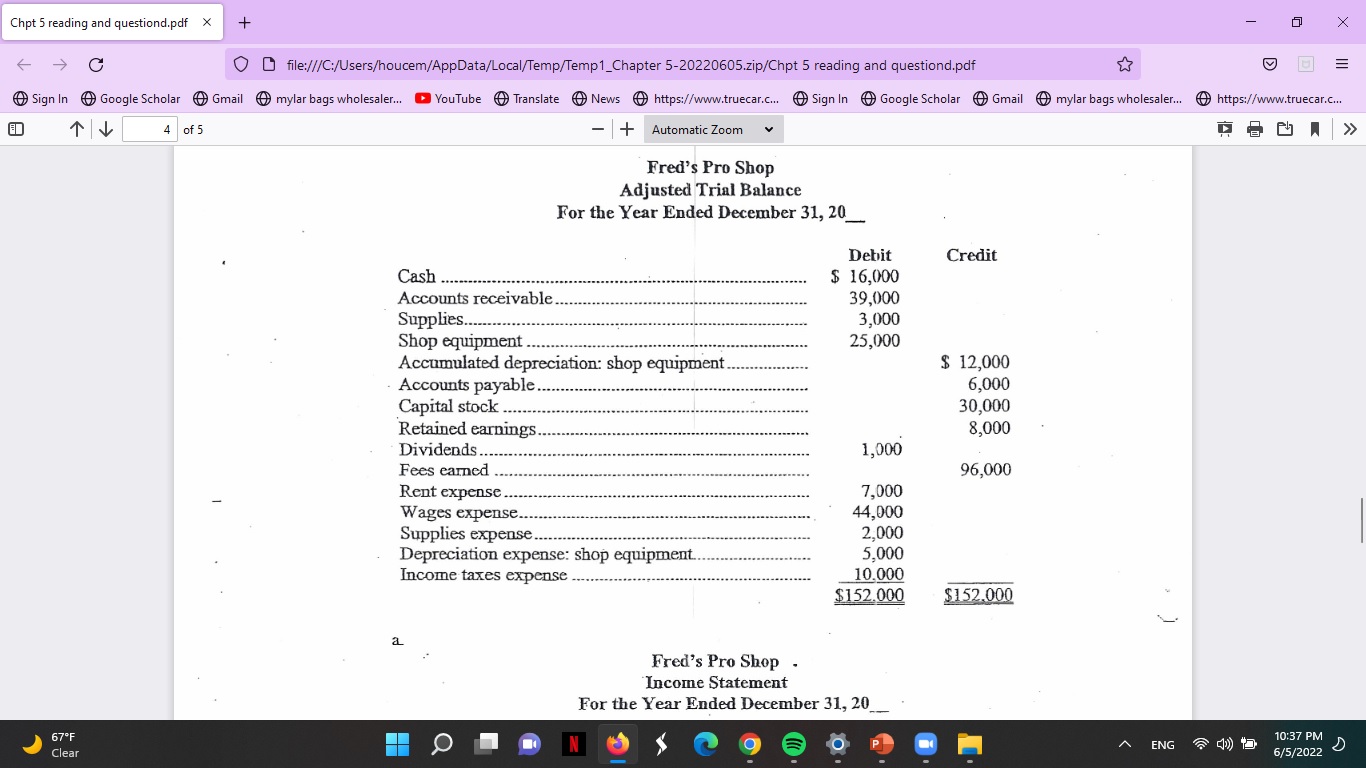

Chpt 5 reading and questiond.pdf X + X C O D file:///C:/Users/houcem/AppData/Local/Temp/Temp1_Chapter 5-20220605.zip/Chpt 5 reading and questiond.pdf E Sign In @ Google Scholar @ Gmail @ mylar bags wholesaler... YouTube @ Translate @ News @ https://www.truecar.c... @ Sign In @ Google Scholar @Gmail @ mylar bags wholesaler.. @ https://www.truecar.c... ED 2 of 5 + 80% ledger is still in balance. The after-closing trial balance will contain only balance sheet accounts. All other accounts will have zero balances. 15. A major step in preparing financial statements is drafting the notes which should accompany the statements. These notes should disclose any information that users of the statements may need to interpret the statements properly. Two items routinely disclosed are the useful lives used in depreciating major types of assets, and the due dates of major liabilities. 16. When a business closes its accounts only at year-end, the revenue, expense, and dividend accounts throughout the period have balances reflecting year-to-date activity. To prepare an income statement for any period shorter than the year to date, subtract from the current balance in the revenue or expense account the balance in the account as of the beginning of the desired period. This process of subtracting prior balances from the current balance is repeated for each revenue and expense account. No such computations are required for the balance sheet accounts, as the balance sheet contains account balances at the balance sheet date. 17.* A worksheet illustrates in one place the relationships between the unadjusted trial balance, and financial statements. A worksheet is simply a spreadsheet, which shows in columnar form the unadjusted trial balance, the effects of adjusting entries, adjusted trial balance, and the adjusted trial balance amounts arranged in the format of financial statements. 18.* Preparation of a worksheet is not a step in the accounting cycle. Rather, a worksheet is simply a working paper (or software program) which enables accountants to "work out" the required adjusting entries. TEST YOURSELF ON THE ACCOUNTING CYCLE True or False . . For each of the following statements, circle the T or the F to indicate whether the statement is true or false. T 1. Publicly owned corporations have a legal obligation to release annual and quarterly financial information to their stockholders and to the public. T 2. The statement of retained earnings must be prepared prior to preparing the income statement T 3. Net income reported in the income statement is an estimated figure, not an exact figure. 57 F Clear O N 10:43 PM A ENG 6/5/2022 DChpt 5 reading and questiond.pdf X + X C O D file:///C:/Users/houcem/AppData/Local/Temp/Temp1_Chapter 5-20220605.zip/Chpt 5 reading and questiond.pdf E Sign In Google Scholar @ Gmail @ mylar bags wholesaler... YouTube @ Translate @News @ https://www.truecar.c... ( . @Sign In @ Google Scholar @ Gmail @mylar bags wholesaler... @ https://www.truecar.c... ED 3 of 5 -+ 90% 54 CHAPTER 5 NAME # 10-MINUTE QUIZ A SECTION The accountant for Sheldrake Consulting prepared the following "Adjusted" Trial Balance at December 31, 2011, after one year of operations Debit Credit Cash ...." $ 7,590 Accounts Receivable.. 5,910 Unexpired Insurance.. 2,550 Office Equipment ... -...4. 25,230 Accumulated Depreciation: Office Equipment.... $ 450 Unearned Consulting Fees ...... 4,230 Capital Stock ........ 21,030 Retained Earnings, January 1, 2011 ......... 3,390 Dividends....." 1,150 Consulting Fees Earned. 28,150 Salaries Expense.. 8,860 Utilities Expense . 2,130 Rent Expense.. 3,390 Depreciation Expense..... -..... 450 $57,250 $57,250 Prepare closing entries for Sheldrake Consulting. 57 F 10:43 PM ENG D Clear N 6/5/2022Chpt 5 reading and questiond.pdf X + X C O D file:///C:/Users/houcem/AppData/Local/Temp/Temp1_Chapter 5-20220605.zip/Chpt 5 reading and questiond.pdf E Sign In @ Google Scholar @ Gmail @ mylar bags wholesaler... YouTube @ Translate @ News @ https://www.truecar.c... ( Sign In @Google Scholar @ Gmail @ mylar bags wholesaler... ( https://www.truecar.c... ED 1 of 5 -+ 70% THE ACCOUNTING CYCLE: REPORTING FINANCIAL RESULTS HIGHLIGHTS OF THE CHAPTER 1. There is much more to year-end activities than the adjusting entry process discussed in Chapter 4. Accountants also prepare financial statements, income tax returns, annual reports, and budgets for the coming year. Meanwhile, CPAs may be auditing the financial statements, requiring constant access to accounting records and explanations of past transactions. Accountants often call year- end their "busy season." 2. In this chapter, we focus upon adjusting entries and the preparation of financial statements. Financial statements are prepared directly from a company's adjusted trial balance. Included are the income statement, statement of retained earnings, balance sheet, and statement of cash flows. 3. Annual financial statements cover the company's fiscal year. Most companies use the calendar year ending at December 31 as their fiscal year, but others end their fiscal year at the seasonal "low point" in their business activities. Many retailers, for example, end their fiscal year in early January. 4. The income statement is prepared first. It shows all of the revenue earned during the period, less all expenses incurred in generating revenue. 5. The statement of retained earnings is prepared second. It covers the same period of time as the income statement. This statement shows the net income or loss for the period, and any dividends the business distributed to stockholders. 6. The balance sheet is prepared next. It shows the financial position of a business at a particular point in time. Financial position refers to the relationship among assets, liabilities, and owners' equity. 7. The statement of cash flows is prepared last. This statement classifies various cash receipts and disbursements into three categories: (a) operating, (b) investing, and (c) financing. It uses the cash flow figures from each of these categories to "tie" the cash balance reported in the balance sheet at the beginning of the period to the cash balance reported at the end of the period. Operating cash flows arise primarily from day-to-day revenue and expense transactions. Investing cash flows arise primarily from buying and selling long-term assets, such as plant and equipment. Financing cash flows arise from transactions with owners and long-term creditors. The income statement, the statement of retained earnings, and the statement of cash flows may be viewed as "links" between two successive balance sheets. 10 After the financial statements have been prepared, all revenue and expense accounts must be closed. 57 F 10:46 PM A ENG 6/5/2022 D ClearChpt 5 reading and questiond.pdf X + X C O D file:///C:/Users/houcem/AppData/Local/Temp/Temp1_Chapter 5-20220605.zip/Chpt 5 reading and questiond.pdf E Sign In Google Scholar @ Gmail @ mylar bags wholesaler... YouTube @ Translate @ News @ https://www.truecar.c...( @Sign In @Google Scholar @Gmail @ mylar bags wholesaler.. ( https://www.truecar.c... ED 1 of 5 + 70% the business distributed to stockholders. 6. The balance sheet is prepared next. It shows the financial position of a business at a particular point in time. Financial position refers to the relationship among assets, liabilities, and owners' equity. 7. The statement of cash flows is prepared last. This statement classifies various cash receipts and disbursements into three categories: (a) operating, (b) investing, and (c) financing. It uses the cash flow figures from each of these categories to "tie" the cash balance reported in the balance sheet at the beginning of the period to the cash balance reported at the end of the period. 8. Operating cash flows arise primarily from day-to-day revenue and expense transactions. Investing cash flows arise primarily from buying and selling long-term assets, such as plant and equipment. Financing cash flows arise from transactions with owners and long-term creditors. The income statement, the statement of retained earnings, and the statement of cash flows may be viewed as "links" between two succ assive balance sheets. 10 After the financial statements have been prepared, all revenue and expense accounts must be closed. 11. Closing the accounts means transferring the balances of revenues and expenses at the end of the period to an account used to measure net income, called income summary. After all revenue and expense balances have been transferred, the Income Summary account will show a credit balance if the business has earned net income for the period, or a debit balance if the business has suffered a net loss for the period. The balance of the Income Summary account is then transferred to the Retained Earning account. 53 12. A Dividends account is used to record any distributions of assets to the stockholders during the period. It is closed by transferring its debit balance to the Retained Earnings account. It does not get closed through the income summary because dividends are not an expense. 13. The purpose of closing revenue, expenses, and the dividend accounts is to reduce their balances to zero for the start of the next accounting period. 14. After closing the accounts, an after-closing trial balance is often prepared to prove that the ledger is still in balance. The after-closing trial balance will contain only balance sheet accounts. All other accounts will have zero balances. 15, A major step in preparing financial statements is drafting the notes which should accompany the 57 F 10:46 PM A ENG Clear 6/5/2022 DChpt 5 reading and questiond.pdf X + X C O D file:///C:/Users/houcem/AppData/Local/Temp/Temp1_Chapter 5-20220605.zip/Chpt 5 reading and questiond.pdf E Sign In Google Scholar @ Gmail @ mylar bags wholesaler... YouTube @ Translate @ News @ https://www.truecar.c... Sign In @Google Scholar @ Gmail @ mylar bags wholesaler... @ https://www.truecar.c... ED 4 of 5 + Automatic Zoom Fred's Pro Shop Adjusted Trial Balance For the Year Ended December 31, 20_ Debit Credit Cash $ 16,000 Accounts receivable. 39,000 Supplies. 3,000 Shop equipment. 25,000 Accumulated depreciation: shop equipment. $ 12,000 Accounts payable.. 6,000 Capital stock .. 30,000 Retained earnings..... 8,000 Dividends .... 1,000 Fees earned 96,000 Rent expense. 7,000 Wages expense. 44,000 Supplies expense. 2,000 Depreciation expense: shop equipment. 5,000 Income taxes expense 10.000 $152.000 $152.000 a Fred's Pro Shop . Income Statement For the Year Ended December 31, 20 57 F N 10:37 PM A ENG 6/5/2022 D Clear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts