Question: Problem 3 You are asked to evaluate the following statements about capital budget criteria. Please state whether each statement below is true or false and

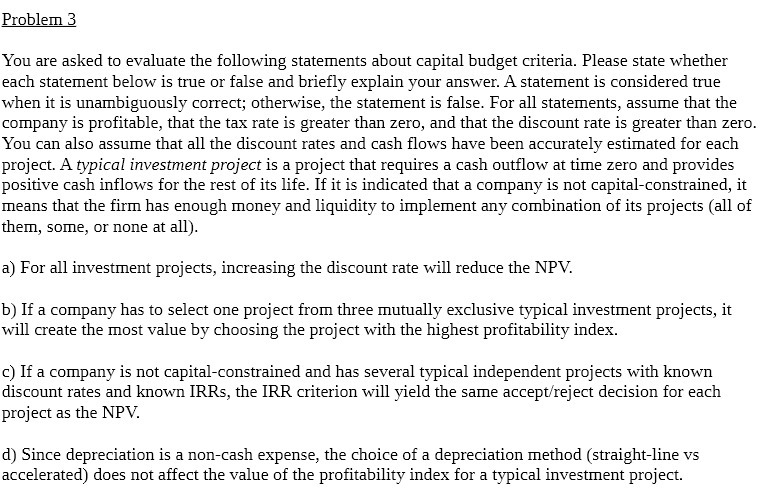

Problem 3 You are asked to evaluate the following statements about capital budget criteria. Please state whether each statement below is true or false and briey explain your answer. A. statement is considered true when it is unambiguously correct; otherwise, the statement is false- For all statements, assume that the company is profitable, that the tax rate is greater than zero, and that the discount rate is greater than zero. You can also assume that all the discount rates and cash ows have been accurately estimated for each project. A gepieoi investment project is a project that requires a cash outow at time zero and provides positive cash inflows for the rest of its life. If it is indicated that a company is not capitalconstrained, it means that the firm has enough money and liquidity to implement any combination of its projects (all of them, some, or none at all]. a) For all invesmient projects, increasing the discount rate will reduce the NPV. b) If a company has to select one project from three mutually exclusive typical investment projects, it will create the most value by choosing the project with the highest profitability index. c) If a company is not capitalconstrained and has several typical independent projects with loiown discount rates and loiown IRRs, the [RR criterion will yield the same acceptfreject decision for each project as the NPV. d) Since depreciation is a noncash expense, the choice of a depreciation method (straightline vs accelerated) does not affect the value of the protability index for a typical investment project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts