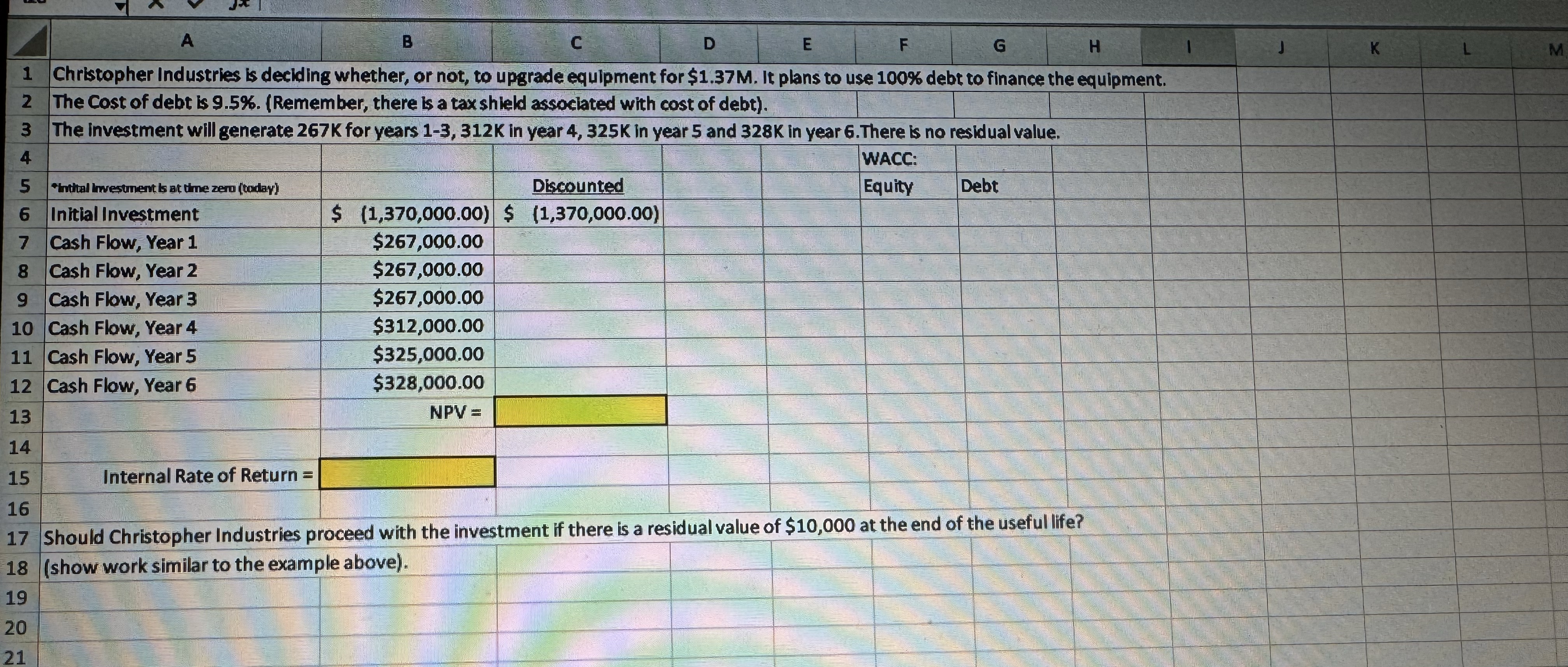

Question: Christopher Industries is deciding whether, or not, to upgrade equlpment for $ 1 . 3 7 M . It plans to use 1 0 0

Christopher Industries is deciding whether, or not, to upgrade equlpment for $ It plans to use debt to finance the equipment.

The Cost of debt is Remember there is a tax shield associated with cost of debt

The investment will generate K for years in year in year and K in year There is no residual value.

Should Christopher Industries proceed with the investment if there is a residual value of $ at the end of the useful life?

show work similar to the example above

Can you please find the cost of equity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock