Question: Chrome File Edit View History B Bookmarks Profiles b Window Help 36% [4]. Tue 5:10 PM Q DE 19 Sports X NOVA P Popular F

![36% [4]. Tue 5:10 PM Q DE 19 Sports X NOVA P](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673e6a6055591_712673e6a600f08b.jpg)

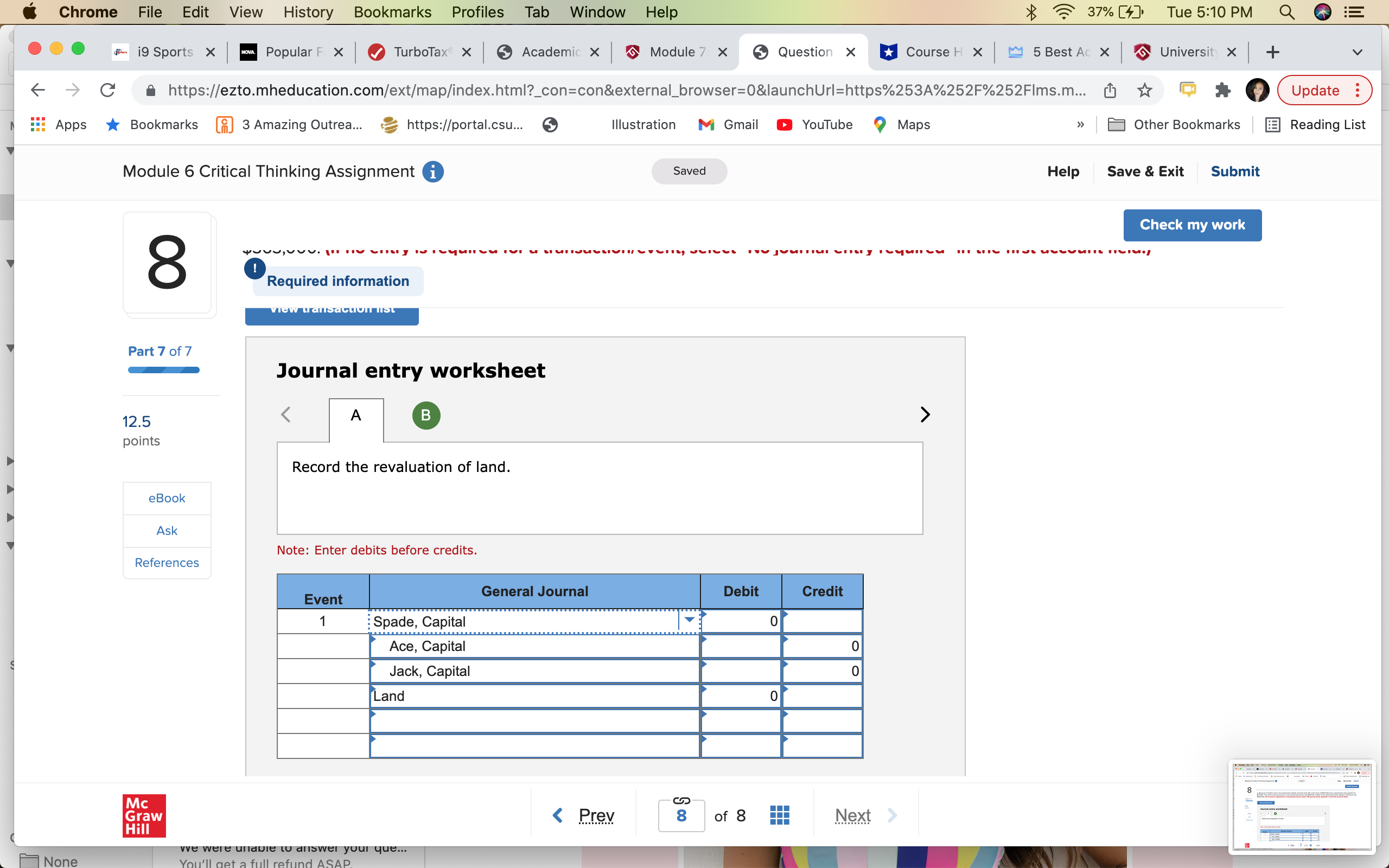

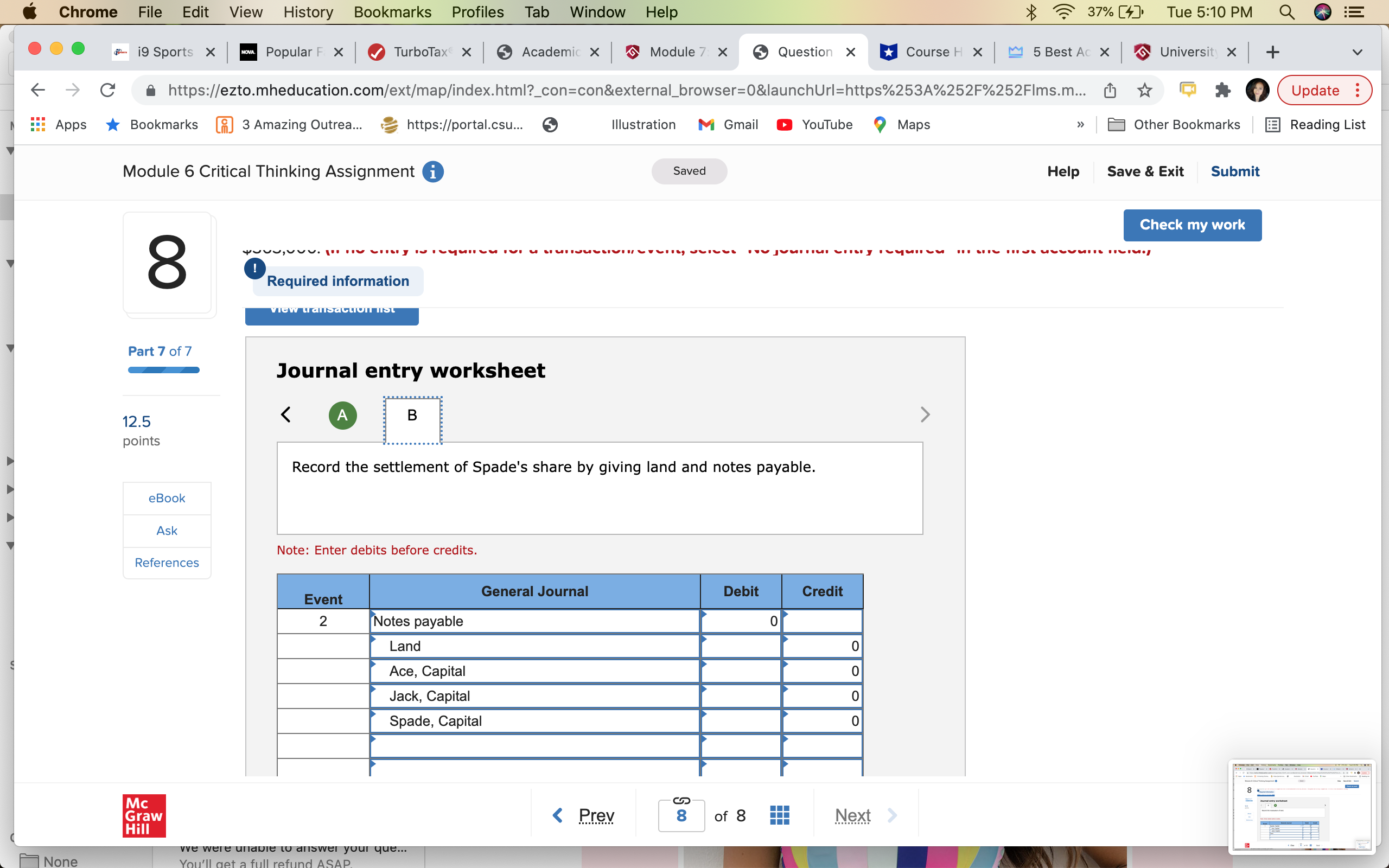

Chrome File Edit View History B Bookmarks Profiles b Window Help 36% [4]. Tue 5:10 PM Q DE 19 Sports X NOVA P Popular F X TurboTax X Academic X Module 7: X Question X Course H X M 5 Best Ac X University x + C https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.m... Update Apps Bookmarks 3 Amazing Outrea... https://portal.csu... Illustration M Gmail YouTube Maps > Other Bookmarks Reading List Module 6 Critical Thinking Assignment i Saved Help Save & Exit Submit Check my work 8 Required information Part 7 of 7 [The following information applies to the questions displayed below.] The partnership of Ace, Jack, and Spade has been in business for 25 years. On December 31, 20X5, Spade decided to retire. The partnership balance sheet reported the following capital balances for each partner at December 31, 12.5 20X5: points Ace, Capital $151 , 700 eBook Jack, Capital 201, 400 Spade, Capital 121, 800 Ask References The partners allocate partnership income and loss in the ratio 20:30:50, respectively. Required: Record Spade's withdrawal under each of the following independent situations. g. Because of limited cash in the partnership, Spade received land with a fair value of $102,000 and a partnership note payable for $51,400. The land's carrying amount on the partnership books was $60,500. Capital of the partnership after Spade's retirement was $363,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) . .. ..... Mc Graw Hill vve were unable to answer your que... NoneChrome File Edit View History B Bookmarks Profiles b Window Help 37% [4]. Tue 5:10 PM Q DE 19 Sports X NOVA P Popular F X TurboTax X Academic X Module 7: X Question X Course H x M 5 Best Ac X University x + C https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.m... Update Apps Bookmarks 3 Amazing Outrea... https://portal.csu... Illustration M Gmail YouTube Maps > Other Bookmarks Reading List Module 6 Critical Thinking Assignment i Saved Help Save & Exit Submit Check my work 8 g. Because of limited cash in the partnership, Spade received land with a fair value of $102,000 and a partnership note payable for $51,400. The land's carrying amount on the partnership books was $60,500. Capital of the partnership after Spade's retirement was $363,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Part 7 of 7 View transaction list 12.5 points Journal entry worksheet eBook A > Ask Record the revaluation of land. References Note: Enter debits before credits. Event General Journal Debit Credit 1 :Spade, Capital 0 Ace, Capital 0 Jack, Capital 0 Mc Graw Other Bookmarks Reading List Module 6 Critical Thinking Assignment i Saved Help Save & Exit Submit Check my work 8 Required information new transaction list Part 7 of 7 Journal entry worksheet 12.5 A > points Record the revaluation of land. eBook Ask Note: Enter debits before credits. References Event General Journal Debit Credit 1 Spade, Capital Ace, Capital Jack, Capita 0 Land 0 Mc Graw Other Bookmarks Reading List Module 6 Critical Thinking Assignment i Saved Help Save & Exit Submit Check my work 8 your, vVV . I.. . Required information new transaction list Part 7 of 7 Journal entry worksheet 12.5 Hill vve were unable to answer your que... None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts