Question: Chrome File Edit View History Bookmarks Profiles Tab Window Help ON X Q 8 * Sat Apr 8 1:02 PM ... M Question 3 -

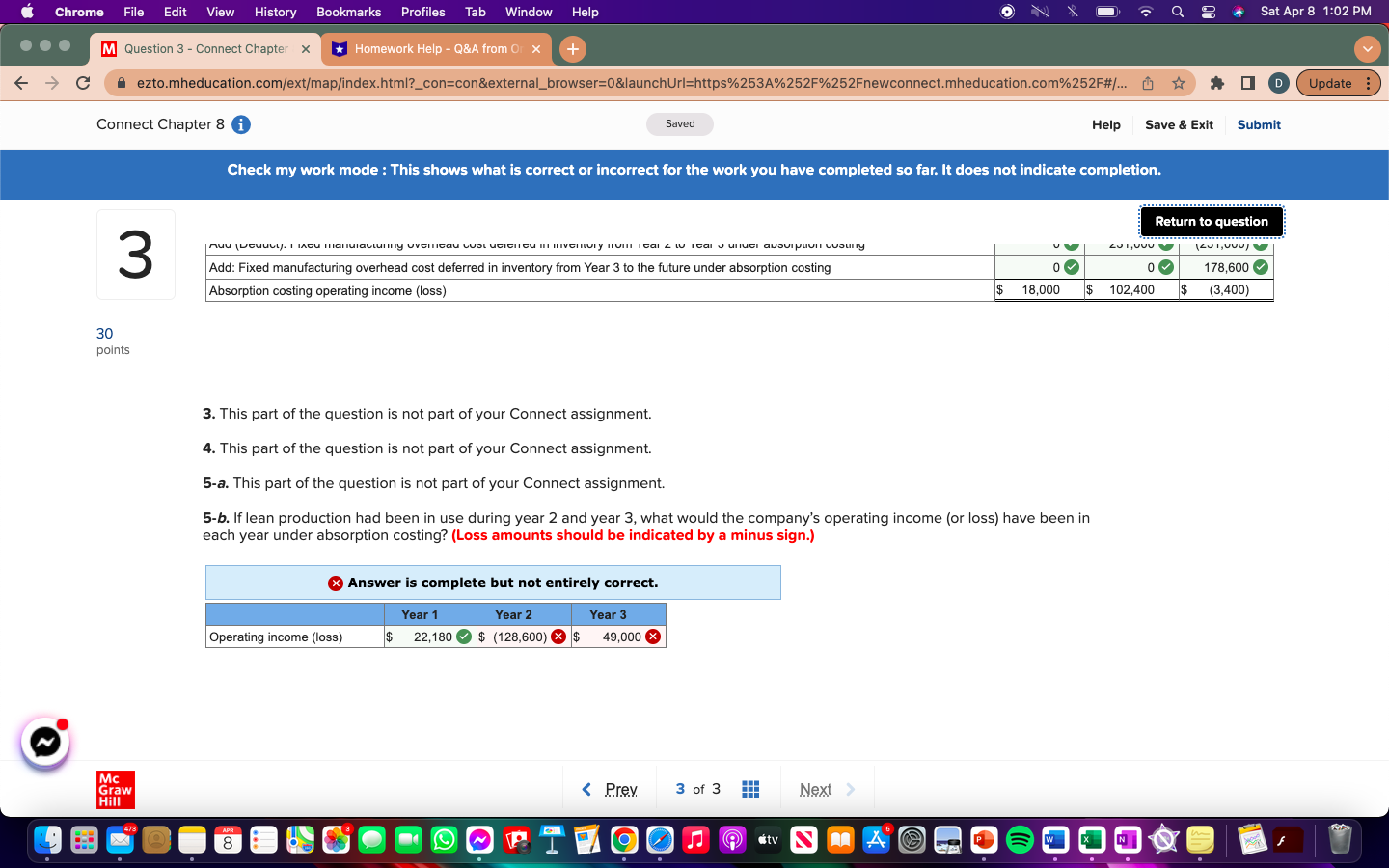

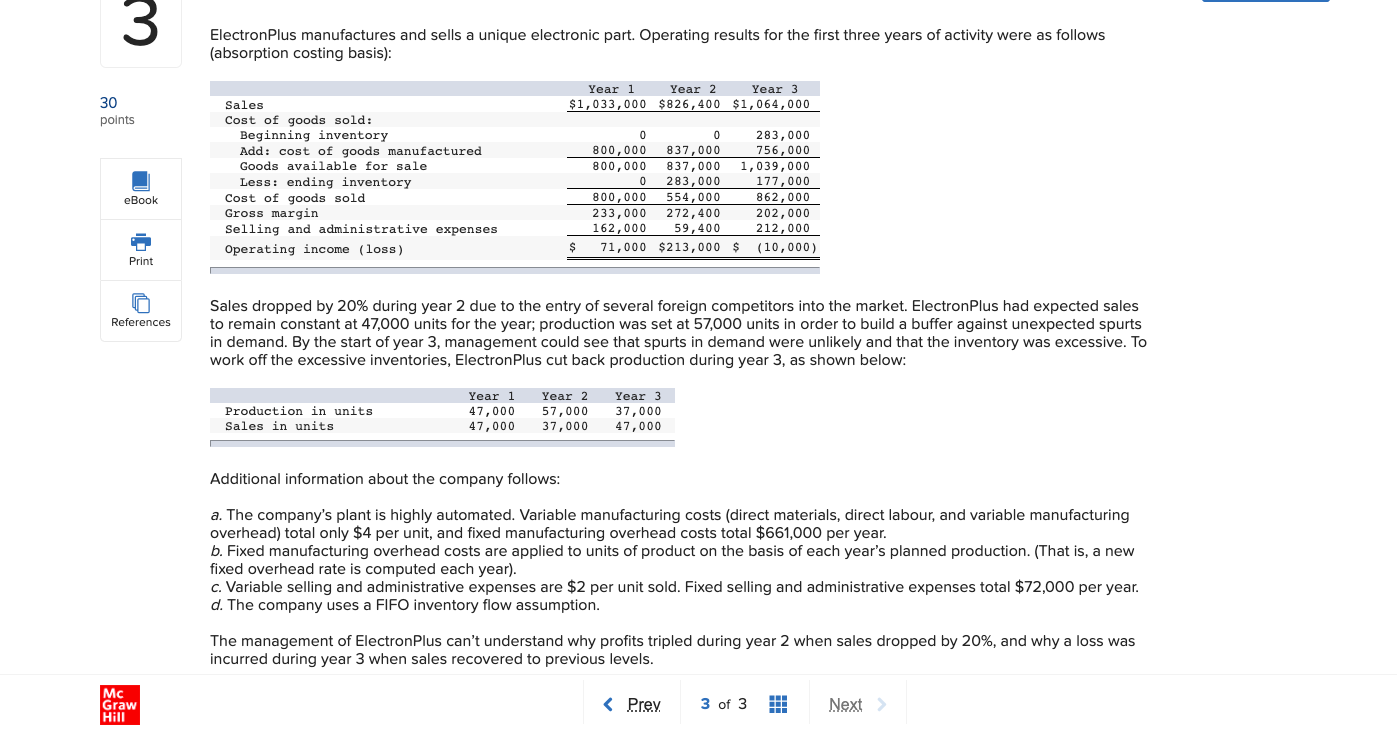

Chrome File Edit View History Bookmarks Profiles Tab Window Help ON X Q 8 * Sat Apr 8 1:02 PM ... M Question 3 - Connect Chapter X *Homework Help - Q&A from Or > + - - C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/... ( * # 0 D Update : Connect Chapter 8 i Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 3 ANN IUGLVL/. I LAGU IIIaI UIQVIIIly VVGINIGau VOL UGIGIICU III IIIVGIRLy HIVIII IGal 2 I IGal V UIIUGI GUOVI JUVII woully vv Add: Fixed manufacturing overhead cost deferred in inventory from Year 3 to the future under absorption costing 178,600 Absorption costing operating income (loss) $ 18,000 $ 102,400 $ (3,400) 30 points 3. This part of the question is not part of your Connect assignment. 4. This part of the question is not part of your Connect assignment. 5-a. This part of the question is not part of your Connect assignment. 5-b. If lean production had been in use during year 2 and year 3, what would the company's operating income (or loss) have been in each year under absorption costing? (Loss amounts should be indicated by a minus sign.) x Answer is complete but not entirely correct. Year 1 Year 2 Year 3 Operating income (loss) $ 22,180 @ $ (128,600) * $ 49,000 x N Mc Graw Hill 47 8 cityRefers nces EIectronPIus manufactures and sells a unique electronic part. Operating results for the rst three years of activity were as follows (absorption costing basis]: Year 1 Year 2 Year 3 Sales $1,033,000 $326,400 $1,064,000 Cast of goods sold: Beginning inventory 0 0 203, 000 Md: coat of goods manufactured 300.000 037 ,000 756, 000 Good: available for sale 800,000 337,000 1,039,000 Lees .' ending inventory 0 283 ,000 177, 000 Cost of goods sold 300,000 554,000 562,000 Gross margin 233,000 272,400 202,000 Selling and administrative expenses 162.000 59 ,400 212, 000 Operating income (1053) $ 71.000 $213,000 3 (10,000] Sales dropped by 20% during year 2 due to the entry of several foreign competitors into the market. EIectronPlus had expected sales to remain constant at 47,000 units for the year: production was set at 57,000 units in order to build a buffer against unexpected spurts in demand. By the start ofyear 3, management could see that spurts in demand were unlikely and that the inventory was excessive. To work offthe excessive inventories, ElectronPIus cut back production during year 3, as shown below: Year 1 Year 2 Year 3 Production in units 47,000 57,000 31,000 Sales in units 41,000 37,000 47,000 Additional information about the company follows: a. The company's plant is highly automated. Variable manufacturing costs (direct materials. direct labour, and variable manufacturing overhead) total only $4 per unit, and xed manufacturing overhead costs total $661,000 per year. b. Fixed manufacturing overhead costs are applied to units of product on the basis of each year's planned production (That is. a new xed overhead rate is computed each year]. C. Variable selling and administrative expenses are $2 per unit sold. Fixed selling and administrative expenses total $72900 per year. 0'. The company uses a FIFO inventory flow assumption. The management of ElectronPlus can't understand why prots tripled during year 2 when sales dropped by 20%. and why a loss was incurred during year 3 when sales recovered to previous levels.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts