Question: Circle the right answer for each question below: 1. Which Hedge Fund strategy is riskier in general? a. Non-Directional b. Directional 2. When the Survivorship

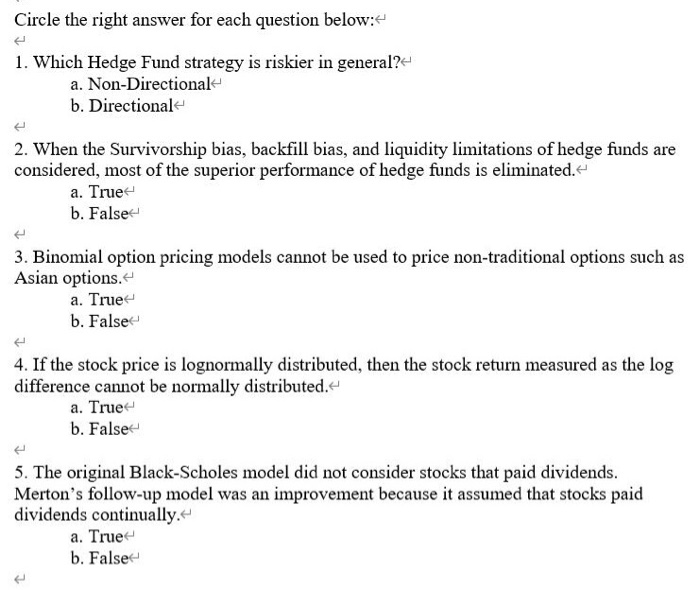

Circle the right answer for each question below: 1. Which Hedge Fund strategy is riskier in general? a. Non-Directional b. Directional 2. When the Survivorship bias, backfill bias, and liquidity limitations of hedge funds are considered, most of the superior performance of hedge funds is eliminated. a. True b. False 3. Binomial option pricing models cannot be used to price non-traditional options such as Asian options. a. True b. False 4. If the stock price is lognormally distributed, then the stock return measured as the log difference cannot be normally distributed. a. True b. False 5. The original Black-Scholes model did not consider stocks that paid dividends. Merton's follow-up model was an improvement because it assumed that stocks paid dividends continually. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts