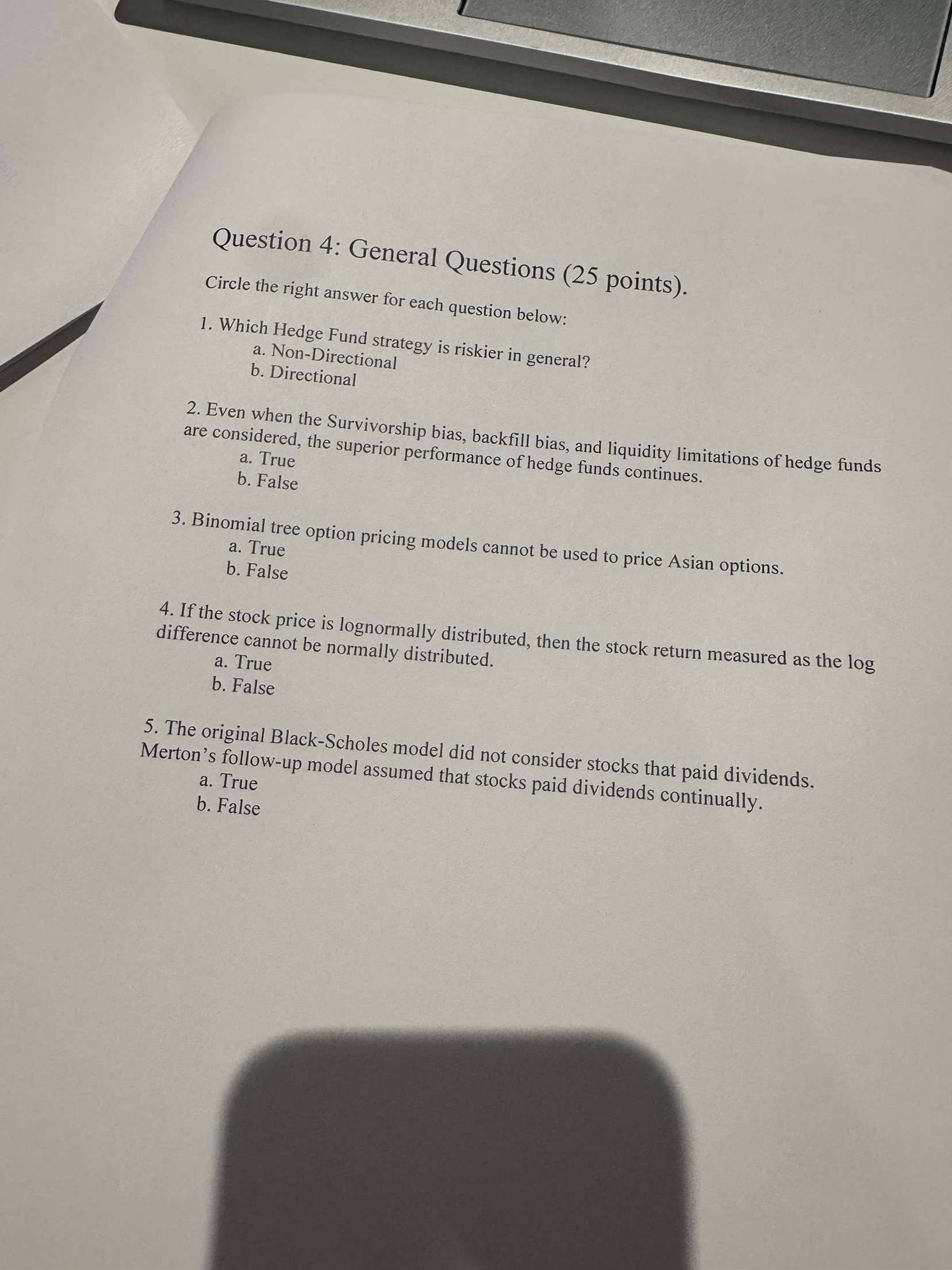

Question: Question 4 : General Questions ( 2 5 points ) . Circle the right answer for each question below: 1 . Which Hedge Fund strategy

Question : General Questions points

Circle the right answer for each question below:

Which Hedge Fund strategy is riskier in general?

a NonDirectional

b Directional

Even when the Survivorship bias, backfill bias, and liquidity limitations of hedge funds are considered, the superior performance of hedge funds continues.

a True

b False

Binomial tree option pricing models cannot be used to price Asian options.

a True

b False

If the stock price is lognormally distributed, then the stock return measured as the log difference cannot be normally distributed.

a True

b False

The original BlackScholes model did not consider stocks that paid dividends. Merton's followup model assumed that stocks paid dividends continually.

a True

b False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock