Question: CIT has a 10 year bond with a par value of $1000, a coupon rate of 4.25% and a price of $1031.20. What is its

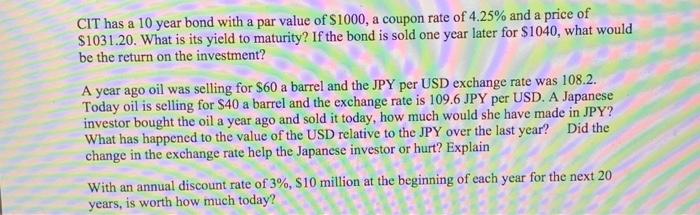

CIT has a 10 year bond with a par value of $1000, a coupon rate of 4.25% and a price of $1031.20. What is its yield to maturity? If the bond is sold one year later for $1040, what would be the return on the investment? A year ago oil was selling for $60 a barrel and the JPY per USD exchange rate was 108.2. Today oil is selling for $40 a barrel and the exchange rate is 109.6 JPY per USD. A Japanese investor bought the oil a year ago and sold it today, how much would she have made in JPY? What has happened to the value of the USD relative to the JPY over the last year? Did the change in the exchange rate help the Japanese investor or hurt? Explain With an annual discount rate of 3%, $10 million at the beginning of each year for the next 20 years, is worth how much today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts