Question: CJ Co is a profitable company which is financed by equity with a market value of $180 million and by debt with a market

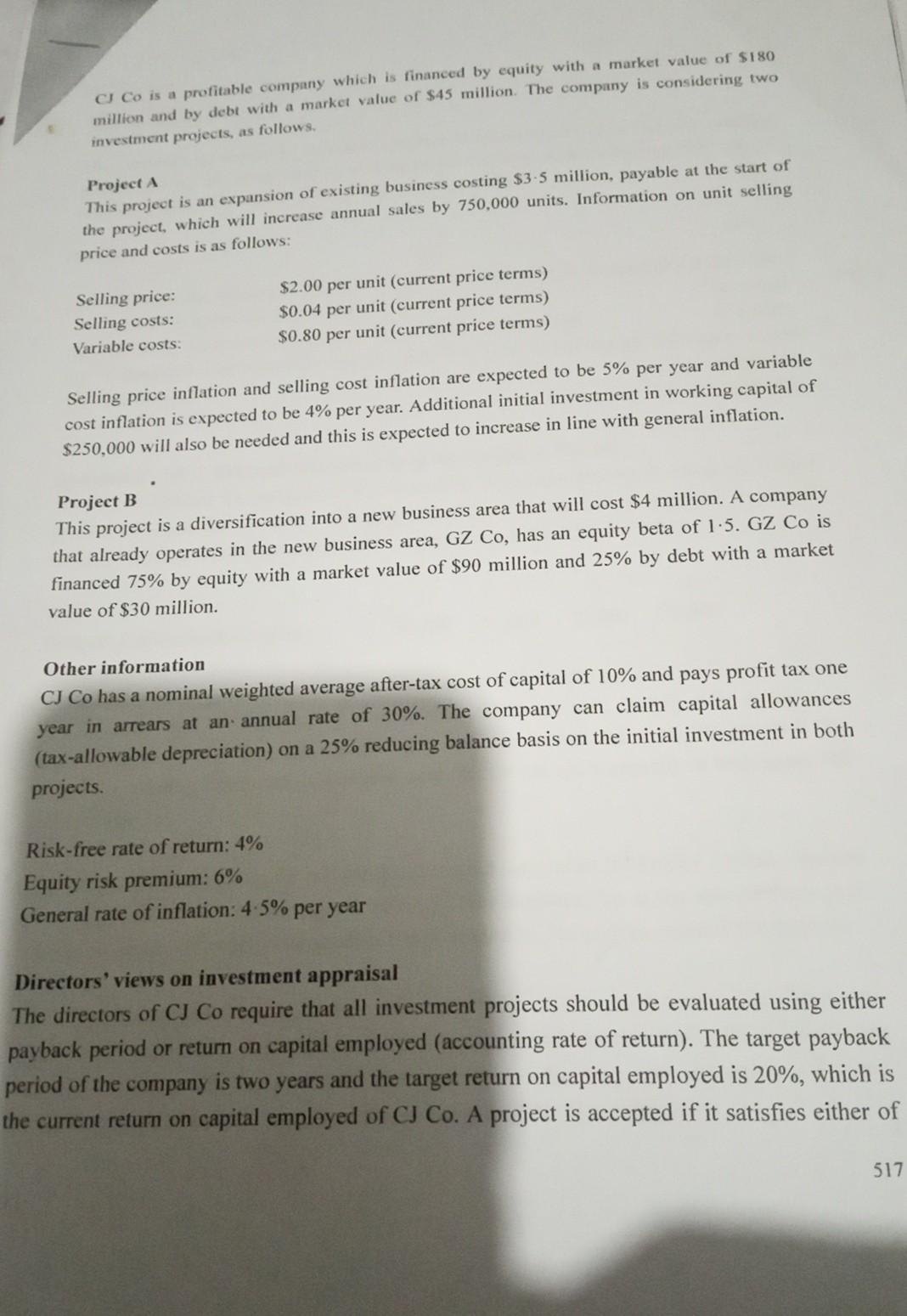

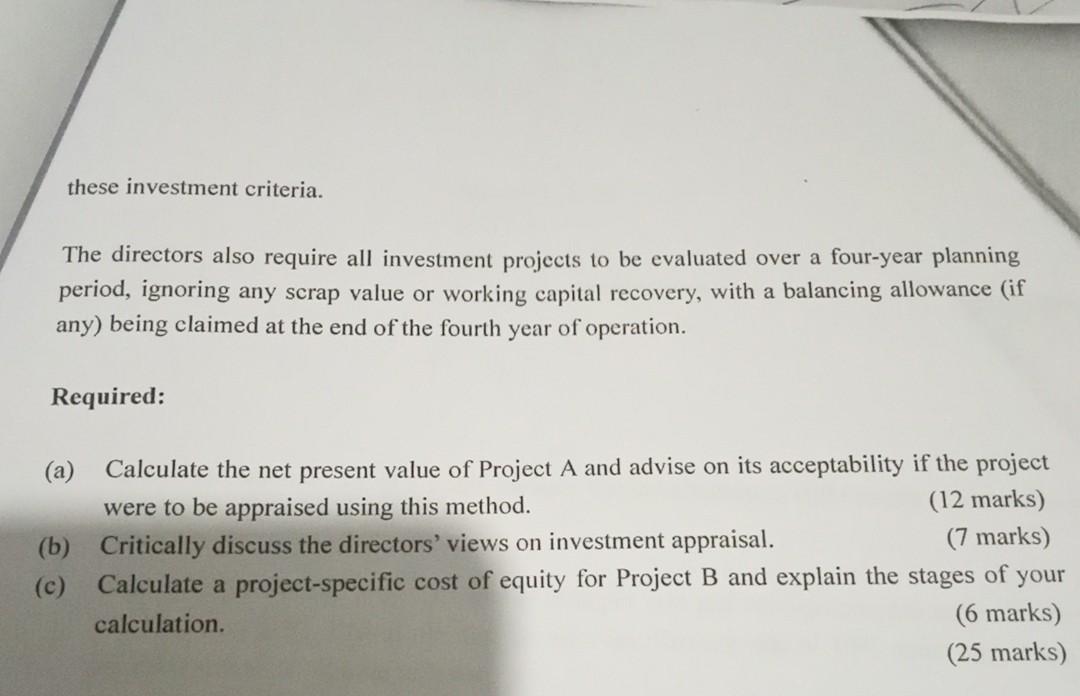

CJ Co is a profitable company which is financed by equity with a market value of $180 million and by debt with a market value of $45 million. The company is considering two investment projects, as follows. Project A This project is an expansion of existing business costing $3.5 million, payable at the start of the project, which will increase annual sales by 750,000 units. Information on unit selling price and costs is as follows: Selling price: Selling costs: $2.00 per unit (current price terms) $0.04 per unit (current price terms) $0.80 per unit (current price terms) Variable costs: Selling price inflation and selling cost inflation are expected to be 5% per year and variable cost inflation is expected to be 4% per year. Additional initial investment in working capital of $250,000 will also be needed and this is expected to increase in line with general inflation. Project B This project is a diversification into a new business area that will cost $4 million. A company that already operates in the new business area, GZ Co, has an equity beta of 1.5. GZ Co is financed 75% by equity with a market value of $90 million and 25% by debt with a market value of $30 million. Other information CJ Co has a nominal weighted average after-tax cost of capital of 10% and pays profit tax one year in arrears at an annual rate of 30%. The company can claim capital allowances (tax-allowable depreciation) on a 25% reducing balance basis on the initial investment in both projects. Risk-free rate of return: 4% Equity risk premium: 6% General rate of inflation: 4-5% per year Directors' views on investment appraisal The directors of CJ Co require that all investment projects should be evaluated using either payback period or return on capital employed (accounting rate of return). The target payback period of the company is two years and the target return on capital employed is 20%, which is the current return on capital employed of CJ Co. A project is accepted if it satisfies either of 517 these investment criteria. The directors also require all investment projects to be evaluated over a four-year planning period, ignoring any scrap value or working capital recovery, with a balancing allowance (if any) being claimed at the end of the fourth year of operation. Required: (a) Calculate the net present value of Project A and advise on its acceptability if the project were to be appraised using this method. (12 marks) (b) Critically discuss the directors' views on investment appraisal. (7 marks) (c) Calculate a project-specific cost of equity for Project B and explain the stages of your calculation. (6 marks) (25 marks)

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

a Calcul ate the net present value of Project A and advise on its accept ability if the project were ... View full answer

Get step-by-step solutions from verified subject matter experts