Question: a. Your division is considering two investment projects, each of which requires an upfront expenditure of $25 million. You estimate that the cost of capital

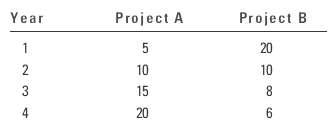

a. Your division is considering two investment projects, each of which requires an upfront expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars):

b. What is the discounted payback period for each of the projects?c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake?d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake?e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake?f. What is the crossover rate?g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?

Project B Project A Year 20 1 2 10 15 20 10 8 3 . 4 2

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

a Payback A cash flows in thousands Payback A 2 1000015000 267 years Payback B cash flows in thousands Payback B 1 500010000 150 years b Discounted Pa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

49-B-C-F-P-V (64).docx

120 KBs Word File