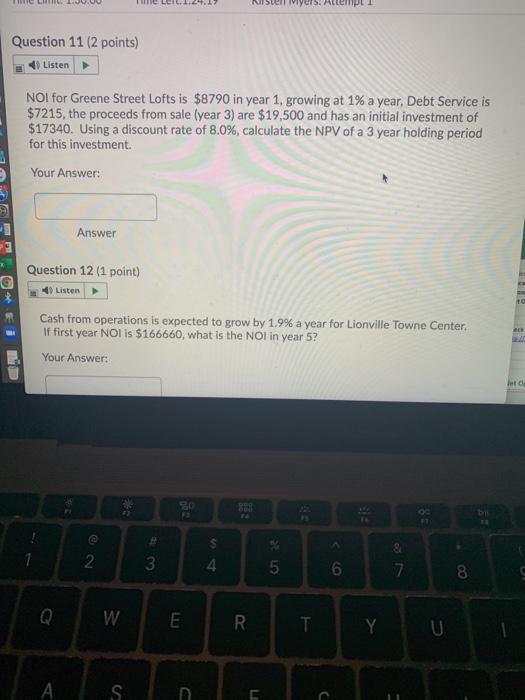

Question: CL e Lei. Nilsen SAMPE Question 11 (2 points) Listen NOI for Greene Street Lofts is $8790 in year 1, growing at 1% a year,

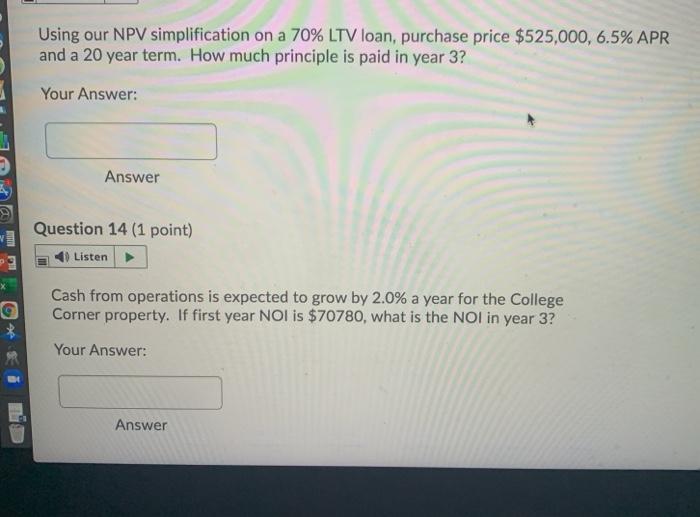

CL e Lei. Nilsen SAMPE Question 11 (2 points) Listen NOI for Greene Street Lofts is $8790 in year 1, growing at 1% a year, Debt Service is $7215, the proceeds from sale (year 3) are $19,500 and has an initial investment of $17340. Using a discount rate of 8.0%, calculate the NPV of a 3 year holding period for this investment Your Answer: Answer Question 12 (1 point) Listen Ei Cash from operations is expected to grow by 1.9% a year for Lionville Towne Center, If first year NOI is $166660, what is the NOI in year 5? Your Answer: leto BO FS 38 2 3 5 6 7 8 Q W E R. T Y U S Using our NPV simplification on a 70% LTV loan, purchase price $525,000, 6.5% APR and a 20 year term. How much principle is paid in year 3? Your Answer: Answer Question 14 (1 point) Listen a * Cash from operations is expected to grow by 2.0% a year for the College Corner property. If first year Nol is $70780, what is the NOI in year 3? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts