Question: Class Example ABC ( Pty ) Ltd manufactures and sells deodorants. The information below relates to the year of assessment ended 3 1 December 2

Class Example

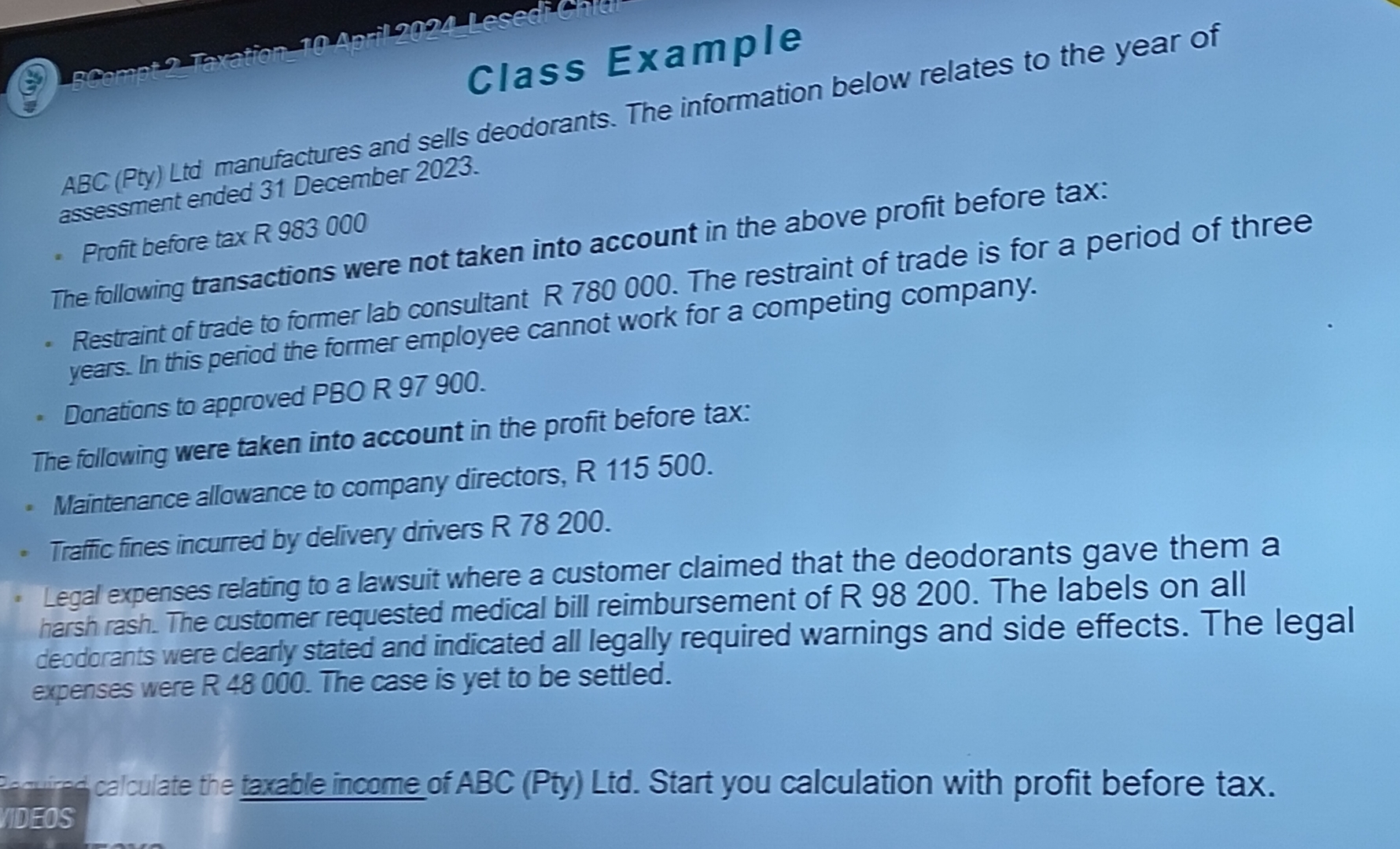

ABC Pty Ltd manufactures and sells deodorants. The information below relates to the year of assessment ended December

Profit before tax R

The following transactions were not taken into account in the above profit before tax:

Restraint of trade to former lab consultant The restraint of trade is for a period of three years. In this period the former employee cannot work for a competing company.

Donations to approved PBO R

The following were taken into account in the profit before tax:

Maintenance allowance to company directors, R

Trafic fines incurred by delivery drivers R

Legal expenses relating to a lawsuit where a customer claimed that the deodorants gave them a harsh rash. The customer requested medical bill reimbursement of The labels on all deodorants were clearly stated and indicated all legally required warnings and side effects. The legal expenses were The case is yet to be settled.

calculate the taxable income of ABC Pty Ltd Start your calculation with profit before tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock