Question: class: Fin. Statement Analysis 3. Computing Cost of Goods Sold and Ending Inventory Under FIFO, LIFO, and Average Cost Assume that Madden Company reports the

class: Fin. Statement Analysis

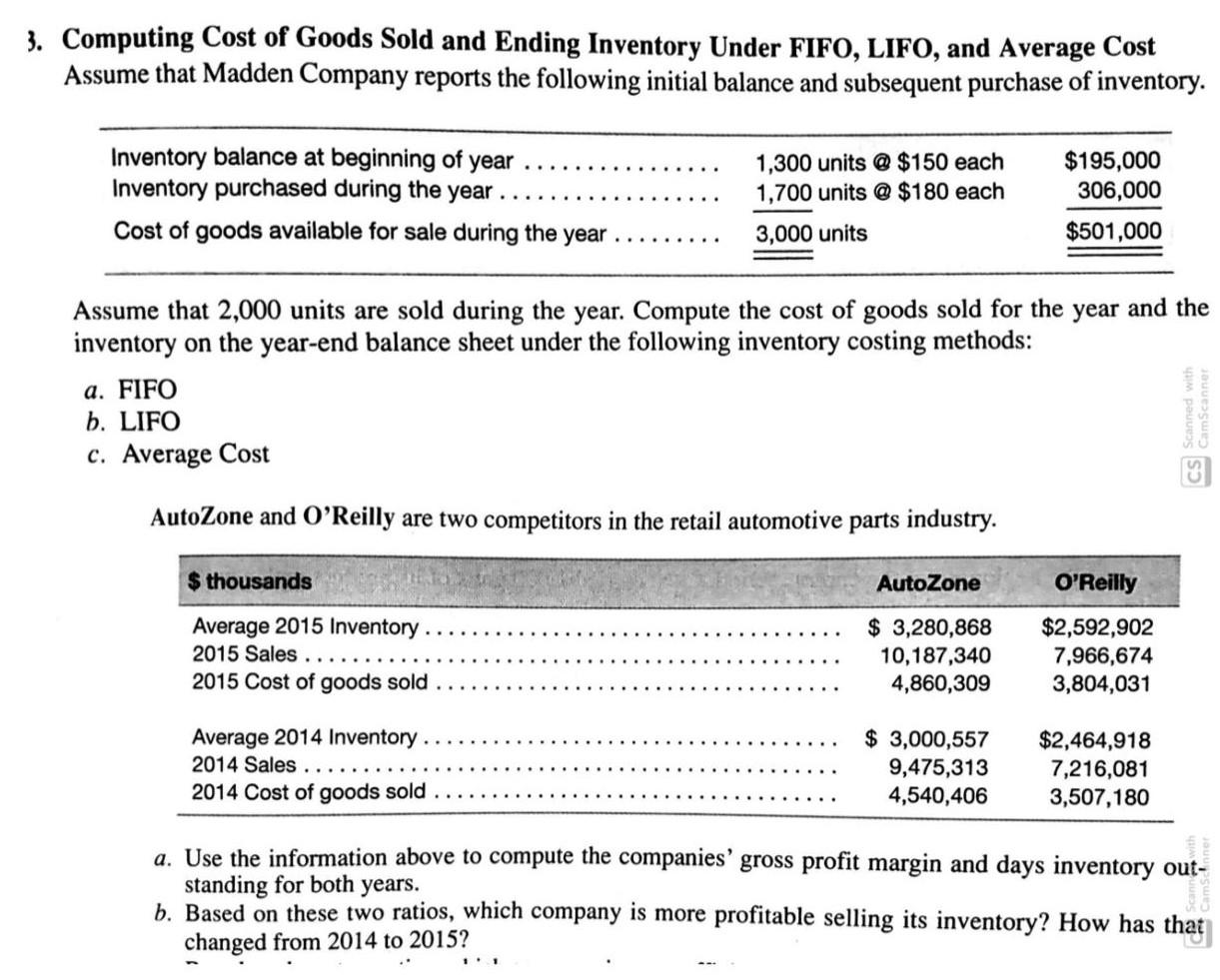

3. Computing Cost of Goods Sold and Ending Inventory Under FIFO, LIFO, and Average Cost Assume that Madden Company reports the following initial balance and subsequent purchase of inventory. Inventory balance at beginning of year Inventory purchased during the year. Cost of goods available for sale during the year 1,300 units @ $150 each 1,700 units @ $180 each $195,000 306,000 $501,000 3,000 units Assume that 2,000 units are sold during the year. Compute the cost of goods sold for the year and the inventory on the year-end balance sheet under the following inventory costing methods: a. FIFO b. LIFO c. Average Cost CS CamScanner AutoZone and O'Reilly are two competitors in the retail automotive parts industry. $thousands AutoZone O'Reilly Average 2015 Inventory .. 2015 Sales ... 2015 Cost of goods sold $ 3,280,868 10,187,340 4,860,309 $2,592,902 7,966,674 3,804,031 Average 2014 Inventory 2014 Sales ..... 2014 Cost of goods sold $ 3,000,557 9,475,313 4,540,406 $2,464,918 7,216,081 3,507,180 a. Use the information above to compute the companies' gross profit margin and days inventory out- standing for both years. b. Based on these two ratios, which company is more profitable selling its inventory? How has that changed from 2014 to 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts