Question: classes are at the bottom paragraph and the question asked that you calculate taxable income for both years and specific which amounts can be used

classes are at the bottom paragraph and the question asked that you calculate taxable income for both years and specific which amounts can be used for carryover.

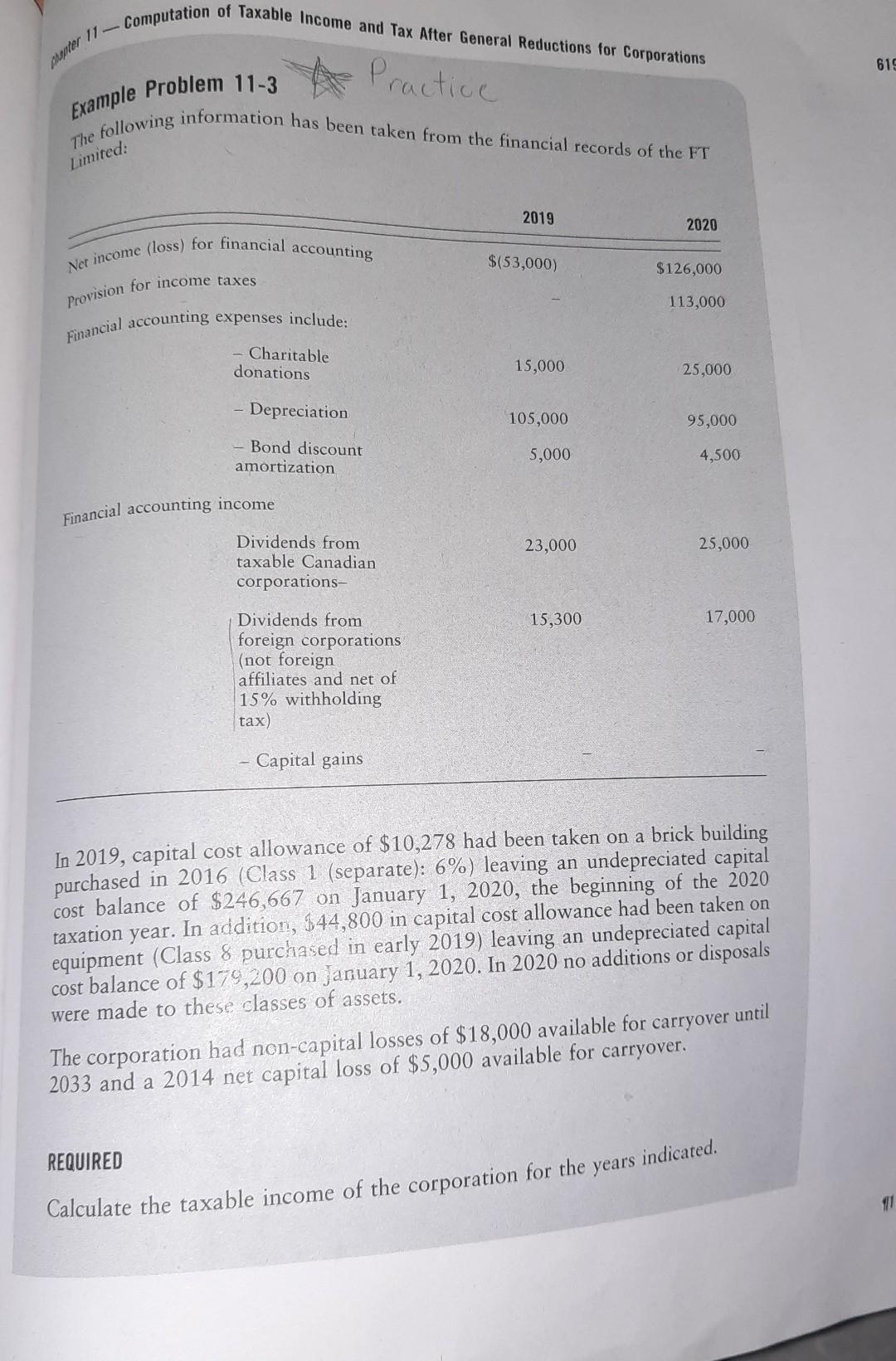

Computation of Taxable income and Tax After General Reductions for Corporations mapter 17 619 A Example Problem 11-3 The following information has been taken from the financial records of the FT Limited: 2019 2020 Net income (loss) for financial accounting $(53,000) $126,000 Provision for income taxes 113,000 Financial accounting expenses include: Charitable donations 15,000 25,000 Depreciation 105,000 95,000 Bond discount amortization 5,000 4,500 Financial accounting income 23,000 25,000 Dividends from taxable Canadian corporations- 15,300 17,000 Dividends from foreign corporations (not foreign affiliates and net of 15% withholding tax) Capital gains In 2019, capital cost allowance of $10,278 had been taken on a brick building purchased in 2016 (Class 1 (separate): 6%) leaving an undepreciated capital cost balance of $246,667 on January 1, 2020, the beginning of the 2020 taxation year. In addition, $44,800 in capital cost allowance had been taken on equipment (Class 8 purchased in early 2019) leaving an undepreciated capital cost balance of $179,200 on January 1, 2020. In 2020 no additions or disposals were made to these classes of assets. The corporation had non-capital losses of $18,000 available for carryover until 2033 and a 2014 net capital loss of $5,000 available for carryover. REQUIRED Calculate the taxable income of the corporation for the years indicated. Computation of Taxable income and Tax After General Reductions for Corporations mapter 17 619 A Example Problem 11-3 The following information has been taken from the financial records of the FT Limited: 2019 2020 Net income (loss) for financial accounting $(53,000) $126,000 Provision for income taxes 113,000 Financial accounting expenses include: Charitable donations 15,000 25,000 Depreciation 105,000 95,000 Bond discount amortization 5,000 4,500 Financial accounting income 23,000 25,000 Dividends from taxable Canadian corporations- 15,300 17,000 Dividends from foreign corporations (not foreign affiliates and net of 15% withholding tax) Capital gains In 2019, capital cost allowance of $10,278 had been taken on a brick building purchased in 2016 (Class 1 (separate): 6%) leaving an undepreciated capital cost balance of $246,667 on January 1, 2020, the beginning of the 2020 taxation year. In addition, $44,800 in capital cost allowance had been taken on equipment (Class 8 purchased in early 2019) leaving an undepreciated capital cost balance of $179,200 on January 1, 2020. In 2020 no additions or disposals were made to these classes of assets. The corporation had non-capital losses of $18,000 available for carryover until 2033 and a 2014 net capital loss of $5,000 available for carryover. REQUIRED Calculate the taxable income of the corporation for the years indicated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts