Question: Please explain these questions step by step, the formula used etc, thank you for your help! enough info, thanks 4. Term structure of interest rates

Please explain these questions step by step, the formula used etc, thank you for your help! enough info, thanks

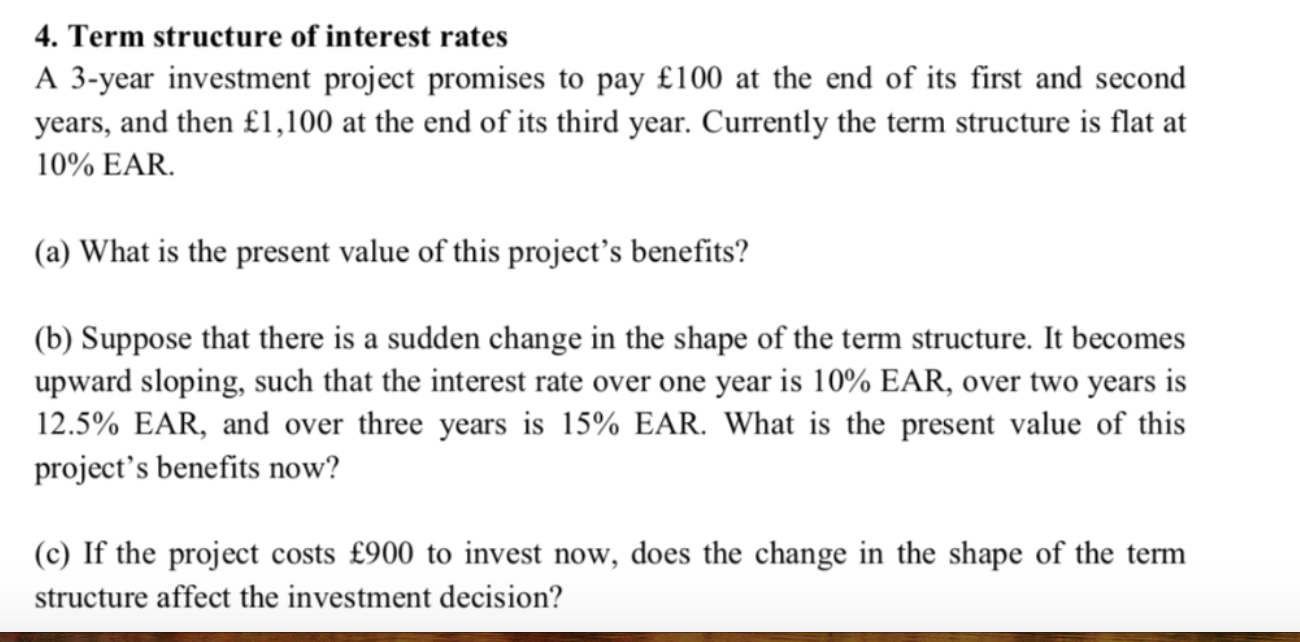

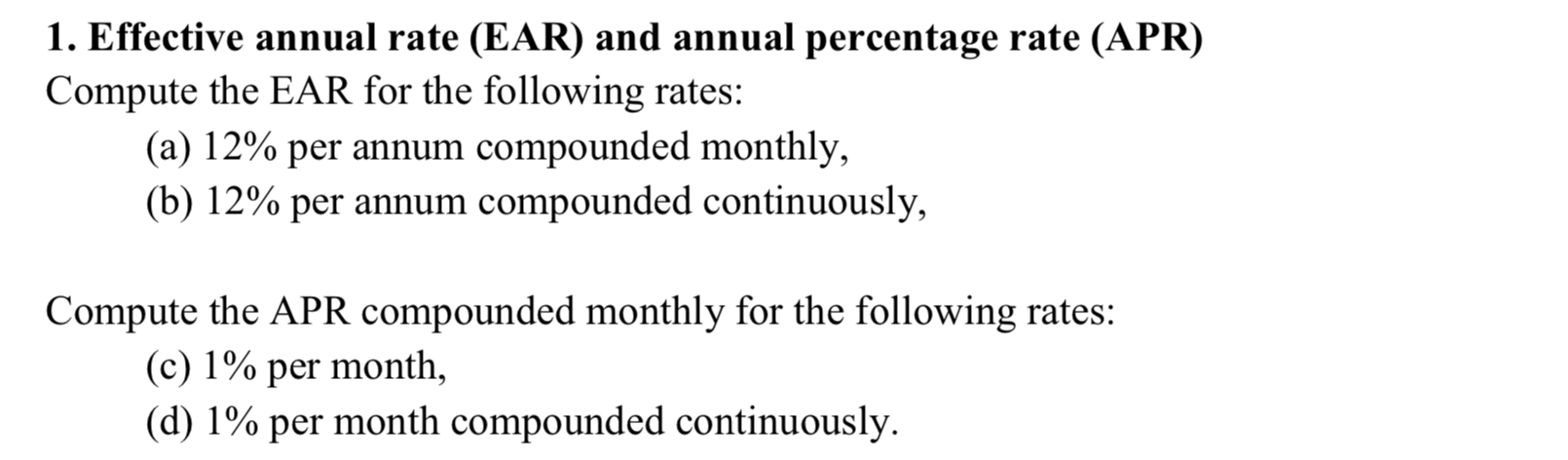

4. Term structure of interest rates A 3-year investment project promises to pay 100 at the end of its first and second years, and then 1,100 at the end of its third year. Currently the term structure is flat at 10% EAR. (a) What is the present value of this project's benefits? (b) Suppose that there is a sudden change in the shape of the term structure. It becomes upward sloping, such that the interest rate over one year is 10% EAR, over two years is 12.5% EAR, and over three years is 15% EAR. What is the present value of this project's benefits now? (c) If the project costs 900 to invest now, does the change in the shape of the term structure affect the investment decision? 1. Effective annual rate (EAR) and annual percentage rate (APR) Compute the EAR for the following rates: (a) 12% per annum compounded monthly, (b) 12% per annum compounded continuously, Compute the APR compounded monthly for the following rates: (c) 1% per month, (d) 1% per month compounded continuously

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts