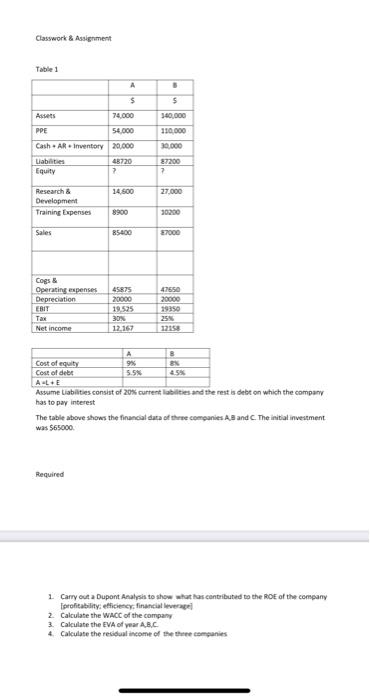

Question: Classwork & Assignment Table 1 A B $ $ Assets 74,000 140,000 PPE 54,000 110,000 Cash + AR + Inventory 20,000 30,000 Liabilities 48720 87200

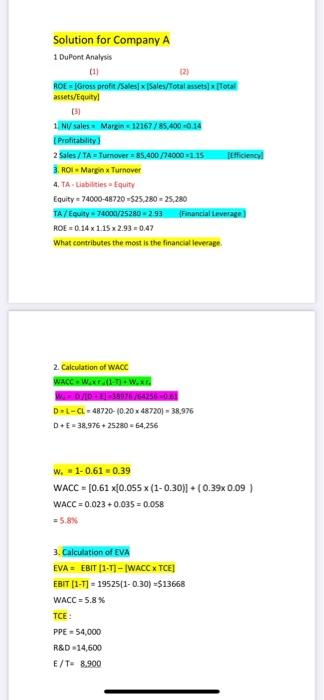

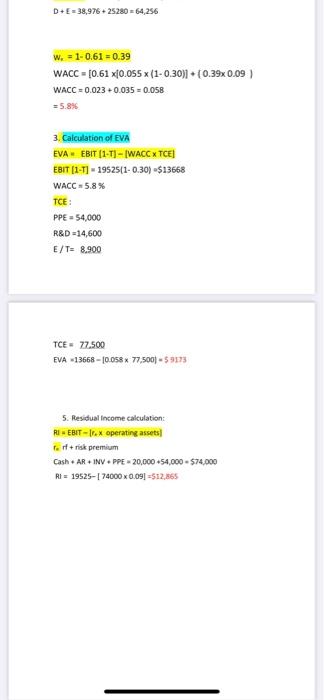

Classwork & Assignment Table 1 5 540.000 130.000 $ 74.000 PPE 54.000 Cash. AR Inventory 20,000 Liabilities 48720 Equity 2 87200 7 14 500 27.000 Research & Development Training Expenses 8900 30200 Sales R5400 87000 Cogs & Operating expenses Depreciation EBIT Tax Net income 45875 20000 19,525 47650 20000 19350 12.167 12158 B A 9% 5.5% Cost of equity Cost of debt ALE Assume Liabilities consist of 20% curtent liabilities and the rest is debe on which the company has to pay interest The table above shows the financial data of these companies AS and C The initial investment Required 1 Carry out a Dupont Analysis to show what has contributed to the ROE of the company profitability efficiency, financial leveral 2 Calculate the WACC of the company 3. Calculate the EVA of year ABC 4. Calculate the residual income of the three companies Solution for Company A 1 DuPont Analysis (11 12) ROE Gross profit/sales Sales/Total esixital assets/Equity! (3) 1 Ny sales Margin 12167785.400 -0.24 Profitability 2 Siles/Tumover = 85.400/4000=115 3. ROI Margin Turnover 4. TA Labilities - Equity Equity=74000-48720 =525,280 = 25,280 TAYEty 74004/25280 293 Financial average ROE = 0.14 x 1.15x2.93 0.47 What contributes the most is the financiat leverage 2. Calculation of WACC WACCxWXG DEL-CL 48720-(0.20 x 487201 - 38.976 DE 38,976 +25280 64,256 w. 1-0.61 -0.39 WACC = [0.61 [0.055 x (1-0.30)] + (0.39 0.09 ) WACC =0.023 +0.035 = 0.058 = 5,8% 3. Calculation of EVA EVA = EBIT 11:11-IWACC XTCEJ EBIT (1-7) 19525(1-0.30) =$13668 WACC = 5.8% TCE: PPE = 54,000 R&D 14,500 E/T 8.900 D+E=38,976 +25280 = 64,256 w. = 1-0.61 -0.39 WACC = [0.61 x{0.055 x (1-0.30)] + (0.39x0.09 ) WACC =0.023+0.035 = 0.058 =5.8% 3. Calculation of EVA EVA EBIT (1-1)-IWACC XTCEJ EBIT (1-7) - 19525(1-0.30) $13668 WACC - 5.8% TCE: PPE = 54,000 R&D=14,600 E/TE 8.900 TCE: 77.500 EVA-13668 -0.058% 77,500-59173 5. Residual income calculation: RIEBIT -Ir. x operating assets r. frisk premium Cash AR INVPPE 20,000 54.000 - 574.000 R= 19525- 74000 x 0.09] =512,865 Classwork & Assignment Table 1 5 540.000 130.000 $ 74.000 PPE 54.000 Cash. AR Inventory 20,000 Liabilities 48720 Equity 2 87200 7 14 500 27.000 Research & Development Training Expenses 8900 30200 Sales R5400 87000 Cogs & Operating expenses Depreciation EBIT Tax Net income 45875 20000 19,525 47650 20000 19350 12.167 12158 B A 9% 5.5% Cost of equity Cost of debt ALE Assume Liabilities consist of 20% curtent liabilities and the rest is debe on which the company has to pay interest The table above shows the financial data of these companies AS and C The initial investment Required 1 Carry out a Dupont Analysis to show what has contributed to the ROE of the company profitability efficiency, financial leveral 2 Calculate the WACC of the company 3. Calculate the EVA of year ABC 4. Calculate the residual income of the three companies Solution for Company A 1 DuPont Analysis (11 12) ROE Gross profit/sales Sales/Total esixital assets/Equity! (3) 1 Ny sales Margin 12167785.400 -0.24 Profitability 2 Siles/Tumover = 85.400/4000=115 3. ROI Margin Turnover 4. TA Labilities - Equity Equity=74000-48720 =525,280 = 25,280 TAYEty 74004/25280 293 Financial average ROE = 0.14 x 1.15x2.93 0.47 What contributes the most is the financiat leverage 2. Calculation of WACC WACCxWXG DEL-CL 48720-(0.20 x 487201 - 38.976 DE 38,976 +25280 64,256 w. 1-0.61 -0.39 WACC = [0.61 [0.055 x (1-0.30)] + (0.39 0.09 ) WACC =0.023 +0.035 = 0.058 = 5,8% 3. Calculation of EVA EVA = EBIT 11:11-IWACC XTCEJ EBIT (1-7) 19525(1-0.30) =$13668 WACC = 5.8% TCE: PPE = 54,000 R&D 14,500 E/T 8.900 D+E=38,976 +25280 = 64,256 w. = 1-0.61 -0.39 WACC = [0.61 x{0.055 x (1-0.30)] + (0.39x0.09 ) WACC =0.023+0.035 = 0.058 =5.8% 3. Calculation of EVA EVA EBIT (1-1)-IWACC XTCEJ EBIT (1-7) - 19525(1-0.30) $13668 WACC - 5.8% TCE: PPE = 54,000 R&D=14,600 E/TE 8.900 TCE: 77.500 EVA-13668 -0.058% 77,500-59173 5. Residual income calculation: RIEBIT -Ir. x operating assets r. frisk premium Cash AR INVPPE 20,000 54.000 - 574.000 R= 19525- 74000 x 0.09] =512,865

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts