Question: *CLEARLY SHOW ANSWER - WILL UPVOTE CORRECT RESPONSE AS I CAN IMMEDIATEY GRADE QUESTION* Back to Assignment Attempts 0 Keep the Highest / 1 3.

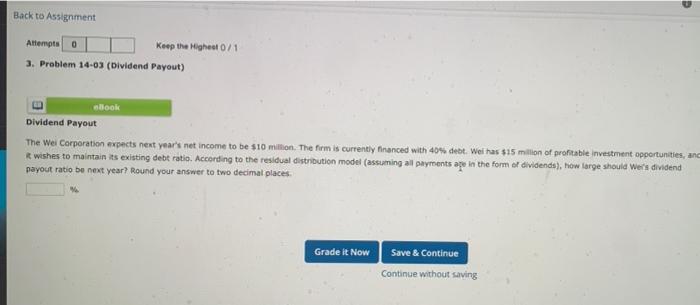

Back to Assignment Attempts 0 Keep the Highest / 1 3. Problem 14-03 (Dividend Payout) Book Dividend Payout The Wel Corporation expects next year's net income to be $10 million. The firm is currently financed with 40% debt. Wel has $15 million of profitable investment opportunities, and It wishes to maintain its existing debt ratio. According to the residual distribution model (assuming all payments are in the form of dividends), how large should Wer's dividend payout ratio be next year) Round your answer to two decimal places Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts