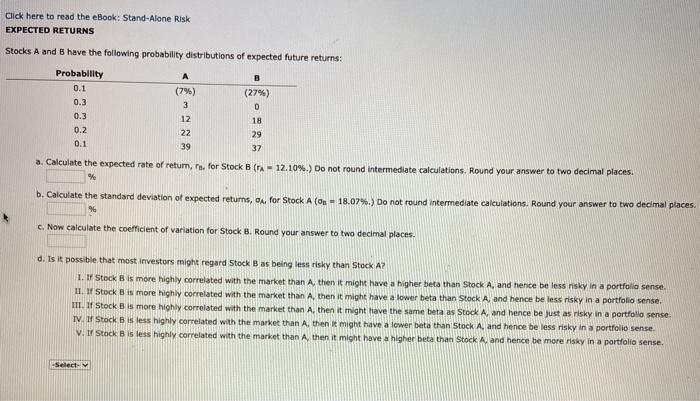

Question: Click here to read the eBook: Stand-Alone Risk EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: B Probability

Click here to read the eBook: Stand-Alone Risk EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: B Probability 0.1 0.3 (7%) 3 0.3 0.2 0.1 12 22 39 (27%) 0 18 29 37 a. Calculate the expected rate of return, T. for Stock B (A - 12.10%.) Do not round Intermediate calculations. Round your answer to two decimal places. % b. Calculate the standard deviation of expected returns, A. for Stock A(n-18.07%.) Do not round Intermediate calculations. Round your answer to two decimal places % c. Now calculate the coefficient of variation for Stock 8. Round your answer to two decimal places. d. Is it possible that most investors might regard Stock B as being less risky than Stock A? 1. I Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense. IL I Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. III. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. IV. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A and hence be less risky in a portfolio sense. V. Ir Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts