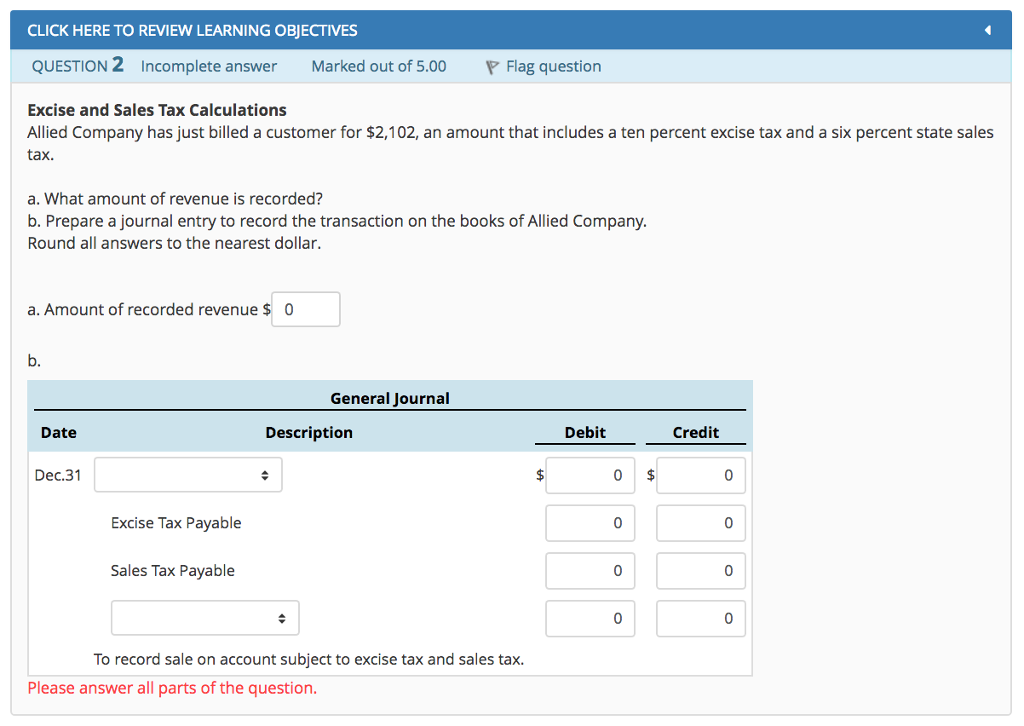

Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 2 Incomplete answer Marked out of 5.00 PFlag question Excise and Sales Tax Calculations Allied Company has just

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 2 Incomplete answer Marked out of 5.00 PFlag question Excise and Sales Tax Calculations Allied Company has just billed a customer for $2,102, an amount that includes a ten percent excise tax and a six percent state sales tax. a. What amount of revenue is recorded? b. Prepare a journal entry to record the transaction on the books of Allied Company. Round all answers to the nearest dollar. a. Amount of recorded revenue$ 0 b. General Journal Date Description Debit Credit Dec.31 0 Excise Tax Payable 0 0 Sales Tax Payable 0 0 To record sale on account subject to excise tax and sales tax. Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts