Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 2 Answer saved Marked out of 5.00 Flag question Excise and Sales Tax Calculations Allied Company has just

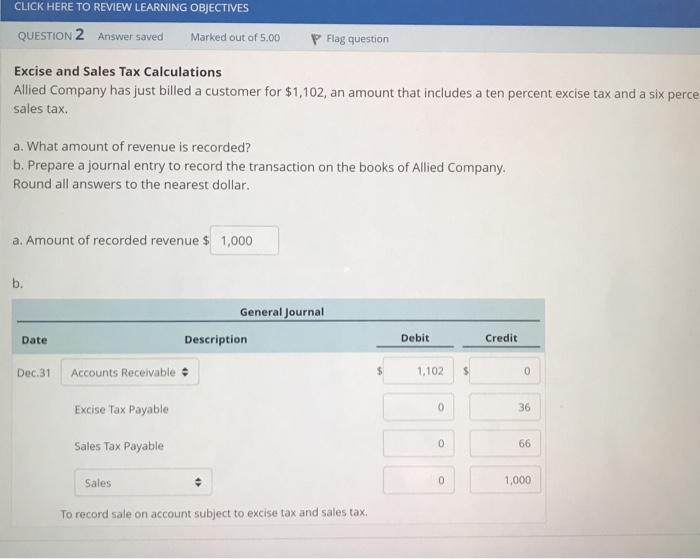

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 2 Answer saved Marked out of 5.00 Flag question Excise and Sales Tax Calculations Allied Company has just billed a customer for $1,102, an amount that includes a ten percent excise tax and a six perce sales tax. a. What amount of revenue is recorded? b. Prepare a journal entry to record the transaction on the books of Allied Company. Round all answers to the nearest dollar a. Amount of recorded revenue $ 1,000 b. General Journal Date Description Debit Credit Dec.31 Accounts Receivable s 1,102 Excise Tax Payable 36 Sales Tax Payable Sales 1,000 To record sale on account subject to excise tax and sales tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts