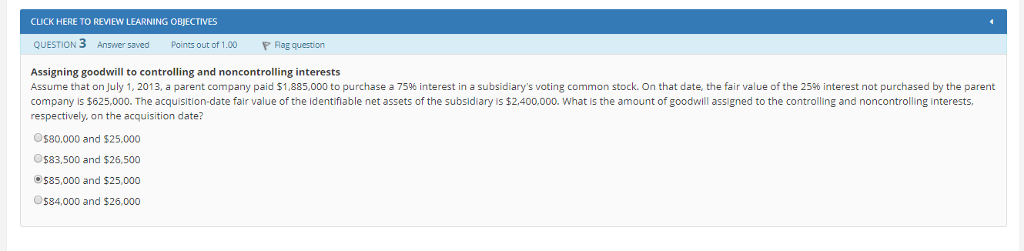

Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 3 Answer saved Points out of 1.00 Rag question Assigning goodwill to controlling and noncontrolling interests Assume that

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 3 Answer saved Points out of 1.00 Rag question Assigning goodwill to controlling and noncontrolling interests Assume that on July 1, 2013, a parent company paid $1,885,000 to purchase a 7596 interest in a subsidiary's voting common stock. On that date, the fair value of the 25% interest not purchased by the parent company is $625,000. The acquisition-date fair value of the identifiable net assets of the subsidiary is $2.400,000. What is the amount of goodwill assigned to the controlling and noncontrolling interests respectively. on the acquisition date? $80.000 and $25,000 $83,500 and $26,500 $85,000 and $25,000 $84,000 and $26,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts