Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 4 Answer saved Points out of 1 .00 ?Flag question Assigning bargain purchase gain (i.e., negative goodwll) to

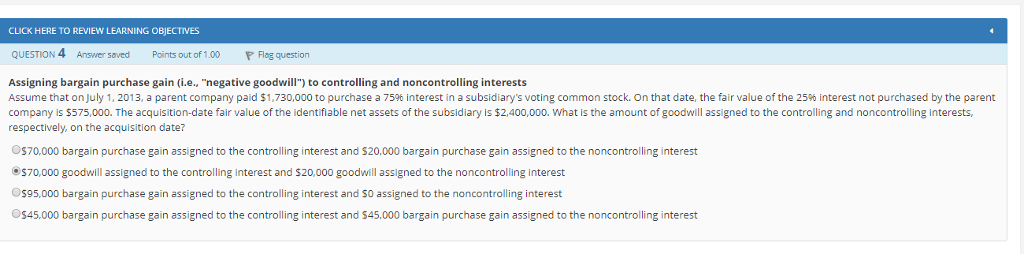

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 4 Answer saved Points out of 1 .00 ?Flag question Assigning bargain purchase gain (i.e., "negative goodwll") to controlling and noncontrolling interests Assume that on July 1, 2013, a parent company paid $1,730,000 to purchase a 75% interest in a subsidiary's voting common stock. On that date, the fair value of the 25% interest not purchased by the parent company is $575,000. The acquisition-date fair value of the identifiable net assets of the subsidiary is $2,400,000. What is the amount of goodwill assigned to the controlling and noncontrolling interests respectively, on the acquisition date? Os70,000 bargain purchase gain assigned to the controlling interest and $20,000 bargain purchase gain assigned to the noncontrolling interest $70,000 goodwill assigned to the controlling interest and $20,000 goodwill assigned to the noncontrolling interest $95,000 bargain purchase gain assigned to the controlling interest and SO assigned to the noncontrolling interest $45.000 bargain purchase gain assigned to the controlling interest and $45.000 bargain purchase gain assigned to the noncontrolling interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts