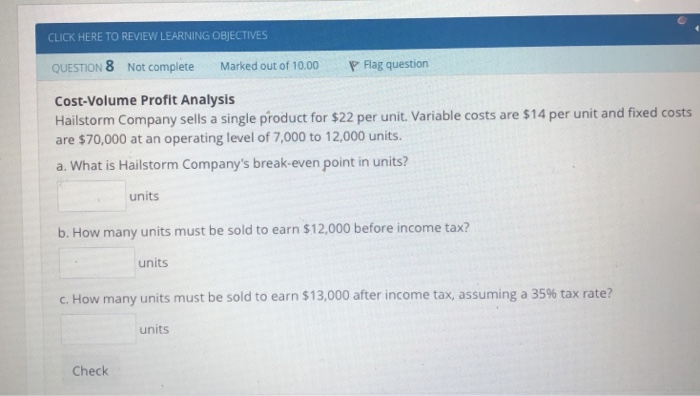

Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 8 Not complete Marked out of 10.00 P Flag question Cost-Volume Profit Analysis Hailstorm Company sells a single

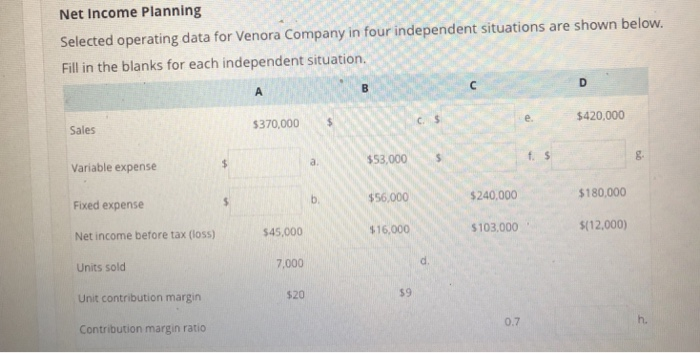

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 8 Not complete Marked out of 10.00 P Flag question Cost-Volume Profit Analysis Hailstorm Company sells a single product for $22 per unit. Variable costs are $14 per unit and fixed costs are $70,000 at an operating level of 7,000 to 12,000 units. a. What is Hailstorm Company's break-even point in units? units b. How many units must be sold to earn $12,000 before income tax? units c. How many units must be sold to earn $13,000 after income tax, assuming a 35% tax rate? units Check Net Income Planning Selected operating data for Venora Company in four independent situations are shown below. Fill in the blanks for each independent situation. $420,000 370,000 Sales $53,000S $56.000 16,000 a. Variable expense Fixed expense Net income before tax (loss) Units sold Unit contribution margin Contribution margin ratio $240,000 180,000 103,000 $(12.000) $45,000 7,000 $20 d. s9 0.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts