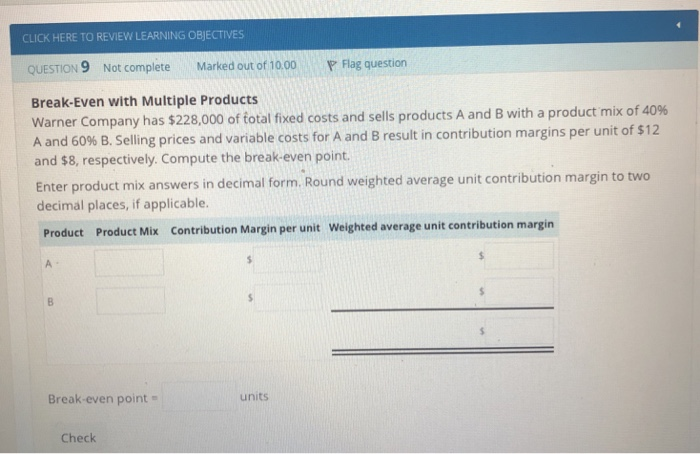

Question: CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 9 Not complete Marked out of 10.00 P Flag question Break-Even with Multiple Products Warner Company has $228,000

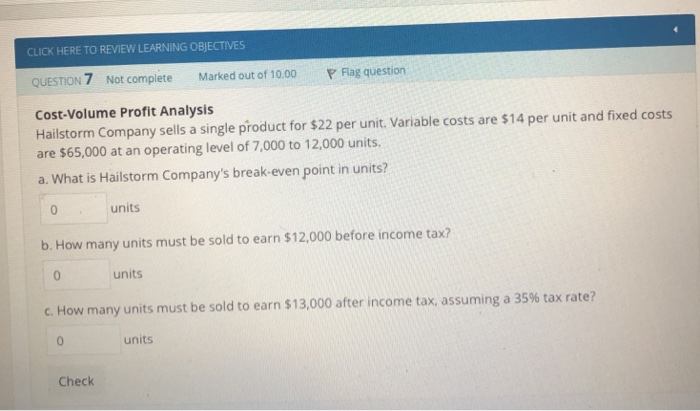

CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 9 Not complete Marked out of 10.00 P Flag question Break-Even with Multiple Products Warner Company has $228,000 of total fixed costs and sells products A and B with a product mix of 40% A and 60% B. Selling prices and variable costs for A and B result in contribution margins per unit of $12 and $8, respectively. Compute the break-even point. Enter product mix answers in decimal form. Round weighted average unit contribution margin t decimal places, if applicable. o two Product Mix Contribution Margin per unit Weighted average unit contribution margin Product Break-even point- units Check CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 7 Not complete Marked out of 10.00 P Flag question Cost-Volume Profit Analysis Hailstorm Company sells a single product for $22 per unit. Variable costs are $14 per unit and fixed costs are $65,000 at an operating level of 7,000 to 12,000 units. a. What is Hailstorm Company's break-even point in units? units b. How many units must be sold to earn $12,000 before income tax? units C. How many units must be sold to earn $13,000 after income tax, assuming a 35% tax rate? units Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts