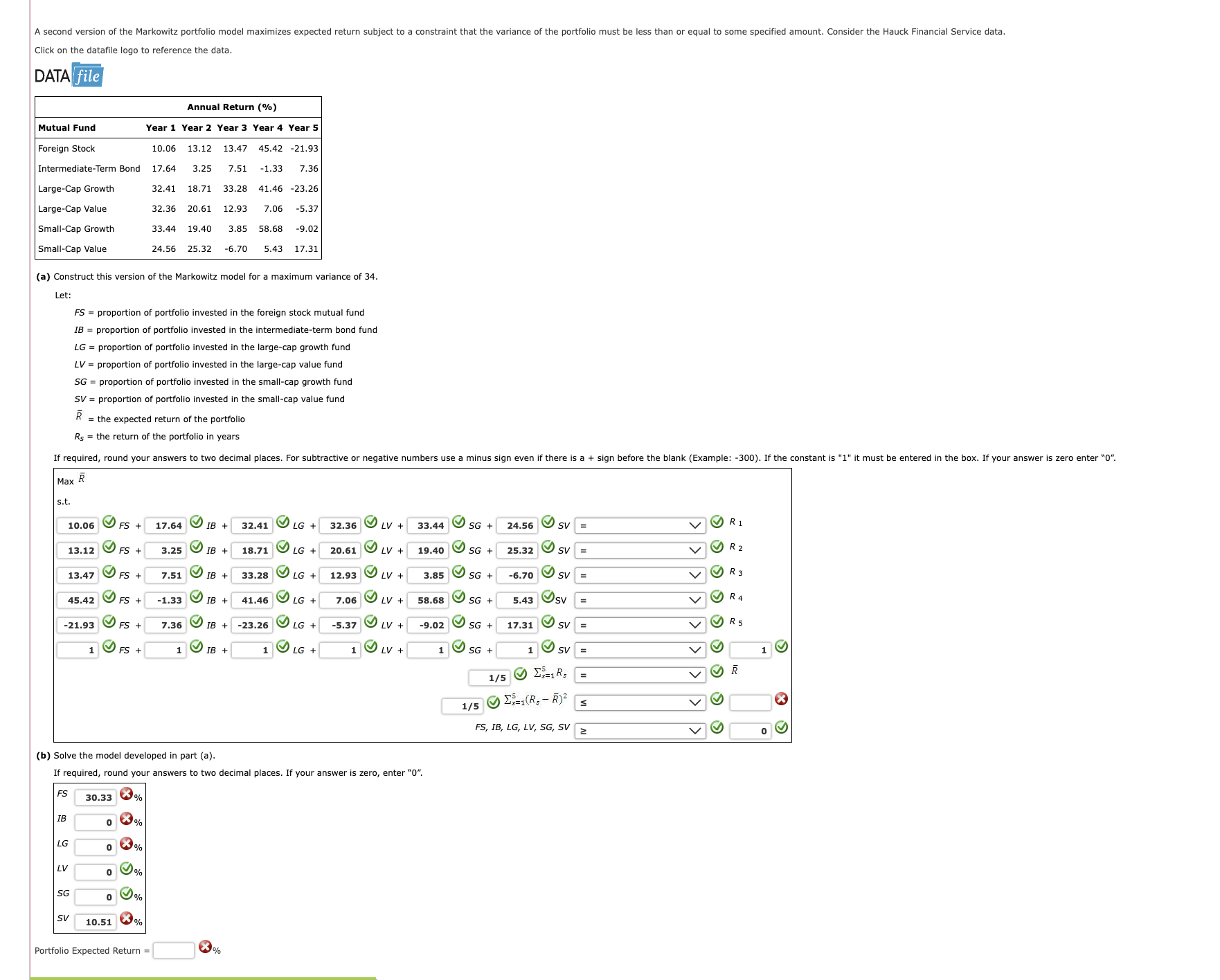

Question: Click on the datafile logo to reference the data. DATA (a) Construct this version of the Markowitz model for a maximum variance of 34 .

Click on the datafile logo to reference the data. DATA (a) Construct this version of the Markowitz model for a maximum variance of 34 . Let: FS= proportion of portfolio invested in the foreign stock mutual fund IB= proportion of portfolio invested in the intermediate-term bond fund LG= proportion of portfolio invested in the large-cap growth fund LV= proportion of portfolio invested in the large-cap value fund SG= proportion of portfolio invested in the small-cap growth fund SV= proportion of portfolio invested in the small-cap value fund R= the expected return of the portfolio RS= the return of the portfolio in years (b) Solve the model developed in part (a). If required, round your answers to two decimal places. If your answer is zero, enter " 0 ". Portfolio Expected Return = % Click on the datafile logo to reference the data. DATA (a) Construct this version of the Markowitz model for a maximum variance of 34 . Let: FS= proportion of portfolio invested in the foreign stock mutual fund IB= proportion of portfolio invested in the intermediate-term bond fund LG= proportion of portfolio invested in the large-cap growth fund LV= proportion of portfolio invested in the large-cap value fund SG= proportion of portfolio invested in the small-cap growth fund SV= proportion of portfolio invested in the small-cap value fund R= the expected return of the portfolio RS= the return of the portfolio in years (b) Solve the model developed in part (a). If required, round your answers to two decimal places. If your answer is zero, enter " 0 ". Portfolio Expected Return = %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts