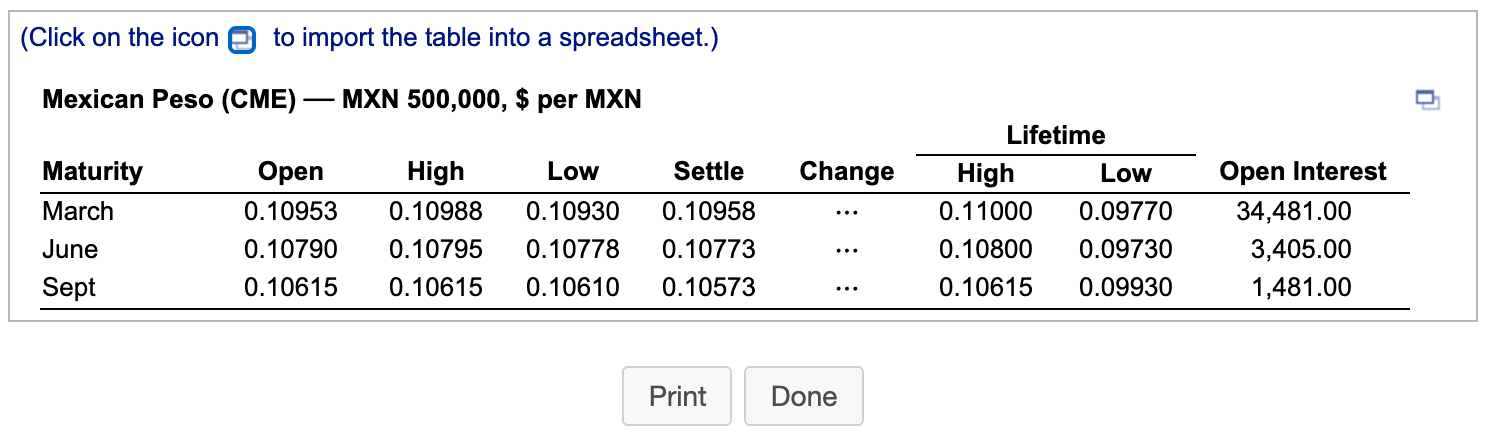

Question: (Click on the icon to import the table into a spreadsheet.) Mexican Peso (CME) MXN 500,000, $ per MXN Low Settle Change Maturity March June

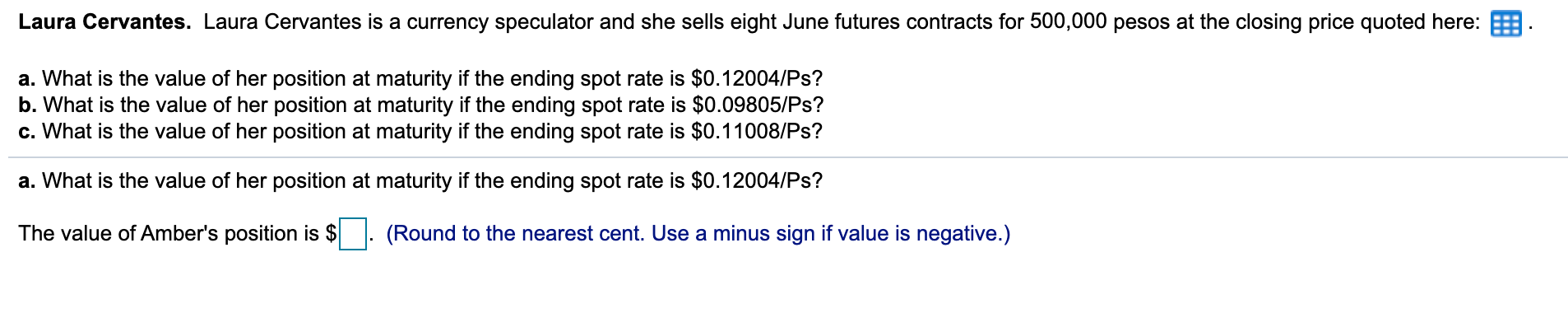

(Click on the icon to import the table into a spreadsheet.) Mexican Peso (CME) MXN 500,000, $ per MXN Low Settle Change Maturity March June Sept Open 0.10953 0.10790 0.10615 High 0.10988 0.10795 0.10615 0.10930 0.10778 0.10610 0.10958 0.10773 0.10573 Lifetime High Low 0.11000 0.09770 0.10800 0.09730 0.10615 0.09930 Open Interest 34,481.00 3,405.00 1,481.00 Print Done Laura Cervantes. Laura Cervantes is a currency speculator and she sells eight June futures contracts for 500,000 pesos at the closing price quoted here: a. What is the value of her position at maturity if the ending spot rate is $0.12004/Ps? b. What is the value of her position at maturity if the ending spot rate is $0.09805/Ps? c. What is the value of her position at maturity if the ending spot rate is $0.11008/Ps? a. What is the value of her position at maturity if the ending spot rate is $0.12004/Ps? The value of Amber's position is $. (Round to the nearest cent. Use a minus sign if value is negative.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts